Choosing the right car insurance is a crucial decision for every driver. With numerous car insurance company names vying for your attention, it can be overwhelming to make an informed choice. This comprehensive guide aims to simplify the selection process by providing an overview of some of the top car insurance companies in the US, factors influencing premiums, and tips for finding the best coverage for your needs.

Understanding the Car Insurance Landscape

The car insurance market in the US is highly competitive, with a mix of large national providers and smaller regional players. Each company offers various policy options, coverage levels, and pricing structures. Understanding the different types of coverage available and how they protect you is the first step in choosing the right insurer.

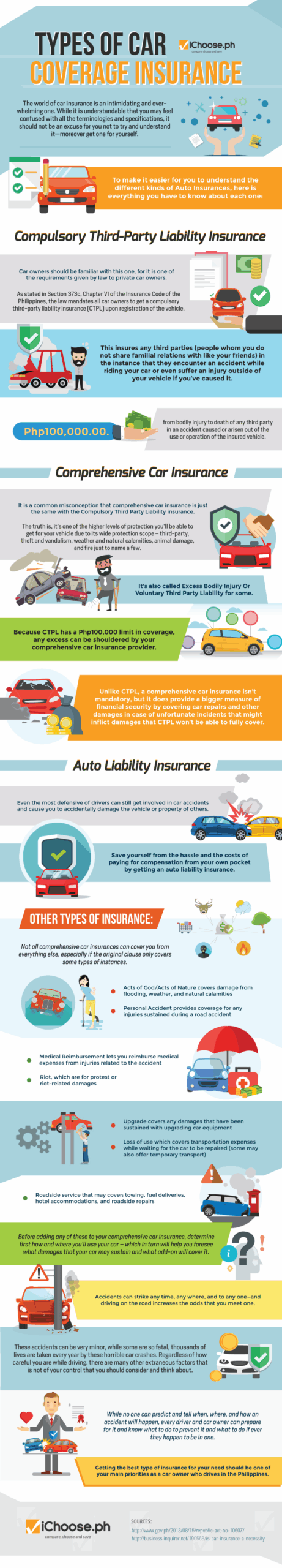

- Liability Coverage: This is the most basic type of car insurance, required by law in most states. It covers damages and injuries you cause to others in an accident.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another object, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, weather damage, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): In some states, PIP covers medical expenses and lost wages for you and your passengers, regardless of fault.

Top Car Insurance Companies

While “best” is subjective and depends on individual needs and circumstances, several companies consistently rank high in customer satisfaction, claims handling, and overall value. Here are some of the top car insurance company names in the US:

- State Farm: Known for its extensive network of agents and strong customer service, State Farm is a popular choice for many drivers. They offer a variety of coverage options and discounts.

- GEICO: Famous for its catchy commercials and competitive rates, GEICO is a direct insurer that primarily sells policies online and over the phone. They are often a good option for price-sensitive shoppers.

- Progressive: Progressive is another large insurer known for its innovative products and services, such as Snapshot, a usage-based insurance program.

- Allstate: Allstate offers a wide range of insurance products, including car insurance, and is known for its extensive network of agents and strong financial stability.

- USAA: USAA is exclusively available to military members, veterans, and their families. They consistently rank high in customer satisfaction and offer competitive rates.

It’s important to note that smaller, regional insurers can sometimes offer better rates or more personalized service than larger national companies. Be sure to research local options in your area.

Factors Influencing Car Insurance Premiums

Car insurance premiums are not one-size-fits-all. Insurers consider various factors to assess risk and determine your rates. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

- Driving Record: A clean driving record with no accidents or moving violations will typically result in lower premiums.

- Age and Gender: Younger drivers, particularly males, are generally considered higher risk and pay higher premiums.

- Location: Drivers in densely populated urban areas or areas with high rates of auto theft or accidents may pay higher premiums.

- Vehicle Type: The make and model of your car can affect your premiums. Expensive cars, sports cars, and cars that are more prone to theft tend to have higher insurance costs.

- Coverage Levels: The more coverage you purchase, the higher your premiums will be. Opting for higher deductibles can lower your premiums but will require you to pay more out of pocket in the event of a claim.

- Credit Score: In many states, insurers use credit scores as a factor in determining premiums. A good credit score can lead to lower rates.

Tips for Finding the Best Car Insurance

Finding the best car insurance involves more than just comparing prices. It’s about finding the right balance of coverage, price, and customer service to meet your individual needs.

- Shop Around and Compare Quotes: Get quotes from multiple insurers to compare coverage options and prices. Online comparison tools can be a helpful starting point.

- Consider Bundling Policies: Many insurers offer discounts for bundling your car insurance with other policies, such as homeowners or renters insurance.

- Increase Your Deductible: Raising your deductible can lower your premiums, but be sure you can afford to pay the higher deductible in the event of a claim.

- Maintain a Good Driving Record: Avoiding accidents and moving violations is the best way to keep your premiums low.

- Take Advantage of Discounts: Ask about available discounts, such as discounts for safe drivers, students, seniors, or members of certain organizations.

- Review Your Coverage Regularly: As your needs change, review your coverage to ensure it still meets your requirements.

The Importance of Customer Service and Claims Handling

While price is an important factor, don’t overlook the importance of customer service and claims handling. A good insurer will be responsive, helpful, and fair in handling your claims. Research customer reviews and ratings to get a sense of an insurer’s reputation.

- Claims Satisfaction: Check customer reviews and ratings related to claims satisfaction. This will give you insights into how smoothly and fairly claims are handled.

- Financial Stability: Choose an insurer with strong financial stability. This ensures that they will be able to pay out claims when needed.

- Customer Support: Ensure the insurer offers convenient customer support options, such as phone, email, or online chat.

Understanding Essential vs. Optional Coverage

Insurers sometimes offer “essential” or “basic” policies, which may seem appealing due to their lower cost. However, these policies often strip down coverage, potentially leaving you vulnerable in certain situations. Carefully consider what constitutes “essential” coverage for your specific needs and ensure that the policy includes those elements. For example, some essential policies may have higher excesses, a less generous no-claims discount scheme, or may cut back on features like child car seat replacement or personal possessions cover. Other policies might not cover windscreen and window damage. It’s best to thoroughly evaluate the included coverage details of each policy before making a final choice.

Conclusion

Choosing the right car insurance company requires careful consideration of your individual needs, budget, and risk tolerance. By understanding the different types of coverage available, the factors that influence premiums, and the importance of customer service, you can make an informed decision and protect yourself and your vehicle. Remember to shop around, compare quotes, and read reviews to find the best car insurance company for you.

Leave a Reply