The General is a well-known car insurance company, particularly recognized for providing coverage to drivers who may be considered “high-risk.” While it may not be the best fit for everyone, it offers specific advantages that cater to a particular segment of the driving population. This article will delve into the details of The General car insurance, exploring its pros, cons, coverage options, discounts, and customer reviews to help you determine if it’s the right choice for your needs.

Who is The General Car Insurance For?

The General car insurance specializes in providing coverage for drivers who may have difficulty obtaining insurance from other companies. This often includes individuals who:

- Need an SR-22 form: An SR-22 is a certificate of financial responsibility often required by the state after a DUI, driving without insurance, or other serious traffic violations. The General can file this form on your behalf in most states.

- Have a history of accidents or traffic violations: Drivers with multiple at-fault accidents or moving violations on their record may find it challenging to secure affordable insurance. The General is more willing to insure these drivers.

- Have experienced a lapse in car insurance coverage: A gap in coverage can raise red flags for some insurers. The General may be more lenient in these situations.

- Have poor credit: In some states, credit scores can impact insurance rates. The General may be an option for drivers with less-than-perfect credit.

Pros and Cons of The General Car Insurance

Before deciding on The General, it’s important to weigh the advantages and disadvantages:

Pros:

- Acceptance of High-Risk Drivers: The General provides a valuable service by insuring drivers who may be turned down by other companies.

- SR-22 Filing: The company offers SR-22 forms in most states, simplifying the process for drivers who require it.

- Flexible Payment Options: The General is known for offering flexible payment plans, which can be helpful for those on a tight budget.

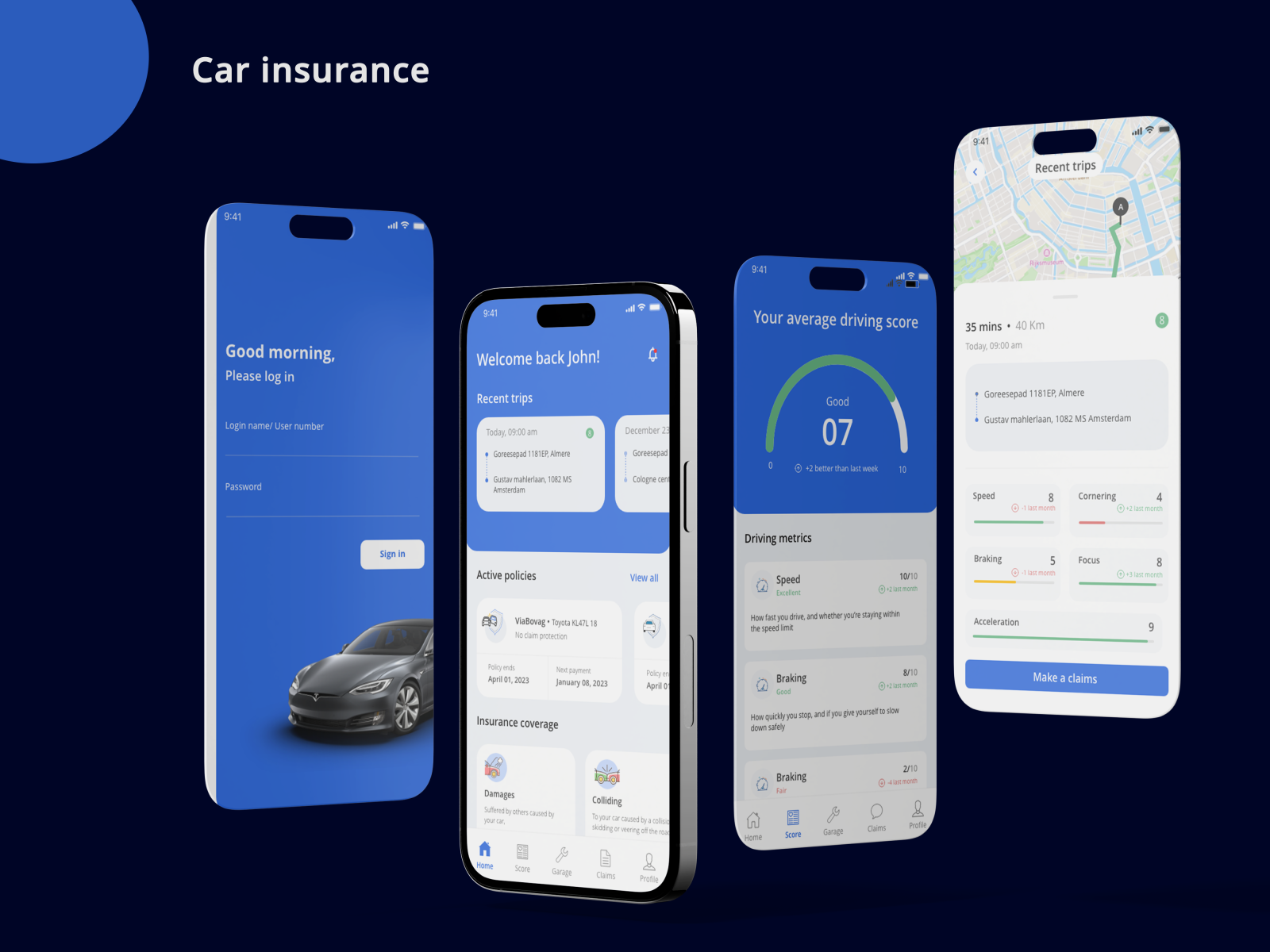

- Mobile App and Online Management: Policyholders can easily manage their accounts, make payments, and file claims through The General’s website and mobile app.

Cons:

- Potentially Higher Rates: Rates can be higher compared to other insurers, especially for drivers who don’t fall into the “high-risk” category.

- Limited Coverage Options: The General may not offer as many add-on coverage options as some of its competitors.

- Customer Complaints: The company has received a higher-than-average number of customer complaints, according to the National Association of Insurance Commissioners (NAIC).

- Industry Ratings: The General is not rated in J.D. Power’s auto claims and shopping satisfaction surveys, and lacks an AM Best rating.

Coverage Options Offered by The General

The General offers standard car insurance coverage options, including:

- Liability Coverage:

- Bodily Injury Liability (BI): Covers medical expenses if you injure someone else in an accident.

- Property Damage Liability (PD): Covers damage to another person’s vehicle or property in an accident you cause.

- Collision Coverage: Pays for damage to your vehicle if you collide with another car or object, regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Covers medical expenses for you and your passengers after an accident, regardless of fault (availability varies by state).

- Rental Car Reimbursement: Pays for a rental car while your vehicle is being repaired after a covered accident.

- Gap Insurance: Covers the difference between the actual cash value of your car and what you still owe on your loan if your car is totaled (available in certain states).

Discounts Available from The General

The General offers a range of discounts to help lower your premium, but availability varies by state. Common discounts include:

- Multi-Vehicle Discount: Insuring more than one vehicle with The General.

- Homeowner Discount: Owning a home, even if it’s not insured by The General.

- Good Student Discount: Insuring a full-time student with good grades.

- Vehicle Safety Feature Discount: Insuring a vehicle with certain safety features, such as airbags or anti-lock brakes.

- Defensive Driving Course Discount: Completing an approved defensive driving course.

- Safe Driver Discount: Participating in a program that tracks driving habits and rewards safe driving (availability varies).

- “Double Deductible” Discount: Agreeing to double your deductible for the first 45 days of your policy for a lower premium.

Customer Reviews and Ratings

Customer reviews for The General are mixed. While some policyholders appreciate the company’s willingness to insure high-risk drivers and its flexible payment options, others express concerns about higher rates and customer service.

- NAIC Complaint Index: The General has an average NAIC complaint index that is higher than expected for a company of its size, indicating a higher volume of complaints relative to its market share.

- CRASH Network Report Card: CRASH Network, an automotive industry trade publication, gave The General a D in its 2024 Insurer Report Card, based on feedback from collision repair professionals.

- Jerry Customer Reviews: Jerry customers have rated The General relatively well, but the distribution of ratings is not specified in the provided text.

It’s important to note that customer experiences can vary widely, and online reviews should be viewed as just one piece of information when making a decision.

Conclusion

The General car insurance can be a viable option for drivers who are considered high-risk and struggle to find coverage elsewhere. Its acceptance of drivers with SR-22 requirements, accidents, or coverage lapses is a significant advantage. However, it’s crucial to compare rates and coverage options with other insurers to ensure you’re getting the best value for your specific needs. Be aware of the potential for higher rates and the company’s history of customer complaints. If you fit the high-risk profile and prioritize accessibility over potentially lower premiums, The General may be worth considering.

Leave a Reply