Navigating the world of car insurance in Florida can feel overwhelming. With numerous companies vying for your attention and varying coverage options, finding the best fit for your needs and budget requires careful consideration. This comprehensive guide will explore the top car insurance companies in Florida, helping you make an informed decision and secure the coverage you need to drive with confidence.

Understanding Florida’s Car Insurance Requirements

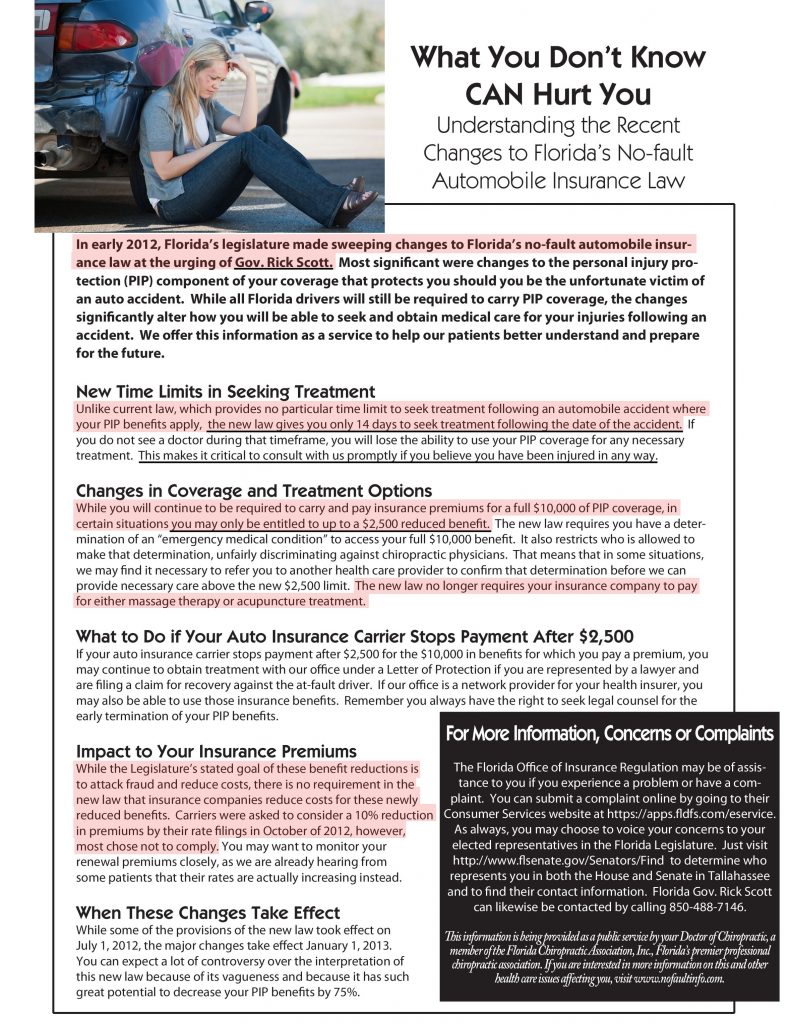

Before diving into specific companies, it’s crucial to understand Florida’s minimum car insurance requirements. Unlike some states, Florida mandates Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage:

Personal Injury Protection (PIP): This covers your medical bills and lost wages if you’re injured in an accident, regardless of who is at fault. Florida requires a minimum of $10,000 in PIP coverage.

Property Damage Liability (PDL): This covers damages you cause to another person’s property, such as their car or fence. Florida requires a minimum of $10,000 in PDL coverage.

While these are the minimum requirements, experts generally recommend purchasing higher coverage limits if your budget allows. Consider adding optional coverages like collision, comprehensive, and uninsured/underinsured motorist coverage for added protection.

Factors to Consider When Choosing a Car Insurance Company

Selecting the right car insurance company involves more than just comparing prices. Consider these factors to find the best fit for your unique circumstances:

Coverage Options: Does the company offer the specific coverages you need, such as gap insurance, roadside assistance, or rental car reimbursement?

Price and Discounts: Compare quotes from multiple companies to find the most competitive rates. Inquire about available discounts, such as those for safe drivers, students, or bundling multiple policies. Many companies like Mercury offer discounts for combining affordable rates.

Financial Stability: Choose a company with a strong financial rating to ensure they can pay out claims promptly and efficiently.

Customer Service: Read online reviews and check customer satisfaction ratings to gauge the company’s responsiveness and claims handling process.

Claims Process: Understand the company’s claims process and how they handle disputes. A smooth and efficient claims process is crucial in the event of an accident.

Top Car Insurance Companies in Florida

Based on factors like coverage options, customer service, financial strength, and price, here are some of the top car insurance companies in Florida:

USAA: Consistently ranked among the best for customer satisfaction and claims handling, USAA offers competitive rates and a wide range of coverage options. However, eligibility is limited to active-duty military members, veterans, and their families.

State Farm: A well-established and reputable insurer, State Farm boasts a large network of agents and offers a variety of coverage options. They are known for their financial stability and commitment to customer service. NerdWallet has awarded State Farm high ratings, making it a strong contender.

Geico: Known for its affordable rates and user-friendly online platform, Geico is a popular choice for budget-conscious drivers. They offer a range of discounts and a streamlined claims process. Geico is often the cheapest car insurance company overall, with low average rates for minimum coverage, and is often the cheapest for drivers with poor credit.

Progressive: Another major player in the car insurance market, Progressive offers a wide range of coverage options and a user-friendly online experience. They are known for their Snapshot program, which allows drivers to save money based on their driving habits. Progressive often provides savings compared to the national average for full coverage policies.

Other Notable Companies: Other companies that may be worth considering include Allstate, Travelers, and Auto-Owners Insurance.

How to Get the Best Car Insurance Rates in Florida

Finding the cheapest car insurance in Florida requires a proactive approach. Here are some tips to help you save money:

Shop Around: Get quotes from multiple companies to compare rates and coverage options. Don’t settle for the first quote you receive.

Increase Your Deductible: Raising your deductible can lower your premium, but make sure you can afford to pay the higher deductible in the event of an accident.

Maintain a Good Driving Record: Avoid accidents and traffic violations, as these can significantly increase your insurance rates.

Improve Your Credit Score: Insurers often use credit scores to assess risk, so improving your credit score can lead to lower premiums.

Take Advantage of Discounts: Inquire about available discounts, such as those for safe drivers, students, bundling multiple policies, or having anti-theft devices installed in your car.

Consider Usage-Based Insurance: Some companies offer usage-based insurance programs that track your driving habits and reward safe driving with lower rates.

The Importance of Comparing Quotes

Comparing car insurance quotes is essential for finding the best rates and coverage. U.S. News analyzed data about car insurance companies in Florida, including premiums, survey responses, and complaints filed to the National Association of Insurance Commissioners (NAIC). Their analysis considered state-specific insurance premiums and other data to provide ratings. They computed the mean rate for male and female drivers aged 25, 40, and 60 who drive 14,000 miles per year, have medium coverage, good credit, and a clean driving record. Remember that these are comparative rates, and your actual rates will vary based on your individual circumstances.

Conclusion

Choosing the right car insurance company in Florida requires careful research and consideration. By understanding Florida’s minimum requirements, evaluating your individual needs, comparing quotes from multiple companies, and taking advantage of available discounts, you can find the best coverage at a price that fits your budget. Drive safely and responsibly, and remember to review your insurance policy periodically to ensure it continues to meet your evolving needs.

Leave a Reply