Navigating the world of car insurance in Michigan can feel like traversing a complex road map. With unique state regulations, varying risk factors across different cities, and a wide array of insurance providers, finding the right policy at the right price requires careful consideration. This article serves as your comprehensive guide to understanding the car insurance landscape in Michigan, highlighting top companies, exploring rate variations, and offering practical tips for securing the best possible coverage.

Understanding Michigan’s Car Insurance Landscape

Michigan operates under a no-fault insurance system, meaning that, generally, your own insurance pays for your medical expenses and other losses regardless of who caused the accident. This system necessitates specific coverage requirements, including Personal Injury Protection (PIP), Property Protection Insurance (PPI), and liability coverage. Understanding these requirements is the first step in making informed decisions about your car insurance policy.

Michigan drivers must carry a minimum level of auto insurance to legally operate a vehicle:

- Bodily Injury Liability (Per Person): \$50,000

- Bodily Injury Liability (Per Accident): \$100,000

- Property Protection Insurance (PPI): Up to \$1,000,000 (for damage your car causes to another person’s property in Michigan)

- Property Damage Liability (Per Accident) Outside Michigan: \$10,000

- Personal Injury Protection (PIP): Medical coverage (options vary; unlimited coverage is available, but drivers may choose lower limits if they have health insurance that qualifies)

Top Car Insurance Companies in Michigan

Several car insurance companies stand out in Michigan, each offering a unique blend of coverage options, customer service, and competitive rates. Let’s take a look at some of the top contenders:

- Travelers: Often cited as the cheapest option for both full coverage and minimum liability in Michigan. They frequently have the lowest rates in many of Michigan’s largest cities.

- GEICO: A strong choice for young drivers due to its affordable rates for this demographic. They also offer competitive pricing in certain cities like Detroit, Flint, Taylor, and Westland.

- Auto-Owners Insurance Co: Known for competitive pricing for drivers with texting violations and at-fault accidents.

- Progressive: A good option for drivers with a DUI conviction.

- AAA: While not always the cheapest, AAA offers solid coverage options and competitive rates in cities like Dearborn and Dearborn Heights.

Factors Affecting Car Insurance Rates in Michigan

Several factors influence car insurance rates in Michigan. Understanding these factors can help you anticipate potential costs and take steps to lower your premiums:

- Location: Car insurance rates vary significantly across Michigan cities. Densely populated areas with high traffic, such as Hamtramck and Highland Park, typically have higher premiums than quieter towns like Ann Arbor and Grand Rapids.

- Driving Record: Traffic violations, such as speeding tickets, DUIs, and at-fault accidents, can substantially increase your insurance rates.

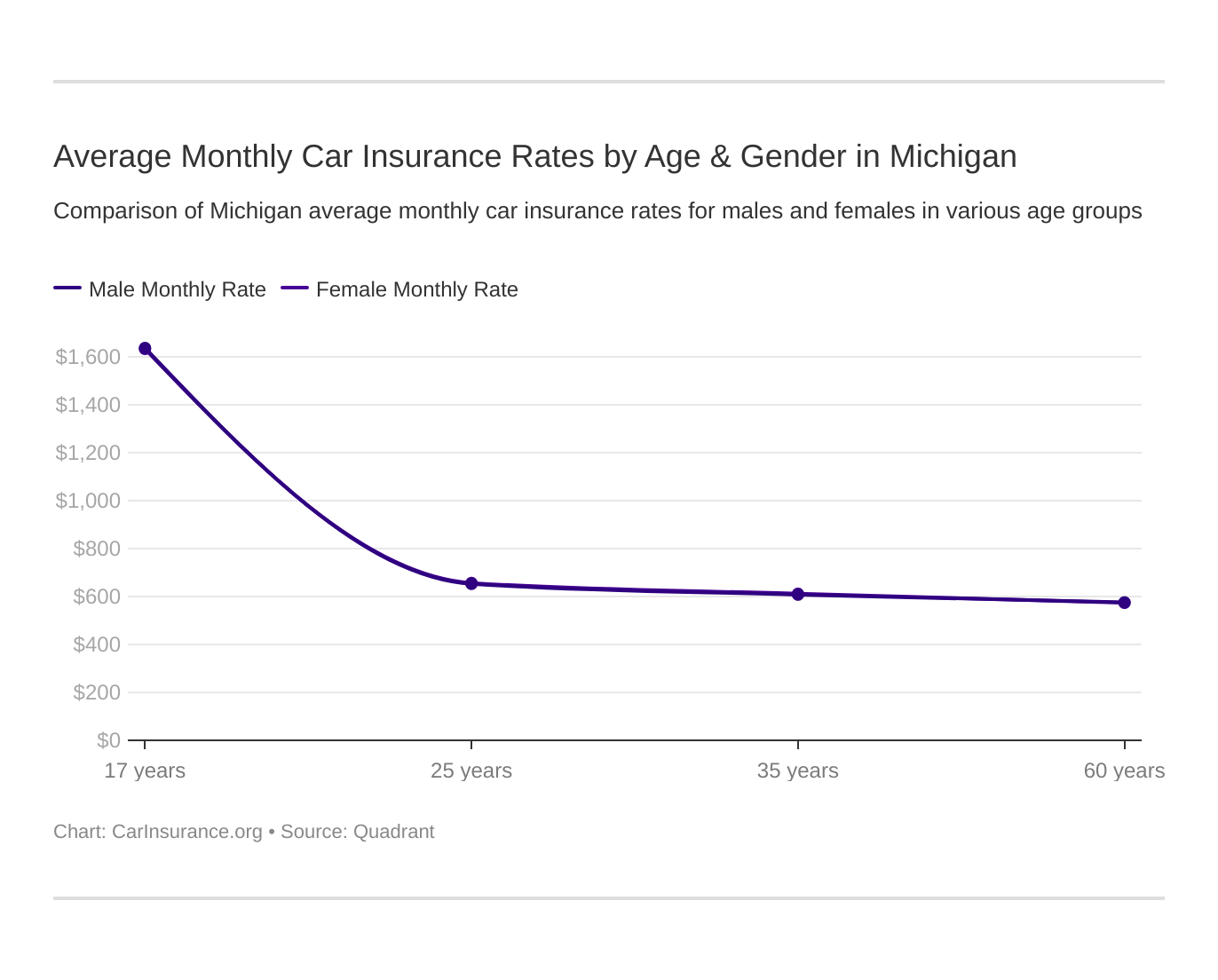

- Age: Young drivers generally face higher premiums due to their lack of driving experience.

- Credit Score: Insurers in Michigan may consider your credit score when determining your rates. A lower credit score can result in higher premiums.

- Coverage Type and Limits: Choosing higher coverage limits and adding optional coverages like collision and comprehensive will increase your premium.

- Vehicle Type: The make and model of your vehicle can also affect your insurance rates. Vehicles with higher theft rates or that are more expensive to repair may result in higher premiums.

Finding the Cheapest Car Insurance in Michigan

While cost is a significant factor, it’s essential to balance affordability with adequate coverage. Here are some strategies for finding the cheapest car insurance in Michigan without sacrificing essential protection:

- Shop Around Extensively: Compare quotes from multiple insurance companies, both national carriers and smaller regional insurers.

- Understand Michigan’s Unique Coverage Rules: Familiarize yourself with the state’s mandatory coverage requirements and consider tailoring your PIP choice to your health coverage.

- Seek State-Specific Discounts: Inquire about potential discounts for bundling home and auto insurance, good driving records, and paying in full.

- Consider Your Vehicle: Opting for a vehicle with strong anti-theft features can help reduce your insurance costs.

- Work on Your Profile: Improving your credit score and maintaining a clean driving record are two of the most effective ways to lower your premiums.

- Check the Michigan Automobile Insurance Placement Facility (MAIPF): If you’re denied coverage by other insurers, the MAIPF is a “last resort” option to obtain required coverage.

The Risks of Opting for Minimum Coverage

While opting for the cheapest car insurance might seem appealing, it’s crucial to understand the potential risks associated with minimum coverage. Michigan requires drivers to carry liability insurance with minimum limits, but these limits may not be sufficient to cover all potential damages in an accident.

Minimum coverage can leave you financially vulnerable in several ways:

- Uncovered Vehicle Damage: If you’re at fault in an accident, minimum coverage won’t cover the cost of repairing your own vehicle.

- Inadequate Bodily Injury Coverage: Medical expenses can quickly exceed the minimum liability limits, leaving you responsible for covering the remaining costs out of pocket.

- Lack of Uninsured Motorist Coverage: Michigan has a high percentage of uninsured drivers. Without uninsured motorist coverage, you’ll be responsible for covering your own damages if you’re hit by an uninsured driver.

- Uncovered Weather-Related Damage: Basic coverage typically won’t pay for damage caused by severe weather events.

- Uncovered Vehicle Theft Damage: Without comprehensive coverage, you won’t be compensated if your car is stolen or damaged during a theft.

Conclusion

Finding the right car insurance company in Michigan requires a thorough understanding of the state’s unique insurance landscape, your individual needs, and the various factors that influence rates. By comparing quotes from multiple insurers, exploring potential discounts, and carefully considering your coverage options, you can secure a policy that provides both adequate protection and affordability. Remember, the cheapest option isn’t always the best – prioritize comprehensive coverage to safeguard yourself against potential financial risks.

Leave a Reply