Choosing the right auto insurance company in Florida is a crucial decision, given the state’s unique driving environment and insurance regulations. From navigating bustling urban centers like Miami and Tampa to understanding the nuances of Florida’s no-fault insurance system, drivers need a reliable and affordable auto insurance policy. This comprehensive guide provides an overview of the top auto insurance companies in Florida, coverage requirements, and strategies for securing the best rates in 2024.

Understanding Florida’s Auto Insurance Landscape

Florida’s auto insurance market is influenced by several factors, including high traffic congestion, moderate theft rates, and slightly above-average claim sizes. While the state is known for its hurricane season, weather-related risks have a relatively low year-round impact on insurance premiums. However, urban traffic plays a significant role, with cities like Tampa and Miami experiencing high accident and claim volumes.

Florida operates under a no-fault insurance system. This requires all drivers to carry personal injury protection (PIP) and property damage liability (PDL) coverage. The minimum coverage requirements in Florida are:

- Personal Injury Protection (PIP): \$10,000 per person

- Property Damage Liability (PDL): \$10,000 per accident

While these minimums satisfy legal requirements, they may not provide sufficient coverage in the event of a serious accident. Consequently, many Florida drivers choose to add optional coverages for more comprehensive protection.

Top Auto Insurance Companies in Florida

U.S. News analyzed various data points, including state-specific insurance premiums, customer survey responses, and state-level auto insurance complaints filed to the National Association of Insurance Commissioners (NAIC) to identify the best auto insurance companies in Florida. The ratings are updated periodically based on the latest information from online sources and surveys.

Here are some of the top-rated auto insurance companies in Florida:

Auto-Owners: Auto-Owners stands out for its strong financial stability (A++ A.M. Best rating) and high claims satisfaction score. They offer competitive rates and a usage-based savings program. However, rates can be higher for young drivers, and they lack a direct online claims filing system.

State Farm: State Farm is recognized for its excellent customer service, competitive rates, flexible coverage options, and multiple discounts. The company’s financial strength is rated A++ by A.M. Best. On the downside, State Farm may have higher costs for high-risk drivers and limited digital tools.

AAA: AAA is well-regarded for its roadside assistance benefits, competitive rates (starting at $122/month for full coverage), accident forgiveness, and good student discounts. Towing up to 100 miles is included with a Premier AAA membership. A potential drawback is that membership is required to access AAA’s auto insurance, and their mobile app lacks some features like ID cards and claims filing.

Allstate: Best known for rideshare coverage. Other benefits include safe driving bonus options, and has local agent access. Potential drawbacks are higher starting rates, and below average claims score.

The Hartford: The Hartford offers AARP perks such as lifetime policy renewability, and priority claims support making it the best option for senior citizens. But, most benefits are only available to Florida AARP members, with a weak bundling discount.

Geico: Geico stands out for low premiums, an excellent digital experience, and aggressive discount opportunities. A potential downside is the reports of mixed customer service ratings and a less personalized approach compared to companies with local agents.

Farmers: Famers offer personalized policies, rideshare and custom parts coverage, and extensive agent network. But, Farmers also come with expensive minimum coverage, and moderate claims score.

Travelers: Travelers provides industry experience, and financial stability with flexible coverage options. The company can be more expensive with above-average rates, and fewer local agents.

Progressive: Progressive is the best for budget shopping, they also offer telematics programs, and discount stacking. However, they have low claims score, and have premium spikes for accidents.

Liberty Mutual: Liberty Mutual provides accident forgiveness, broad discount list, and custom add-on coverages. Potential drawbacks include a moderate claims score, and pricey minimum coverage.

Factors Affecting Auto Insurance Rates in Florida

Several factors influence auto insurance rates in Florida, including:

- Driving Record: A clean driving record typically results in lower premiums, while accidents, tickets, and DUIs can significantly increase rates. State Farm maintains the most stable pricing, with just a $4 increase from a clean record to a DUI.

- Age: Young drivers, particularly males, face the highest insurance costs. Rates generally decrease with age, stabilizing around age 30. 60-year-old females pay the lowest average rate.

- Coverage Level: Choosing minimum coverage keeps you legally compliant, but adding optional coverages provides greater financial protection.

- Vehicle Type: The make and model of your vehicle can impact insurance rates. Vehicles with high safety ratings and lower repair costs generally have lower premiums.

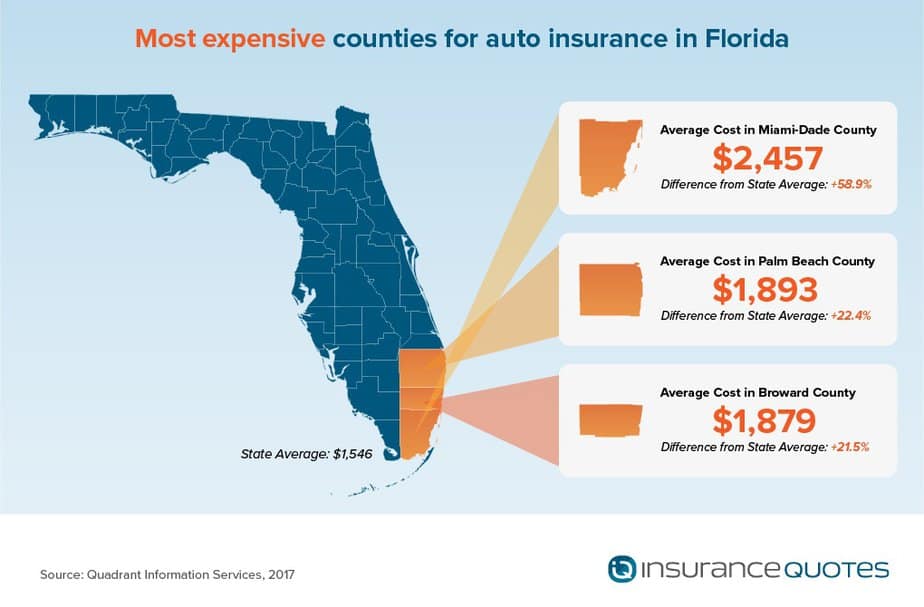

- Location: Urban areas with high traffic density, such as Tampa and Miami, tend to have higher insurance rates.

- Credit Score: Insurance companies often use credit scores to assess risk. Maintaining a good credit score can help lower your premiums.

Strategies for Saving on Auto Insurance in Florida

Florida drivers can employ various strategies to save on auto insurance premiums:

- Shop Around: Comparing quotes from multiple insurers is essential for finding the best rates.

- Take Advantage of Discounts: Many insurers offer discounts for safe driving, low mileage, anti-theft devices, bundling policies, and being a good student.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premium.

- Maintain a Clean Driving Record: Avoiding accidents and tickets is one of the most effective ways to keep rates low.

- Drop Unnecessary Coverage: If you have an older vehicle, consider dropping collision or comprehensive coverage if the cost outweighs the car’s value.

Choosing the Right Coverage

Selecting the appropriate coverage is crucial for protecting yourself financially in the event of an accident. Beyond the state-mandated minimums, consider adding the following optional coverages:

- Bodily Injury Liability (BIL): Covers injuries you cause to others in an accident. Although not required in Florida unless you have certain violations, it is strongly recommended.

- Comprehensive Coverage: Pays for non-collision damage from events like hurricanes, floods, theft, or vandalism.

- Collision Coverage: Covers repair or replacement of your vehicle after an at-fault accident.

- Uninsured/Underinsured Motorist Coverage: Helps pay your medical expenses if you’re hit by a driver with no or too little insurance.

- Medical Payments Coverage (MedPay): Offers extra help beyond PIP for medical bills, co-pays, and deductibles.

Conclusion

Navigating Florida’s auto insurance market requires careful consideration of various factors, including coverage requirements, risk exposure, and budget constraints. By comparing quotes from top insurers, understanding available discounts, and customizing your coverage to meet your specific needs, you can secure the best auto insurance policy in Florida.

Leave a Reply