An insurance certificate, a seemingly simple document, plays a crucial role in various business and personal transactions in the United States. Understanding its purpose, types, and limitations is essential for anyone involved in contracts, projects, or even everyday activities like driving. This guide will provide a comprehensive overview of what an insurance certificate is, why it’s important, the different types available, and how to obtain one.

What is a Certificate of Insurance (COI)?

A certificate of insurance (COI) is a standardized document that summarizes the key aspects of an insurance policy. Think of it as a snapshot of your insurance coverage, providing essential details such as the policyholder’s name, policy effective dates, types of coverage, and coverage limits. It serves as proof that you have insurance coverage in place.

Importantly, a COI is not the insurance policy itself. It’s an informational document intended to provide evidence of coverage to interested parties. It doesn’t alter, extend, or amend the actual policy terms. This distinction is critical because a COI doesn’t grant the holder any direct rights under the policy. It merely confirms that a policy exists.

Why is a Certificate of Insurance Important?

Certificates of insurance are essential for several reasons, both for businesses and individuals:

Proof of Coverage: The primary purpose of a COI is to provide proof that you have insurance coverage. This is often required by clients, landlords, contractors, or other parties before they will enter into a business relationship with you.

Contractual Requirements: Many contracts specifically require you to provide a COI as a condition of the agreement. This ensures that you have the necessary insurance to cover potential liabilities arising from the contract.

Risk Management: Requesting a COI from contractors or vendors allows you to assess their insurance coverage and transfer some of the risk associated with their activities. If they cause damage or injury, their insurance should cover the costs.

Legal Compliance: Certain industries and professions may be legally required to maintain specific types of insurance. A COI serves as proof of compliance with these regulations.

Building Trust: Providing a COI demonstrates professionalism and builds trust with clients and partners. It shows that you are responsible and prepared to handle potential risks.

Types of Certificates of Insurance

While the basic purpose of a COI remains the same, there are different types tailored to specific insurance policies:

Certificate of Liability Insurance: This is the most common type of COI and confirms that you have business liability insurance coverage. It outlines the key elements of your policy, assuring customers and prospects that your business is protected from common risks such as third-party injuries or property damage. It’s essential to check for specific details such as “additional insured” status and “waiver of subrogation” to ensure adequate protection.

Certificate of Workers’ Compensation Insurance: In most states, businesses with employees are required to carry workers’ compensation insurance. This COI verifies that you have this coverage, which protects you from liability if an employee is injured on the job. General contractors or project management companies often require this certificate from subcontractors.

Certificate of Auto Liability Insurance: If your business involves the use of vehicles, you’ll need a certificate of auto liability insurance. This confirms that you have auto insurance with liability coverage. It’s often required for drivers of owned, non-owned, leased, or hired vehicles. Lenders may also request this certificate if they finance the purchase of a vehicle.

What Information is Included in a Certificate of Insurance?

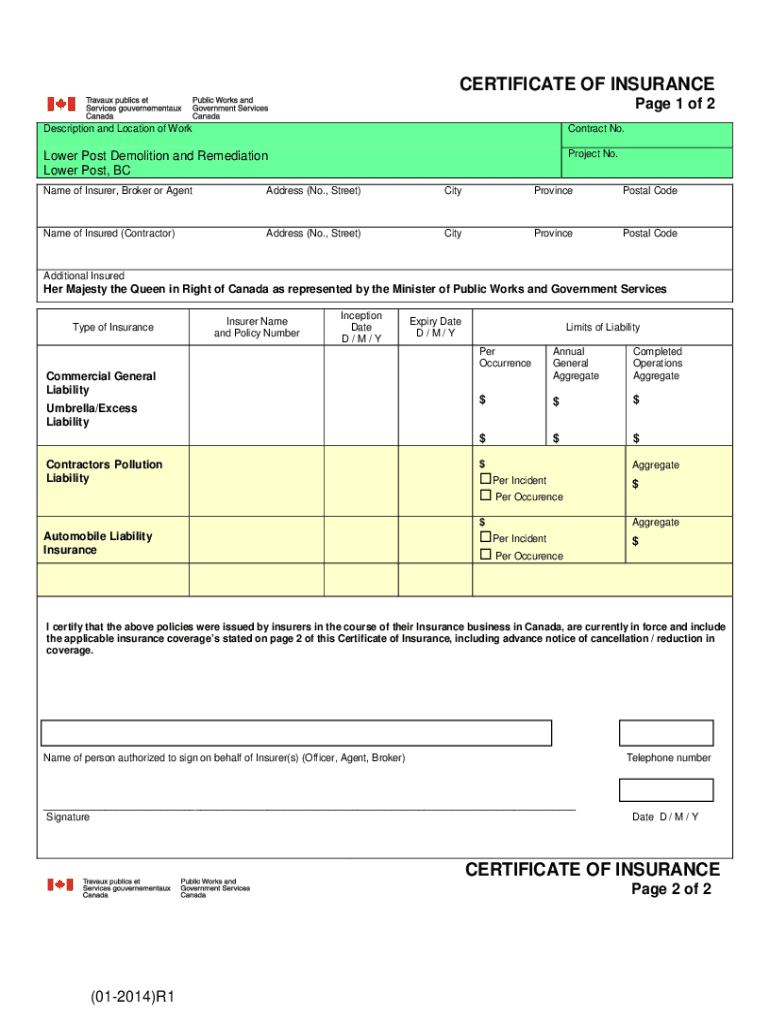

A standard COI typically includes the following information, often presented in nine key sections:

Disclaimer: This section clarifies that the COI is for informational purposes only and does not alter the actual insurance policy.

Producer: This identifies the insurance company or broker that issued the COI.

Insured: This section lists the name and address of the policyholder (your business or yourself).

Insurers Affording Coverage: This lists all of the insurance companies providing coverage under your policy.

Coverages: This is the most detailed section, outlining the types of insurance coverage you have, policy numbers, effective dates, coverage limits, and any additional insureds or waivers of subrogation.

Description of Operations: This section provides specific details about the job or project for which the COI was issued, including locations and project numbers.

Certificate Holder: This lists the name and address of the party requesting the COI (e.g., your client or landlord).

Cancellation: This section specifies the number of days’ notice the certificate holder will receive if the policy is canceled before the expiration date.

Authorized Representative: This includes the signature of the insurance agent or representative who authorized the COI.

How to Obtain a Certificate of Insurance

Obtaining a COI is usually a straightforward process:

Request from Your Agent: The easiest way to obtain a COI is to contact your insurance agent or broker. They can generate and provide you with the certificate, typically free of charge.

Online Access: Many insurance companies offer online portals where you can access and download your COI directly.

Provide Necessary Information: When requesting a COI, be prepared to provide the name and address of the certificate holder, as well as any specific requirements they may have regarding coverage limits or additional insured status.

Review and Verify: Once you receive the COI, carefully review it to ensure that all the information is accurate and that it meets the requirements of the requesting party.

Understanding the Limitations of a Certificate Holder Status

It’s crucial to understand that simply being listed as a “certificate holder” on a COI doesn’t automatically grant you any rights or coverage under the insurance policy. The certificate holder is merely being notified that a policy exists. To gain actual protection under the policy, you typically need to be listed as an “additional insured” through a specific policy endorsement. This provides you with direct coverage and the ability to file claims in certain situations.

In conclusion, a certificate of insurance is a valuable tool for verifying insurance coverage and managing risk. However, it’s essential to understand its limitations and ensure that you have the appropriate coverage and endorsements in place to protect your interests. Consulting with an insurance professional can help you navigate the complexities of insurance certificates and ensure that you have the right coverage for your specific needs.

Leave a Reply