Finding the cheapest car insurance in Florida can feel like navigating a maze. With numerous providers, varying coverage options, and unique state regulations, it’s essential to understand how to secure the best possible rates without sacrificing adequate protection. This comprehensive guide breaks down the key factors influencing car insurance costs in Florida and provides actionable strategies to help you find the most affordable coverage tailored to your individual needs.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is unique due to several factors. The state’s high population density, frequent severe weather events (hurricanes, flooding), and a relatively high rate of uninsured drivers all contribute to potentially higher premiums compared to other states. Additionally, Florida is a “no-fault” state, meaning that regardless of who is at fault in an accident, each driver’s own insurance policy (specifically, Personal Injury Protection or PIP) initially covers their injuries. This system, while intended to streamline claims, can also impact overall insurance costs.

Key Factors Affecting Car Insurance Rates in Florida

Several elements influence the price you pay for car insurance in Florida:

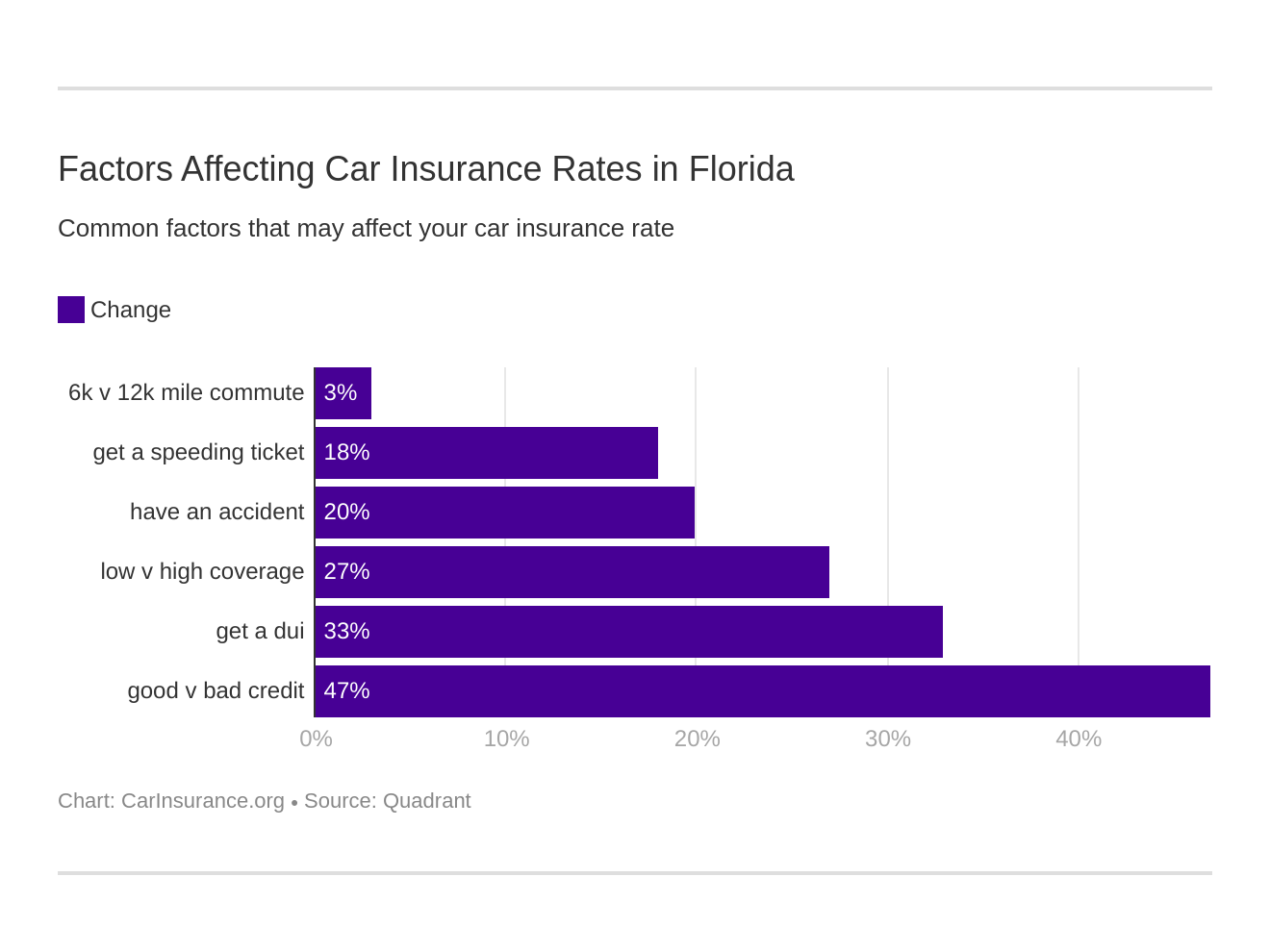

- Driving Record: A clean driving record with no accidents or moving violations is the most significant factor in securing low rates. Speeding tickets, DUI convictions, and at-fault accidents can significantly increase your premiums.

- Age and Experience: Younger drivers and those with limited driving experience typically face higher rates due to their perceived higher risk. As drivers gain experience and maintain a clean record, their rates tend to decrease.

- Credit Score: In Florida, insurance companies can use your credit score to assess risk. A lower credit score may result in higher premiums, while a good or excellent credit score can unlock lower rates.

- Vehicle Type: The make and model of your vehicle impact insurance costs. More expensive vehicles, sports cars, and vehicles with higher theft rates generally cost more to insure. Safety features can help lower insurance costs.

- Coverage Levels: The amount of coverage you choose directly affects your premium. Opting for minimum coverage levels will result in lower premiums, but it may leave you financially vulnerable in the event of a serious accident. Higher liability limits, comprehensive and collision coverage will increase your premium, but provide greater protection.

- Location: Urban areas with higher traffic density and a greater risk of accidents typically have higher insurance rates than rural areas.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible will lower your premium, but you’ll need to be prepared to pay that amount if you file a claim.

Strategies to Find the Cheapest Car Insurance in Florida

Here are proven strategies to help you lower your car insurance costs in Florida:

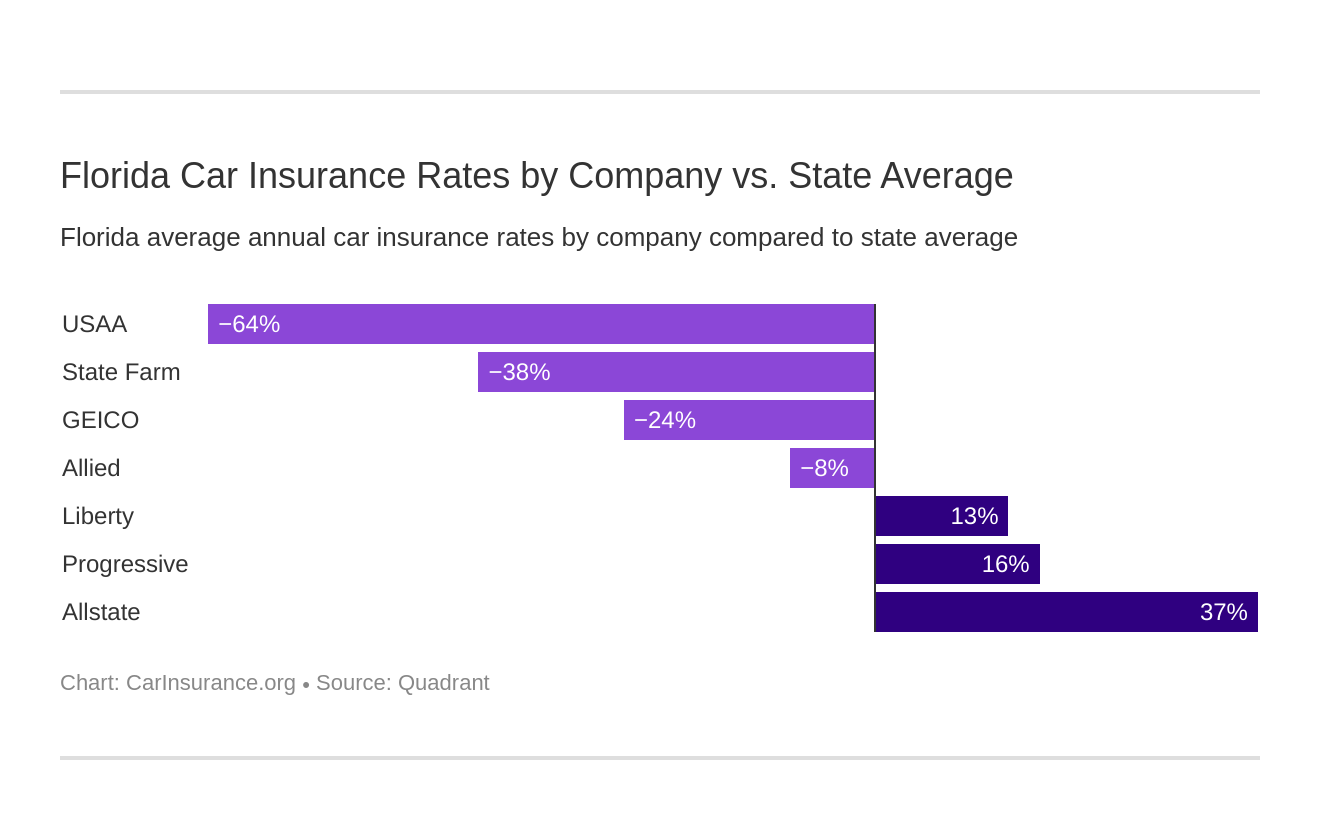

- Shop Around and Compare Quotes: The most effective way to find the cheapest car insurance is to compare quotes from multiple insurance companies. Use online comparison tools and independent insurance agents to gather quotes from at least three to five different insurers.

- Increase Your Deductible: Raising your deductible can significantly lower your premium. However, ensure you can comfortably afford the higher deductible if you need to file a claim.

- Maintain a Good Credit Score: Improving your credit score can lead to lower insurance rates. Pay your bills on time, reduce debt, and monitor your credit report for errors.

Take Advantage of Discounts: Many insurance companies offer discounts for various factors, such as:

- Safe Driver Discount: For maintaining a clean driving record.

- Good Student Discount: For students with good grades.

- Multi-Policy Discount: For bundling car insurance with other policies, such as home or renters insurance.

- Vehicle Safety Features Discount: For vehicles equipped with anti-theft devices, airbags, and other safety features.

- Affiliation Discounts: For being a member of certain organizations or a graduate of particular universities.

- Consider a Telematics Policy: Some insurance companies offer telematics programs that track your driving habits using a mobile app or a device installed in your car. Safe driving habits can lead to significant discounts.

- Review Your Coverage Needs Regularly: As your life circumstances change, so do your insurance needs. Review your coverage levels annually or when you experience major life events, such as getting married, buying a home, or changing jobs. Make sure you’re not paying for coverage you no longer need.

- Pay Annually Instead of Monthly: If possible, pay your insurance premium in one lump sum annually. Many insurers offer discounts for annual payments compared to monthly installments.

- Bundle Your Insurance Policies: Bundling your car insurance with your home insurance, life insurance, or other policies can often result in significant savings.

- Consider the Type of Car You Drive: When purchasing a new car, research insurance costs beforehand. Some vehicles are cheaper to insure than others. Safety features and a low theft rate contribute to lower insurance premiums.

- Improve your car security: Adding car security features such as car alarms and immobilizers to your vehicle could reduce the risk of theft. Insurance providers will consider the decreased risk of insuring your vehicle and may reduce your monthly premium.

Minimum Car Insurance Requirements in Florida

Florida law requires drivers to carry the following minimum car insurance coverage:

- Personal Injury Protection (PIP): \$10,000

- Property Damage Liability (PDL): \$10,000

While these are the minimum requirements, it’s often advisable to carry higher liability limits to protect yourself from potential lawsuits in the event of an accident where you are at fault.

Choosing the Right Coverage

Selecting the right car insurance coverage involves balancing cost with adequate protection. Consider the following coverage options:

- Liability Coverage: Covers damages and injuries you cause to others in an accident where you are at fault.

- Collision Coverage: Covers damage to your vehicle resulting from a collision, regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are hit by an uninsured or underinsured driver. Given Florida’s high rate of uninsured drivers, this coverage is particularly important.

The Importance of Regular Review

The car insurance market is dynamic, and rates can change frequently. It’s essential to review your policy and shop around for new quotes at least once a year to ensure you’re still getting the best possible rate. Don’t simply renew your policy without comparing other options.

Conclusion

Finding the cheapest car insurance in Florida requires a proactive approach. By understanding the factors that influence rates, utilizing comparison tools, taking advantage of discounts, and regularly reviewing your coverage needs, you can secure affordable protection tailored to your specific circumstances. Don’t settle for the first quote you receive; take the time to shop around and compare options to find the best value for your money. Remember, the cheapest insurance isn’t always the best; prioritize adequate coverage to protect yourself financially in the event of an accident.

Leave a Reply