Understanding your homeowners insurance can feel like navigating a maze of jargon and paperwork. Among the most crucial documents in your policy is the declaration page, often called the “dec page.” This document serves as a summary of your coverage, providing a quick snapshot of the essential details of your insurance. In the United States, where homeownership is a cornerstone of the American dream, understanding your declaration page is vital for protecting your investment and ensuring you have adequate financial security. This guide will break down what a homeowners insurance declaration page is, what information it contains, and why it’s so important.

What is a Homeowners Insurance Declaration Page?

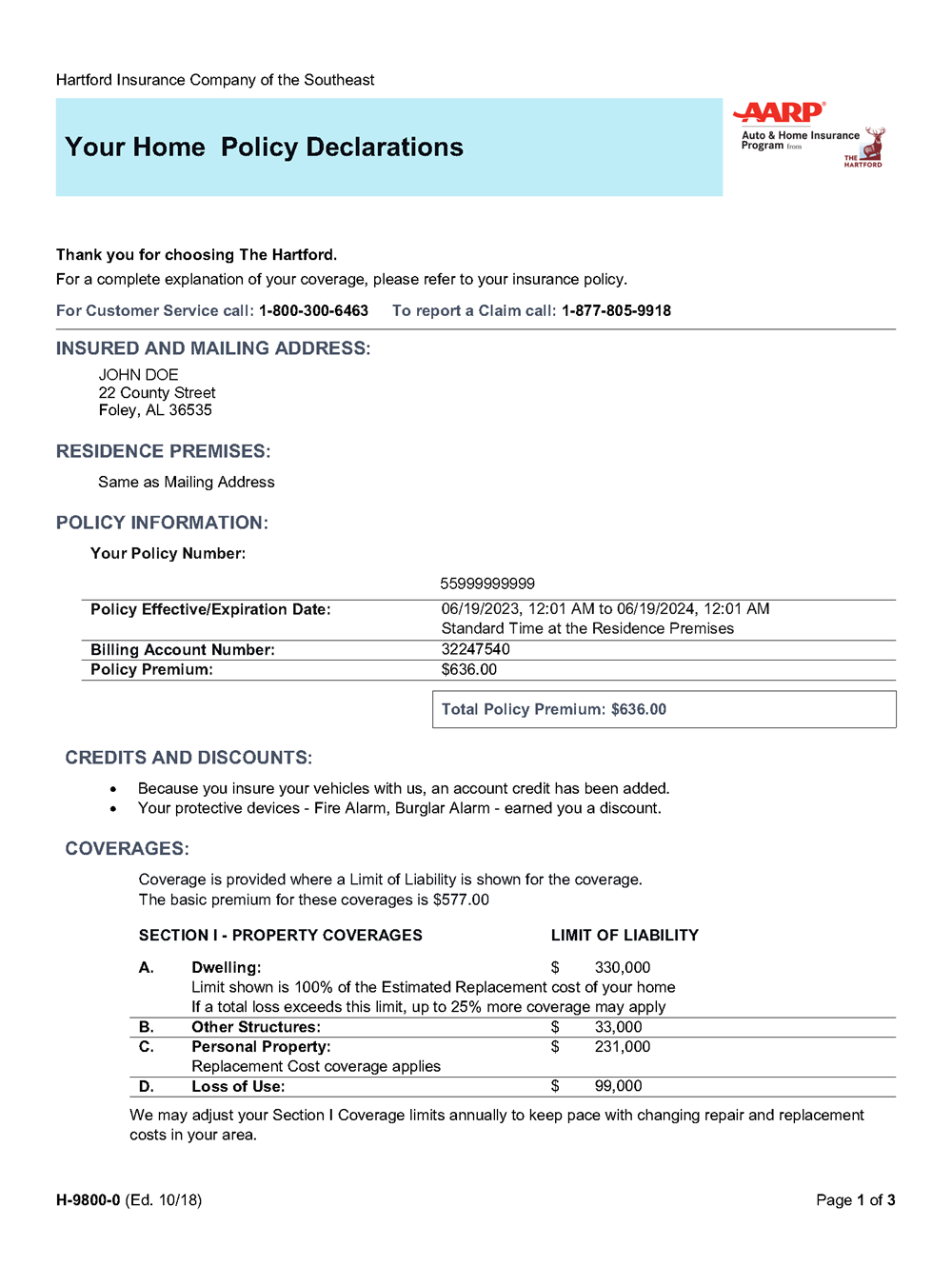

The homeowners insurance declaration page is a concise summary of your insurance policy. Think of it as the Cliff’s Notes version of your entire insurance contract. It provides key information such as the policy number, coverage dates, insured property address, coverage limits, deductibles, and the types of coverage included in your policy. It’s typically the first page (or few pages) of your complete policy document and is designed to be easily understood.

Key Components of a Homeowners Insurance Declaration Page

Understanding the different sections of your declaration page is essential for knowing exactly what your policy covers and how it protects you. Here’s a breakdown of the typical components you’ll find:

Policy Number and Coverage Period: This section displays your unique policy number, which you’ll need when filing a claim or contacting your insurance company. It also clearly states the start and end dates of your coverage, indicating the period during which the policy is active.

- It’s crucial to note these dates and ensure your policy is renewed on time to avoid any lapse in coverage.

Insured’s Name and Address: This section lists the name(s) of the policyholder(s) and the address of the insured property.

- Verify that this information is accurate to prevent any potential issues with claims processing.

Coverage Limits: This is arguably the most important section, detailing the maximum amount your insurance company will pay for different types of losses. Common coverages include:

- Coverage A: Dwelling: This covers the physical structure of your home, including the walls, roof, and attached structures like a garage. The coverage limit should reflect the cost to rebuild your home if it’s completely destroyed.

- Coverage B: Other Structures: This covers structures on your property that aren’t attached to your home, such as sheds, detached garages, fences, and swimming pools. The coverage limit is typically a percentage of Coverage A.

- Coverage C: Personal Property: This covers your belongings inside your home, such as furniture, clothing, electronics, and appliances. The coverage limit is usually a percentage of Coverage A, and you may need additional coverage for high-value items. Consider creating an inventory of your personal belongings to determine adequate coverage.

- Coverage D: Loss of Use: This covers additional living expenses if your home is uninhabitable due to a covered loss. It may include hotel stays, meals, and other expenses you incur while your home is being repaired or rebuilt.

Liability Coverage: This section outlines your coverage if you’re found legally responsible for injuries or property damage to others.

- Bodily Injury Liability: Covers medical expenses and legal fees if someone is injured on your property.

- Property Damage Liability: Covers the cost of repairing or replacing someone else’s property if you’re responsible for the damage.

Deductible: This is the amount you must pay out of pocket before your insurance coverage kicks in.

- You’ll typically have different deductibles for different types of claims (e.g., a standard deductible for most perils and a separate deductible for hurricane damage in coastal states). Understanding your deductible is crucial for budgeting in case you need to file a claim.

Policy Premium: This is the amount you pay for your homeowners insurance policy. It can be paid monthly, quarterly, semi-annually, or annually.

Discounts: This section lists any discounts applied to your premium, such as discounts for bundling your home and auto insurance, having a security system, or being a senior citizen.

Endorsements and Riders: These are additional coverages or modifications to your standard policy.

- They may limit or extend your coverage in specific areas or circumstances, such as earthquake coverage, flood insurance, or coverage for valuable items like jewelry or art.

Why is the Declaration Page Important?

The declaration page is a vital document for several reasons:

- Quick Reference: It provides a concise summary of your coverage, making it easy to understand your policy’s key details without having to read through the entire policy document.

- Claims Processing: It contains essential information needed when filing a claim, such as your policy number, coverage limits, and deductible.

- Policy Review: It helps you review your coverage annually to ensure it still meets your needs, especially if you’ve made any renovations or acquired new valuable possessions.

- Mortgage Requirements: Mortgage lenders often require a copy of your declaration page as proof of insurance.

How to Obtain and Review Your Declaration Page

You can typically obtain your declaration page from your insurance company’s website, mobile app, or by contacting your insurance agent. When you receive your declaration page, take the time to carefully review each section. Make sure the information is accurate, the coverage limits are adequate, and you understand your deductible. If you have any questions or concerns, don’t hesitate to contact your insurance agent for clarification.

Common Mistakes to Avoid

- Not Reviewing the Declaration Page: Many homeowners simply file their policy documents away without ever reviewing the declaration page. This can lead to unpleasant surprises when it’s time to file a claim.

- Underestimating Coverage Needs: It’s crucial to ensure your coverage limits are adequate to rebuild your home and replace your belongings in case of a total loss.

- Ignoring Endorsements: Carefully review any endorsements or riders to understand their impact on your coverage.

- Failing to Update Your Policy: If you make significant changes to your home or acquire valuable possessions, be sure to update your policy accordingly to ensure you have adequate coverage.

Conclusion

The homeowners insurance declaration page is an essential document that provides a snapshot of your coverage. By understanding the key components of your declaration page and reviewing it regularly, you can ensure that you have adequate protection for your home and belongings. Don’t hesitate to contact your insurance agent if you have any questions or concerns about your policy. Taking the time to understand your homeowners insurance can provide peace of mind and protect your financial future.

Leave a Reply