Navigating the world of car insurance can feel overwhelming, especially when you’re trying to find the best rates and coverage in Virginia. With so many car insurance companies in VA vying for your business, it’s crucial to compare your options and understand what each provider brings to the table. This article will help you compare car insurance companies in Virginia, highlighting their strengths and weaknesses, and guide you toward making an informed decision that fits your specific needs and budget.

Understanding Virginia’s Car Insurance Landscape

Virginia, like all states, has specific requirements for car insurance. Understanding these minimums is the first step in ensuring you’re legally covered. However, minimum coverage might not be enough to protect you financially in the event of an accident. Exploring additional coverage options, such as collision and comprehensive, is essential for complete peace of mind. The cost of car insurance in Virginia can vary significantly based on factors such as your age, driving history, the type of vehicle you drive, and your location within the state. Cities with higher accident rates, like Virginia Beach and Richmond, tend to have higher premiums.

Top Car Insurance Companies in Virginia

Several major players dominate the car insurance market in Virginia. Here’s a look at some of the top companies, along with their pros and cons:

Allstate: Allstate is known for its wide range of coverage options and strong customer service. They offer accident forgiveness, which can be a significant benefit if you have a mishap on the road. However, their rates can be higher compared to some other providers.

- Pros: Wide coverage selection, savings for safe drivers, strong local support.

- Cons: Rates can be higher, discount eligibility varies.

Progressive: Progressive is recognized for its flexible policies and online tools, including the “Name Your Price” tool, which allows you to find coverage that fits your budget. While they offer competitive rates, risky drivers may face higher premiums, and their Snapshot program can sometimes lead to rate increases.

- Pros: Flexible budgeting tool, strong financial backing, competitive monthly rates.

- Cons: Higher rates for risky drivers, mixed results with Snapshot.

Geico: Geico is a popular choice for budget-conscious drivers, offering some of the cheapest car insurance in Virginia. They have an easy-to-use mobile app and offer discounts for bundling and multiple vehicles. However, they may lack some specialty coverages compared to other providers, and some customers have reported inconsistent customer service.

- Pros: Easy online access, low-cost coverage options, stackable discounts available.

- Cons: Fewer policy add-ons, mixed service reviews.

State Farm: State Farm stands out for its network of local agents and trusted customer service. They offer flexible coverage options and bundling discounts for combining car insurance with home or renters insurance. However, their rates can be pricey for drivers with violations, and not all drivers will qualify for their advertised savings.

- Pros: Flexible coverage options, bundling brings savings, trusted customer service.

- Cons: May cost more for some, discount limits apply.

Liberty Mutual: Liberty Mutual offers personalized coverage plans and multiple discount opportunities. They also provide accident forgiveness in some cases. However, their premiums can be higher without discounts, and service experiences can vary.

- Pros: Personalized coverage plans, multiple discount opportunities, accident forgiveness available.

- Cons: Higher premiums without discounts, service experiences vary.

USAA: USAA is a top choice for military members and their families, offering low rates, strong customer support, and exclusive military discounts. However, eligibility is limited to those with military affiliations, and they primarily operate online.

- Pros: Low rates for eligible drivers, strong customer support, exclusive military discounts.

- Cons: Limited eligibility, online-first experience.

Farmers: Farmers offers customizable policy options and reliable local support through their agents. They provide various ways to save, including bundling and safe driving discounts. However, their rates can be high for some drivers, and their online tools may be more basic compared to other companies.

- Pros: Customizable policy options, plenty of ways to save, reliable local support.

- Cons: Not always budget-friendly, online tools are basic.

Nationwide: Nationwide offers a wide range of coverage options and multiple discount opportunities, including safe driver, bundling, and loyalty discounts. They are known for their responsive customer service. However, rates may vary by driver, and they have fewer local offices compared to some competitors.

- Pros: Wide range of coverage, multiple discount options, strong customer service.

- Cons: Rates may vary by driver, fewer local offices.

Travelers: Travelers provides flexible coverage options, valuable discount programs, and reliable customer service. However, their rates may be higher for some drivers, especially those with prior incidents, and they have fewer in-person locations.

- Pros: Flexible coverage options, valuable discount programs, reliable customer service.

- Cons: Rates may be higher for some, fewer in-person locations.

American Family: American Family offers customizable coverage plans, discounts for bundling, good driving, and loyalty, and helpful customer support. However, they may be costlier for high-risk drivers, and their online tools are less advanced than some competitors.

- Pros: Customizable coverage plans, discounts that add up, helpful customer support.

- Cons: May be costlier for some, basic digital experience.

Comparing Rates and Coverage Options

To find the best car insurance in VA, it’s essential to compare rates and coverage options from multiple companies. Here are some factors to consider:

- Coverage Needs: Determine the level of coverage you need based on your assets and risk tolerance. Consider factors like liability limits, collision and comprehensive coverage, and uninsured/underinsured motorist coverage.

- Discounts: Inquire about available discounts, such as those for safe driving, bundling policies, being a student, or having anti-theft devices.

- Financial Stability: Check the financial strength ratings of insurance companies to ensure they can pay out claims. A.M. Best is a good source for these ratings.

- Customer Service: Read reviews and check customer satisfaction ratings to get an idea of the company’s service quality.

- Claims Process: Understand the claims process and what to expect in case of an accident.

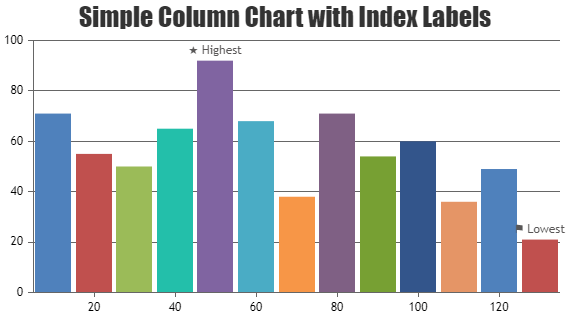

Virginia Car Insurance Rates by Provider, Age and Gender

Car insurance rates in Virginia can vary significantly depending on the provider, age, and gender of the driver. Generally, younger drivers, especially males, tend to pay higher premiums due to their perceived higher risk. As drivers gain experience and maintain a clean driving record, their rates typically decrease.

- Age: 17-year-old drivers often face the highest rates, with premiums decreasing as drivers reach their mid-20s and beyond.

- Gender: Male drivers often pay slightly higher rates than female drivers, particularly in younger age groups.

- Provider: USAA often offers the most affordable coverage across all age and gender groups, but eligibility is limited to military members and their families. Geico and Progressive also offer competitive rates for a broader range of drivers.

Common Car Insurance Claims and Discounts in Virginia

Understanding the most common car insurance claims in Virginia can help you choose the right coverage options. Collision claims are the most frequent, followed by comprehensive damage, theft, weather-related incidents, and vandalism. To lower your premiums, explore available discounts, such as:

- Good Driver Discount: Awarded for maintaining a clean driving record.

- Bundling Discount: Offered for purchasing multiple policies from the same company (e.g., car and home insurance).

- Anti-Theft Discount: Available for vehicles equipped with anti-theft devices.

- New Car Discount: Provided for insuring a new vehicle.

Making the Right Choice

Choosing the best car insurance company in Virginia requires careful consideration of your individual needs, budget, and driving profile. By comparing rates, coverage options, and customer service reviews, you can find a provider that offers the right balance of affordability and protection. Don’t hesitate to get quotes from multiple companies and ask questions to ensure you understand your policy and its coverage. Remember that the cheapest option isn’t always the best; prioritize comprehensive coverage and reliable service to protect yourself financially in the long run.

Leave a Reply