Renting a car in the UK offers the freedom to explore its diverse landscapes, from the rolling hills of the countryside to the historic streets of its vibrant cities. But before you embark on your journey, understanding car rental insurance, particularly collision damage insurance, is crucial for a stress-free experience. This guide delves into what collision damage insurance is, what it covers, and how it can protect you financially during your UK road trip.

Understanding the Basics of Car Rental in the UK

Before we dive into collision damage insurance, let’s cover the fundamentals of renting a car in the UK. To successfully rent a vehicle, you’ll generally need:

A Valid Driver’s License: If your license was issued within the EU/EEA, it’s typically accepted without any additional documentation. However, if you’re a non-EU/EEA driver, you’ll likely need an International Driving Permit (IDP) in addition to your national license. It’s best to get one before you arrive in the UK.

A Credit Card: Most rental agencies require a credit card in the primary driver’s name to cover the deposit. While some may accept debit cards, be prepared for a potentially higher deposit. It’s always best to check with the rental company beforehand to confirm their specific policies.

Minimum Age Requirements: While the minimum age to rent a car is usually 21, drivers under 25 (or over 70) often face additional fees. Be sure to factor this into your rental budget.

Identification: A valid passport or government-issued ID is also required to verify your identity. Ensure that the name on your ID matches the name on your booking and credit card.

Mandatory vs. Optional Car Rental Insurance in the UK

In the UK, every rental car is legally required to have Third-Party Liability Insurance. This is a basic form of coverage that protects you against:

Injury or Damages to Third Parties: This covers costs associated with accidents where you are at fault and another person is injured.

Property Damage: This insurance also covers damages caused to another person’s property, such as their vehicle or a building.

However, it’s crucial to understand what Third-Party Liability doesn’t cover:

- Damage to the rental car itself.

- Theft of the rental car.

- Personal injury to the driver and passengers in the rental car.

This is where optional insurances, like Collision Damage Waiver (CDW) and Theft Protection (TP), become highly important.

Demystifying Collision Damage Waiver (CDW)

Collision Damage Waiver (CDW) is designed to limit your financial responsibility if the rental car is damaged in an accident. Most car rentals in the UK include a basic CDW, but it often comes with a significant “excess,” also known as a deductible. This means you’ll be responsible for paying a certain amount out-of-pocket before the CDW coverage kicks in.

What CDW Covers:

- Damages caused by collisions, regardless of fault.

- Costs associated with repairing the rental car after an accident.

What CDW Typically Doesn’t Cover:

- Damage to the windows, tires, or undercarriage of the vehicle (unless specific additional coverage is purchased).

- Lost or damaged car keys.

- Damage resulting from reckless or negligent driving (e.g., driving under the influence).

Super CDW: Reducing Your Excess

For added peace of mind, consider purchasing Super CDW, also known as Excess Reduction. This option further reduces or even eliminates the excess you’d be responsible for in the event of damage. While it comes at an additional cost, Super CDW can provide significant financial protection and eliminate the worry of unexpected repair bills.

Other Important Car Rental Insurance Options

Besides CDW, other optional insurances can further safeguard your rental experience:

Theft Protection (TP): This reduces your liability if the rental car is stolen. However, like CDW, it often includes an excess. TP usually doesn’t cover personal belongings left in the car, so always ensure valuables are secured.

Personal Accident Insurance (PAI): PAI covers medical expenses for the driver and passengers if they are injured in an accident. Before purchasing PAI, check your existing travel insurance policy, as it might already provide adequate coverage.

Windscreen, Tires, and Undercarriage Protection: As mentioned earlier, standard CDW often excludes damage to these vulnerable components. Adding this specific protection can protect you from potentially high repair costs.

Key Car Rental Insurance Terms to Know

Understanding the terminology used in car rental insurance is essential to making informed decisions:

Excess/Deductible: The amount you must pay out-of-pocket before the insurance coverage applies. A higher excess typically results in a lower daily rental rate, and vice versa.

Zero-Excess Insurance: A policy that completely eliminates the excess, providing maximum financial protection, but at a higher cost.

Exclusions: Specific conditions or scenarios that the insurance policy does not cover. Examples include driving under the influence, off-road driving, or using the vehicle for illegal activities.

Filing a Rental Car Damage Claim

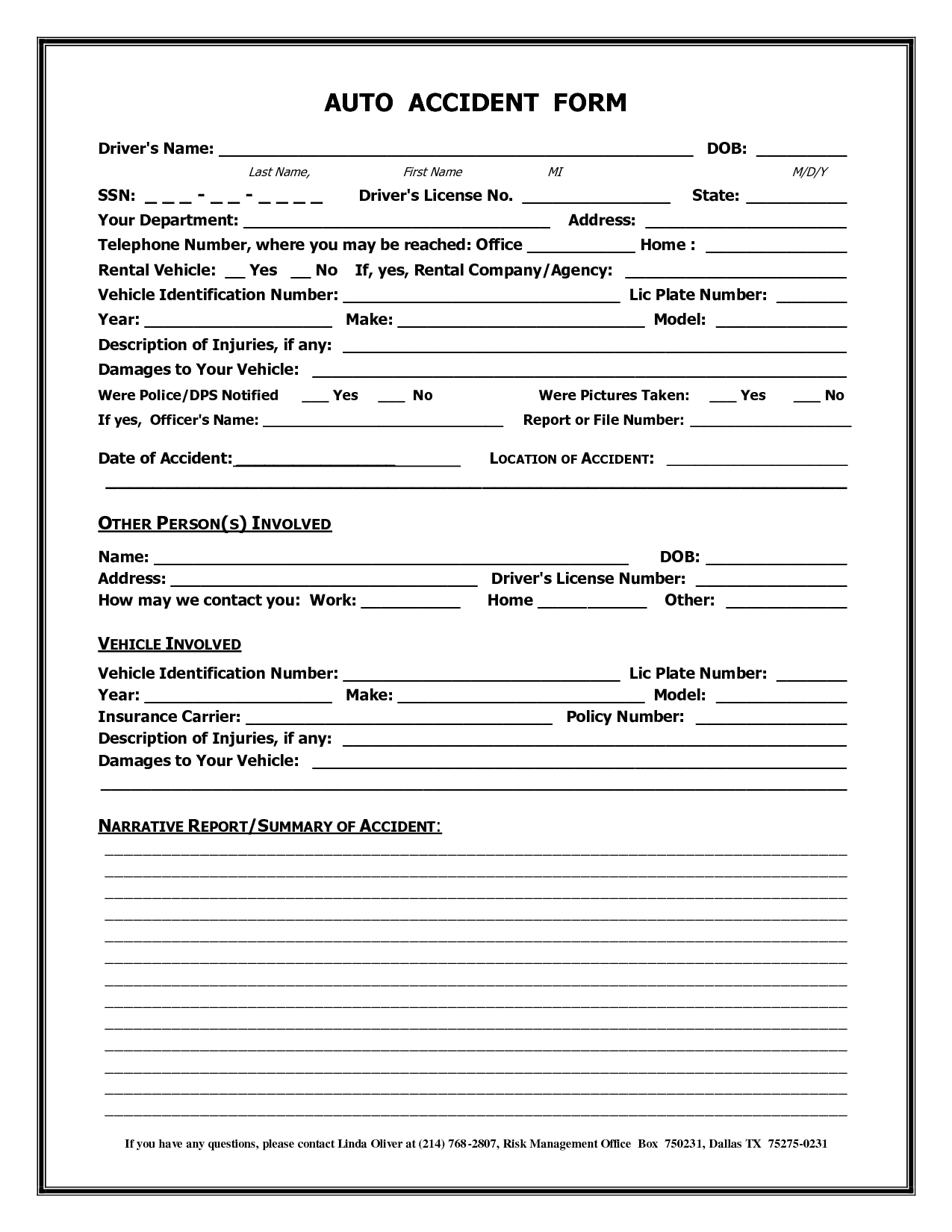

If you’re involved in an accident or discover damage to your rental car, follow these steps:

- Document the Scene: Take photos of the damage, noting the time, date, and location.

- Notify the Rental Company: Report the incident to the rental company immediately.

- Complete an Accident Report Form: The rental company will likely require you to fill out an accident report form for insurance purposes.

- Understand Your Liability: Review your rental agreement and insurance coverage to understand what costs you may be responsible for.

Navigating Tolls and Congestion Zones

When driving in the UK, be aware of toll roads and congestion charge zones, particularly in London. Most rental companies offer options such as automatic toll devices or guidance on how to pay these charges. Failing to pay these fees can result in fines, which the rental company will likely pass on to you, often with additional administrative charges. Familiarize yourself with the locations of congestion zones and toll roads along your planned route.

Making Informed Decisions

By understanding the different types of car rental insurance available in the UK, particularly collision damage insurance, you can make informed decisions that protect you financially and allow you to enjoy your road trip with peace of mind. Carefully consider your needs, budget, and risk tolerance when choosing the right coverage options for your UK car rental.

Leave a Reply