Mortgage insurance is a critical component of the home-buying process for many Americans. It acts as a safety net, protecting lenders when borrowers are unable to meet their mortgage obligations. While it doesn’t directly protect the borrower from foreclosure, it makes homeownership more accessible, especially for those who can’t afford a large down payment. This guide will explain what property mortgage insurance is, how it works, the different types available, and what you need to know to make informed decisions.

What is Property Mortgage Insurance?

Property mortgage insurance is an insurance policy that protects the lender or titleholder against financial loss if a borrower defaults on their mortgage payments or is otherwise unable to fulfill the terms of the mortgage agreement. Think of it as a guarantee for the lender, reducing their risk when lending money to individuals who may be considered higher-risk borrowers. It’s essential to distinguish mortgage insurance from mortgage life insurance, which is designed to protect the borrower’s heirs by paying off the mortgage balance if the borrower dies. There are three main types of mortgage insurance: Private Mortgage Insurance (PMI), Mortgage Insurance Premium (MIP) for FHA loans, and Mortgage Title Insurance. Understanding the differences is crucial for any prospective homeowner.

How Property Mortgage Insurance Works

Property mortgage insurance typically involves either a monthly premium payment or a one-time lump-sum payment that’s added to the loan amount at the start of the mortgage. The specific type of mortgage insurance needed depends on several factors, including the type of mortgage and the size of the down payment. For example, if you’re getting a conventional loan and putting down less than 20%, your lender will likely require Private Mortgage Insurance (PMI). The monthly costs associated with mortgage insurance are also based on factors such as the size of the down payment, the type and term of the loan, the loan’s purpose, loan amount, the borrower’s credit score, debt-to-income ratio and number of borrowers. Understanding these factors can help you anticipate and plan for the costs of mortgage insurance.

Types of Property Mortgage Insurance

Understanding the different types of property mortgage insurance is key to making informed decisions about your mortgage.

- Private Mortgage Insurance (PMI): This is typically required by lenders when a borrower makes a down payment of less than 20% on a conventional loan. PMI protects the lender if the borrower defaults on the loan. Once the loan balance reaches 80% of the original home value, the borrower can usually request the cancellation of PMI.

- Mortgage Insurance Premium (MIP): This applies to mortgages backed by the Federal Housing Administration (FHA). Unlike PMI, MIP is required regardless of the size of the down payment. It includes an upfront premium and a monthly premium. The duration of the MIP payments can vary depending on the loan terms and down payment amount.

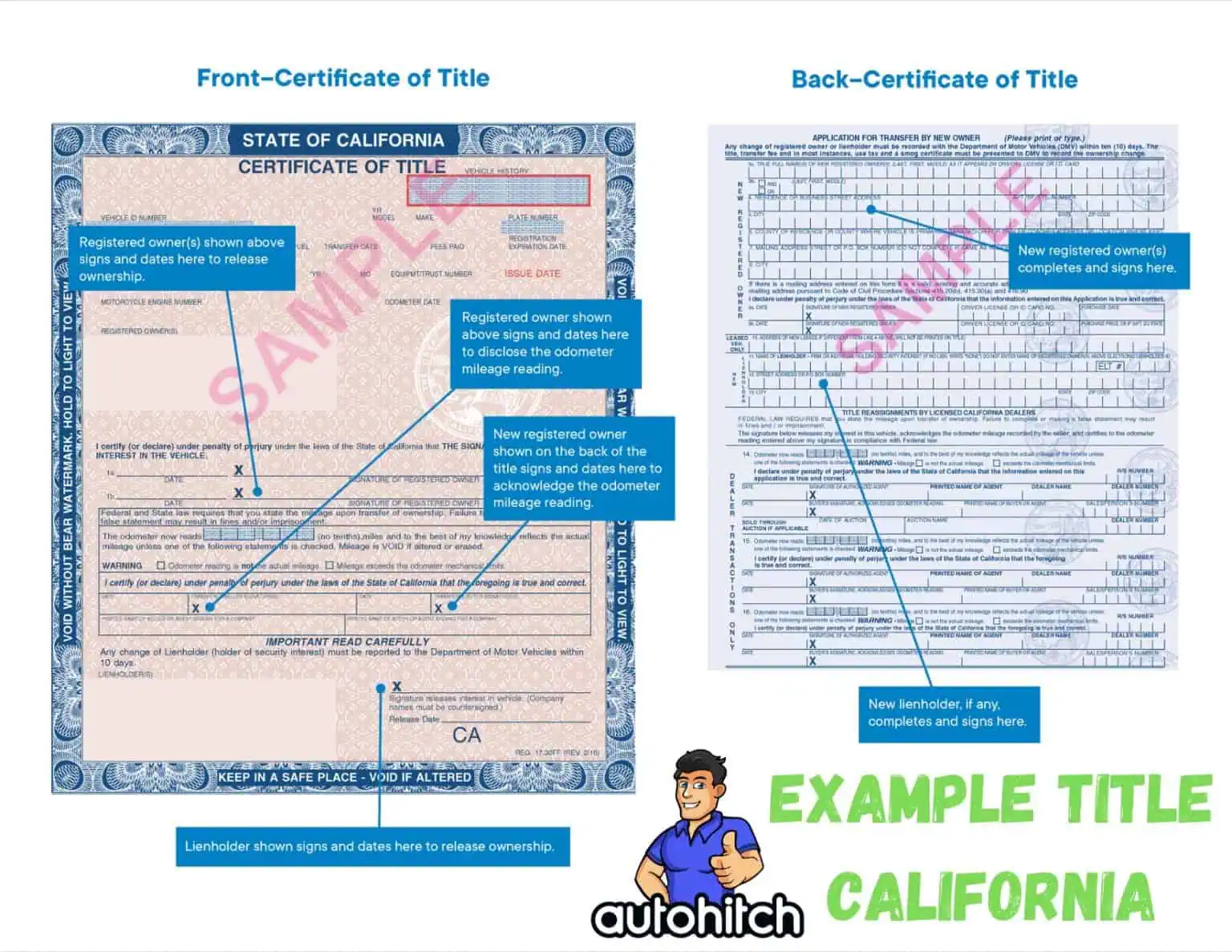

- Mortgage Title Insurance: This protects against financial loss if the property title has issues that arise after the sale, such as outstanding liens or conflicting ownership claims. It ensures the lender or property holder is protected if the sale is invalidated due to title problems. Before closing, a title search is conducted to identify any potential issues.

Factors Affecting the Cost of Mortgage Insurance

Several factors influence the cost of your mortgage insurance premium. These include:

- Type of Policy: Level/decreasing term life or critical illness; joint or single.

- Cover Level: The amount of coverage you need.

- Term (Duration): How long the policy will last.

- Add-ons/Optional Extras: Additional coverage for specific situations.

- Age: Older individuals typically face higher premiums due to increased risk.

- Medical History: A history of medical problems can increase premiums.

- Lifestyle Factors: Smoking or participating in high-risk activities can also raise premiums.

Who Needs Property Mortgage Insurance and Why?

Mortgage protection is essential for anyone with a mortgage, as most families’ mortgage payments depend on one or more regular incomes. Losing one of these incomes due to an unexpected death or a specified critical illness could make it impossible to keep up with payments/pay off a mortgage. It’s a must for anyone with a mortgage because it protects your family from having to go through the fear and worry of potentially losing their home at what is already an extremely stressful and traumatic time.

Avoiding or Cancelling Property Mortgage Insurance

There are ways to potentially avoid or cancel property mortgage insurance.

- Larger Down Payment: Saving for a down payment of 20% or more on a conventional loan eliminates the need for PMI.

- Refinancing: Once you’ve built up enough equity in your home, you can refinance your mortgage to remove PMI.

- PMI Cancellation: For conventional loans, you can request PMI cancellation once your loan balance reaches 80% of the original home value.

- Negotiate with Lender: Some lenders offer options to avoid PMI with a higher interest rate.

However, some loans, such as FHA loans, require MIPs regardless of the equity you hold in the home.

Mortgage Protection Life Insurance

As a borrower, a financial representative may offer mortgage protection life insurance when you apply for a mortgage. You can decline this insurance, but the bank may require you to sign some forms and waivers verifying your decision and that you understand the risks associated with having a mortgage. This differs from standard mortgage insurance, as it protects your heirs if you pass away before the mortgage is paid off. Payouts for mortgage life insurance can be either declining-term (the payout drops as the mortgage balance drops) or level, although the latter costs more. The recipient of the payments can be either the lender or the heirs of the borrower, depending on the terms of the policy.

The Bottom Line

Property mortgage insurance is an important aspect of the home-buying process, especially for those who cannot afford a large down payment. It protects the lender against financial loss if the borrower defaults on the loan. While it doesn’t protect the borrower directly, it makes homeownership more accessible. Understanding the different types of mortgage insurance, the factors that affect its cost, and how to potentially avoid or cancel it are essential for making informed decisions about your mortgage. If you have a conventional loan, you’ll generally need to pay mortgage insurance until you have at least 20% equity in the home. Depending on the type of government-backed FHA loan, you may pay a mortgage insurance premium for 11 years or the life of the loan.

Leave a Reply