Choosing the right life insurance company is a critical decision that can provide financial security and peace of mind for your loved ones. In the UK, a variety of providers offer different types of policies, each with its own set of features, benefits, and costs. This comprehensive guide explores some of the best life insurance companies in the UK, helping you make an informed decision based on your individual needs and circumstances.

Understanding Life Insurance

Life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the insurer agrees to pay a lump sum (death benefit) to your designated beneficiaries if you pass away during the policy’s term. This payout can help cover various expenses, such as mortgage payments, funeral costs, living expenses, and future education costs for your children.

Types of Life Insurance

Before comparing different companies, it’s essential to understand the main types of life insurance available in the UK:

Term Life Insurance: This is the most common type, providing coverage for a specific period (the “term”). If you die within the term, your beneficiaries receive the payout. If the term expires and you are still alive, the coverage ends. Term life insurance is generally more affordable than whole-of-life insurance. There are several sub-types:

- Level Term: The death benefit remains the same throughout the term.

- Decreasing Term: The death benefit decreases over time, often used to cover a mortgage.

- Increasing Term: The death benefit increases over time, typically to keep pace with inflation.

- Whole-of-Life Insurance: This provides lifelong coverage, guaranteeing a payout whenever you die, as long as premiums are paid. Whole-of-life policies often include a cash value component that grows over time, which you can borrow against or withdraw from.

- Family Income Benefit: Instead of a lump sum, this policy pays out a regular monthly income to your beneficiaries for a specified period after your death.

- Over 50s Life Insurance: This type of policy is specifically designed for individuals over the age of 50 and guarantees acceptance without a medical exam. However, it’s important to carefully compare the premiums and potential payout, as you may end up paying more in premiums than the death benefit your loved ones receive.

Key Factors to Consider When Choosing a Life Insurance Company

Several factors should influence your choice of life insurance company:

- Financial Stability: Choose a company with a strong financial rating, indicating its ability to pay out claims.

- Policy Options: Look for a company that offers a range of policy types and coverage amounts to suit your needs.

- Price: Compare quotes from multiple providers to find the most competitive premiums.

- Claims Payout Rate: Check the insurer’s claims payout rate, which reflects the percentage of claims paid out.

- Customer Service: Read reviews and consider the company’s reputation for customer service and claims handling.

- Additional Benefits: Some policies offer additional benefits, such as critical illness cover, waiver of premium, or access to wellness programs.

Top Life Insurance Companies in the UK

Based on factors like financial stability, policy options, claims payout rates, and customer satisfaction, here are some of the leading life insurance companies in the UK:

- Aviva: A well-established insurer with a long history, Aviva offers a variety of term life insurance policies, over-50s life insurance, income protection, and private health insurance. Their latest statistics show a high claims payout rate. They also offer the Aviva DigiCare+ smartphone app which provides health advice and access to clinicians. For a 30-year-old non-smoker, a level term policy for £300,000 cover costs around £113 a year.

- HSBC: This global banking organization has been providing life insurance in the UK since 1988. HSBC sells level and decreasing term cover with the option to add critical illness cover and income protection. Their policies come with an accidental death benefit. Their latest statistics show a high claims payout rate. For a 30-year-old non-smoker, a level term policy for £300,000 cover costs around £111 a year.

- Legal & General: As the UK’s largest provider of term cover, Legal & General offers a wide range of policies and features. They are known for their financial strength and commitment to customer service. Legal & General sells level, decreasing and increasing term policies with the option to add critical illness cover. For a 30-year-old non-smoker, a level term policy for £300,000 cover costs around £118 a year.

- Royal London: Founded in 1861, Royal London is one of the UK’s largest insurers. Royal London sells level, decreasing term policies through its website, covering up to £750,000. Their latest statistics show a high claims payout rate. For a 30-year-old non-smoker, a level term policy for £300,000 cover costs around £127 a year.

- Vitality: Vitality incentivizes customers to make healthy lifestyle choices through rewards schemes. Vitality sells level, decreasing and increasing term cover with the option to add critical illness cover. Their latest statistics show a high claims payout rate. For a 30-year-old non-smoker, a level term policy for £300,000 cover costs around £113 a year.

Factors Affecting Life Insurance Costs

The cost of life insurance varies depending on several factors:

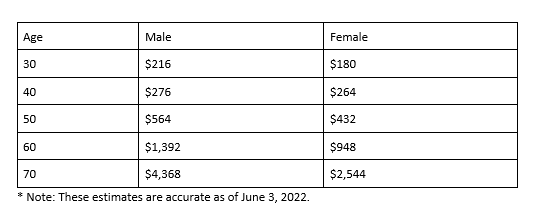

- Age: Younger individuals typically pay lower premiums.

- Health: Existing health conditions and lifestyle choices (such as smoking) can increase premiums.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Policy Type: Whole-of-life policies are generally more expensive than term life policies.

- Term Length: Longer term lengths may result in higher premiums.

Making the Right Choice

Choosing the best life insurance company requires careful consideration of your individual circumstances and financial goals. Consider working with an independent financial advisor who can assess your needs, compare different policies, and recommend the most suitable option for you. Remember to shop around, compare quotes, and read reviews before making a final decision. Life insurance provides invaluable peace of mind, knowing your loved ones will be financially protected in the event of your passing.

Leave a Reply