Choosing the right car insurance company in the USA is a crucial decision that can significantly impact your financial well-being in the event of an accident or other unforeseen circumstances. With numerous providers vying for your business, it’s essential to understand the key factors that differentiate them. This comprehensive guide will explore some of the top car insurance companies in the USA, highlighting their strengths, weaknesses, and unique offerings to help you make an informed choice.

Understanding Car Insurance Basics

Before diving into specific companies, it’s important to grasp the fundamental aspects of car insurance. In the United States, car insurance is often mandated by state law, requiring drivers to maintain a minimum level of coverage. The most common types of car insurance include:

- Liability Coverage: This covers damages and injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This pays for damage to your vehicle resulting from a collision with another car or object, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): In some states, PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

Understanding these different coverage types is the first step in selecting the right car insurance policy for your needs.

Factors to Consider When Choosing a Car Insurance Company

When evaluating car insurance companies, several factors should be taken into account:

- Coverage Options: Does the company offer the specific coverage types you need?

- Price and Discounts: How competitive are the company’s rates, and what discounts are available?

- Financial Stability: Is the company financially sound and able to pay claims promptly?

- Customer Service: How responsive and helpful is the company’s customer service team?

- Claims Handling: How efficient and fair is the company’s claims process?

- Reputation: What is the company’s overall reputation among customers and industry experts?

Top Car Insurance Companies in the USA

While the “best” car insurance company is subjective and depends on individual needs and circumstances, some companies consistently rank high in customer satisfaction, financial strength, and coverage options. Here are some of the top car insurance companies in the USA:

- State Farm: State Farm is one of the largest car insurance companies in the US, known for its strong financial stability and extensive network of local agents. They offer a wide range of coverage options and are often praised for their customer service.

- GEICO: GEICO is another major player in the car insurance market, known for its competitive rates and user-friendly online tools. They offer a variety of discounts and are a popular choice for budget-conscious drivers.

- Progressive: Progressive is known for its innovative Snapshot program, which allows drivers to save money based on their driving habits. They also offer a wide range of coverage options and discounts.

- Allstate: Allstate is a well-established car insurance company with a strong reputation for customer service and claims handling. They offer a variety of coverage options and are known for their “Good Hands” promise.

- USAA: USAA is a highly-rated car insurance company that primarily serves military members and their families. They are known for their excellent customer service, competitive rates, and comprehensive coverage options.

Evaluating Coverage Options and Policy Features

When comparing car insurance companies, it’s crucial to evaluate the specific coverage options and policy features they offer. Consider the following:

- Liability Limits: Make sure the liability limits are sufficient to protect your assets in the event of a serious accident.

- Deductibles: Choose deductibles that you can comfortably afford to pay out-of-pocket in the event of a claim.

- Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and multi-policy discounts.

- Additional Coverage Options: Consider adding optional coverage options, such as roadside assistance, rental car reimbursement, and gap insurance, if they are appropriate for your needs.

- Policy Exclusions: Be aware of any policy exclusions that may limit your coverage in certain situations.

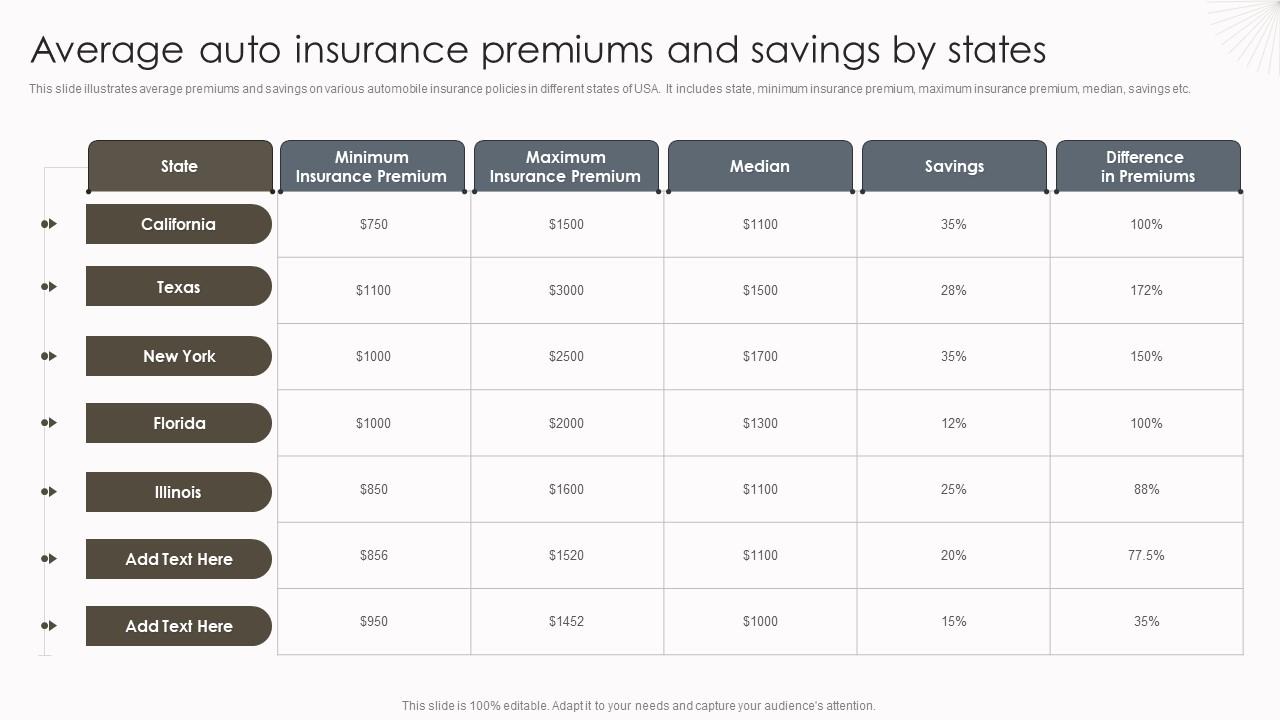

The Impact of Location on Car Insurance Rates

The location where you live can significantly impact your car insurance rates. Drivers in densely populated urban areas typically pay higher premiums than drivers in rural areas due to the increased risk of accidents and theft. Factors such as traffic congestion, crime rates, and weather conditions can all influence insurance rates. For example, drivers in cities like London may pay significantly higher premiums than those in smaller towns due to higher accident rates. Understanding the factors that influence car insurance rates in your specific location is crucial for finding the best possible deal.

Using Online Tools and Comparison Websites

Numerous online tools and comparison websites can help you compare car insurance quotes from different companies. These tools allow you to enter your personal information and driving history to receive customized quotes from multiple insurers. Comparison shopping can save you time and money by allowing you to quickly identify the most competitive rates and coverage options. However, it’s important to note that not all car insurance companies are included on every comparison website. For a comprehensive comparison, it’s recommended to get quotes from multiple sources, including direct quotes from insurers.

Making the Right Choice

Choosing the right car insurance company in the USA is a personal decision that depends on your individual needs, circumstances, and preferences. By carefully evaluating your coverage needs, comparing rates and policy features, and considering the factors outlined in this guide, you can make an informed decision and find a car insurance company that provides the best value and protection for you. Remember to review your car insurance policy periodically and make adjustments as your needs change over time.

Leave a Reply