Finding cheap car insurance quotes can feel like navigating a maze. With numerous providers, varying coverage options, and a host of factors influencing premiums, it’s easy to feel overwhelmed. However, by understanding the key elements that impact car insurance costs and employing some savvy strategies, you can significantly reduce your expenses without sacrificing essential protection. This comprehensive guide provides practical tips and insights to help you secure the most affordable car insurance quotes in the US.

Understanding the Factors Affecting Car Insurance Quotes

Before diving into strategies for finding cheap car insurance, it’s crucial to understand the factors that insurance companies consider when determining your premium. These factors can be broadly categorized as personal factors, vehicle-related factors, and coverage-related factors.

Personal Factors:

- Age: Younger drivers, particularly those under 25, typically face higher premiums due to their perceived inexperience and higher accident rates.

- Driving History: A clean driving record with no accidents or traffic violations is a major factor in securing low rates. Conversely, accidents, speeding tickets, and DUIs can significantly increase your premiums.

- Credit Score: In many states, insurance companies use credit scores as an indicator of risk. A higher credit score generally translates to lower premiums.

- Location: Urban areas with higher population density and crime rates often have higher insurance costs compared to rural areas.

- Gender: While regulations vary, some studies suggest that gender can influence insurance rates, with young male drivers sometimes facing higher premiums.

- Marital Status: Married individuals may receive slightly lower rates than single individuals, as they are often perceived as more responsible drivers.

- Occupation: Certain professions are statistically associated with higher or lower risk, which can impact insurance rates.

Vehicle-Related Factors:

- Make and Model: The type of car you drive significantly impacts insurance costs. High-performance vehicles, luxury cars, and vehicles with high theft rates typically have higher premiums.

- Age of Vehicle: Newer cars are often more expensive to insure due to their higher replacement value and the cost of repairing advanced technology.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for lower insurance rates.

- Vehicle Usage: The amount you drive your car annually affects your premium. Lower annual mileage generally results in lower rates.

Coverage-Related Factors:

- Coverage Type: The type of coverage you choose (liability, comprehensive, collision, etc.) directly impacts your premium. More comprehensive coverage options naturally come with higher costs.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

- Coverage Limits: The amount of coverage you select for liability, collision, and comprehensive coverage affects your premium. Higher coverage limits provide greater financial protection but also come with higher costs.

Strategies for Getting Cheap Car Insurance Quotes

Now that you understand the factors influencing car insurance rates, here are practical strategies to help you find the most affordable quotes:

- Shop Around and Compare Quotes:

- Use Online Comparison Tools: Numerous websites allow you to compare quotes from multiple insurance companies simultaneously. These tools can save you significant time and effort in your search for cheap car insurance.

- Get Quotes from Direct Insurers: Some insurance companies, like NFU Mutual, do not participate in online comparison sites. It’s essential to get quotes directly from these insurers to ensure you’re considering all available options.

- Compare Cover Options and Prices: Explore the different cover options available and ensure they meet your specific needs. Don’t just focus on price; consider the level of coverage and the reputation of the insurer.

Adjust Your Coverage and Deductibles:

- Increase Your Deductible: Raising your deductible can significantly lower your premium. However, ensure you can comfortably afford to pay the higher deductible in the event of an accident.

- Re-evaluate Coverage Needs: Assess your current coverage and determine if you need all the bells and whistles. For instance, if you drive an older car, dropping collision coverage might be a cost-effective option.

- Remove Unnecessary Extras: Review your policy for unnecessary extras like rental car reimbursement or roadside assistance, which can be removed to lower your premium.

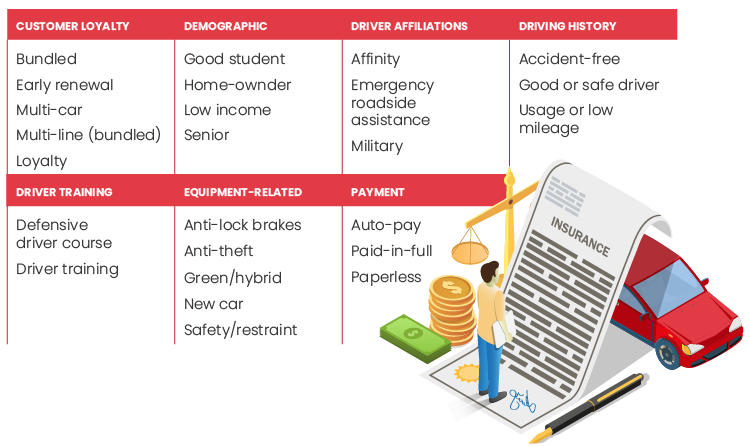

Take Advantage of Discounts:

- Good Driver Discount: Maintain a clean driving record to qualify for a good driver discount.

- Multi-Policy Discount: Bundle your car insurance with other insurance policies, such as home or renters insurance, to receive a multi-policy discount.

- Vehicle Safety Discount: If your car has safety features like anti-lock brakes or airbags, inform your insurer to potentially qualify for a discount.

- Student Discount: Full-time students with good grades may be eligible for a student discount.

- Low Mileage Discount: If you drive fewer miles than average, you may qualify for a low mileage discount.

- Affiliation Discounts: Some insurers offer discounts to members of certain organizations, such as alumni associations or professional groups.

Improve Your Credit Score:

- Pay Bills on Time: Make all your bill payments on time to improve your credit score.

- Reduce Debt: Lower your credit card balances to improve your credit utilization ratio.

- Check Your Credit Report: Review your credit report for errors and dispute any inaccuracies.

Consider Telematics or Usage-Based Insurance:

- Telematics Devices: Install a telematics device in your car to monitor your driving habits. Safe driving behavior can lead to significant discounts.

- Usage-Based Insurance: Pay-per-mile insurance policies charge you based on the number of miles you drive, which can be a cost-effective option for low-mileage drivers.

Be Honest and Accurate:

- Provide Accurate Information: Always provide honest and accurate information when applying for car insurance. Misleading information can lead to denial of coverage or cancellation of your policy.

- Update Your Information: Inform your insurer of any changes that may affect your premium, such as a change of address or a change in your annual mileage.

![]()

- Review and Renew Strategically:

- Don’t Accept Automatic Renewals: Insurance companies often count on customers ignoring price increases or sticking with the same policy out of convenience, make sure you check price before renewal.

- Shop Around Before Renewal: Start shopping for new quotes a few weeks before your policy renewal date to ensure you have ample time to compare options and secure the best rate.

- Challenge Price Increases: If you notice your premium has gone up, don’t hesitate to challenge it. Call your provider, highlight cheaper quotes you’ve found elsewhere, and let them know you’re willing to switch.

By implementing these strategies, you can significantly reduce your car insurance costs without compromising on the coverage you need. Remember to shop around, compare quotes, and take advantage of available discounts to secure the most affordable car insurance quotes in the US.

Leave a Reply