Navigating the world of car insurance can be overwhelming, especially when you’re trying to find the best coverage at a reasonable price. If you’re a resident of West Virginia, “The Mountain State,” this guide is designed to help you understand your options and make informed decisions about your car insurance. We’ll explore some of the top car insurance companies in West Virginia, discuss factors affecting your rates, and provide tips for finding the best coverage for your needs.

Understanding West Virginia Car Insurance Requirements

Before diving into specific companies, it’s crucial to understand the minimum car insurance requirements in West Virginia. West Virginia law mandates that every vehicle must be covered by liability insurance. The minimum liability coverage requirements are:

- \$20,000 for bodily injury or death of one person in an accident.

- \$40,000 for bodily injury or death of two or more people in an accident.

- \$10,000 for property damage in an accident.

While these are the minimum requirements, it’s often advisable to consider higher coverage limits to adequately protect yourself financially in case of an accident where you are at fault. Choosing higher limits can provide a greater safety net against potential lawsuits and significant financial losses.

Factors Affecting Car Insurance Rates in West Virginia

Several factors influence your car insurance rates in West Virginia. Understanding these elements can help you anticipate your premium costs and potentially lower them.

- Driving Record: A clean driving record with no accidents or traffic violations will generally result in lower insurance rates. Conversely, a history of accidents, speeding tickets, or DUIs can significantly increase your premiums.

- Age and Experience: Younger, less experienced drivers are often considered higher risk and typically face higher insurance premiums. As you gain driving experience and maintain a good record, your rates are likely to decrease. New drivers under 18 are subject to West Virginia’s Graduated Driver License (GDL) program, a 3-step process that includes restrictions like supervised driving hours and passenger limits.

- Vehicle Type: The make and model of your vehicle play a significant role. Expensive vehicles, sports cars, and vehicles with high theft rates tend to have higher insurance costs. Safer vehicles with advanced safety features may qualify for discounts.

- Location: Your location within West Virginia can affect your rates. Urban areas with higher population densities and higher rates of accidents or theft may have higher premiums than rural areas. For example, auto insurance costs vary by county, with average sedan costs ranging from \$766 to \$855 annually.

- Coverage Selection: The type and amount of coverage you choose will impact your premiums. Opting for comprehensive and collision coverage with higher limits will generally result in higher costs compared to basic liability coverage.

- Credit Score: In many states (though regulations vary), insurance companies use credit scores as a factor in determining premiums. Maintaining a good credit score can potentially lead to lower insurance rates.

- Discounts: Many car insurance companies offer a variety of discounts. Common discounts include safe driver discounts, multi-policy discounts (bundling car and home insurance), good student discounts, and discounts for having anti-theft devices installed in your vehicle.

Top Car Insurance Companies in West Virginia

While specific rankings can vary, some of the leading car insurance companies that frequently offer competitive rates and reliable service in West Virginia include:

- Erie Insurance: Known for its strong customer service and competitive rates, Erie often ranks highly in customer satisfaction surveys. Erie offers state minimum liability car insurance starting at around \$44 a month or \$529 a year.

- State Farm: A well-established and widely recognized insurer, State Farm offers a variety of coverage options and is known for its financial stability.

- Allstate: Another major national insurer, Allstate provides a range of insurance products and is known for its extensive network of agents.

- Nationwide: Nationwide offers competitive rates and a variety of discounts. The cheapest full coverage car insurance starts at around \$173 a month or \$2,070 a year with Nationwide.

- Brierfield Insurance Company: Brierfield Insurance Company offers a range of coverage options, discounts, and digital tools to assist policyholders in making informed decisions. They are known for their commitment to customer satisfaction and efficient claims handling.

It’s important to get quotes from multiple companies to compare rates and coverage options before making a final decision.

Types of Car Insurance Coverage

When shopping for car insurance in West Virginia, consider the following types of coverage:

- Liability Coverage: This covers damages and injuries you cause to others if you’re at fault in an accident. It includes both bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, natural disasters, or animal strikes.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments (MedPay) Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

Tips for Finding Affordable Car Insurance in West Virginia

Here are some practical tips to help you find affordable car insurance in West Virginia:

- Shop Around and Compare Quotes: Get quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can be helpful in this process.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, but make sure you can afford to pay the deductible out-of-pocket if you need to file a claim.

- Bundle Your Insurance Policies: Many companies offer discounts if you bundle your car insurance with other policies, such as home or renters insurance.

- Maintain a Good Driving Record: Drive safely and avoid accidents and traffic violations to keep your insurance rates low.

- Take Advantage of Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, and discounts for safety features.

- Review Your Coverage Annually: As your circumstances change, review your coverage needs and adjust your policy accordingly. You may be able to lower your coverage limits if your vehicle depreciates in value or if you no longer need certain types of coverage.

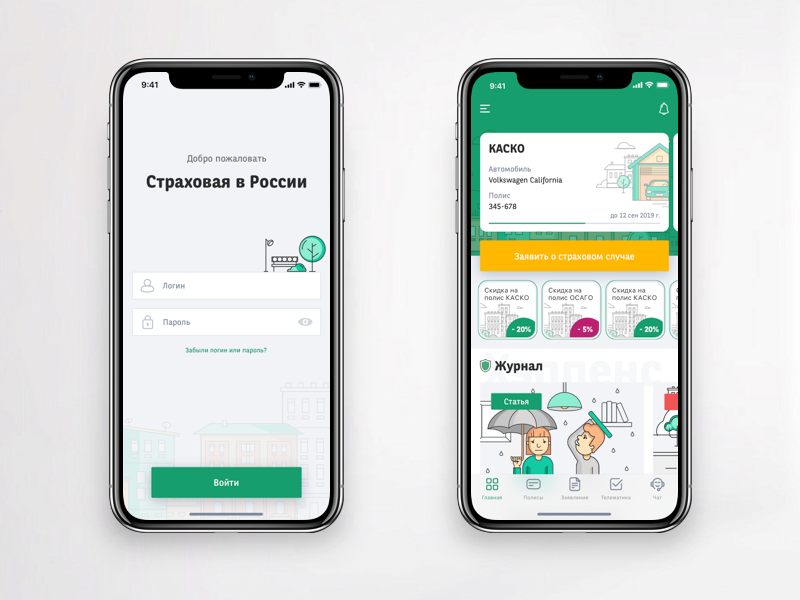

The Role of Digital Tools and Mobile Apps

Many car insurance companies now offer user-friendly mobile apps and online portals that make it easy to manage your policy, file claims, and access important information. These digital tools can enhance the overall customer experience and provide added convenience. For example, Brierfield Insurance Company offers a mobile app with features like policy access, claims filing, and account management.

Conclusion

Finding the right car insurance in West Virginia requires careful consideration of your individual needs, driving record, vehicle type, and budget. By understanding the factors that affect your rates, exploring your coverage options, and comparing quotes from multiple companies, you can make an informed decision and secure the best possible protection for yourself and your vehicle. Remember to regularly review your policy and take advantage of available discounts to ensure you’re always getting the most value for your money.

Leave a Reply