Finding the right car insurance in Miami can feel like navigating a maze. With numerous providers vying for your attention and a variety of coverage options to consider, it’s crucial to make an informed decision. This article aims to guide you through the process, highlighting some of the best car insurance companies in Miami, factors influencing your rates, and tips for securing the best possible coverage at a competitive price.

Understanding Car Insurance in Miami

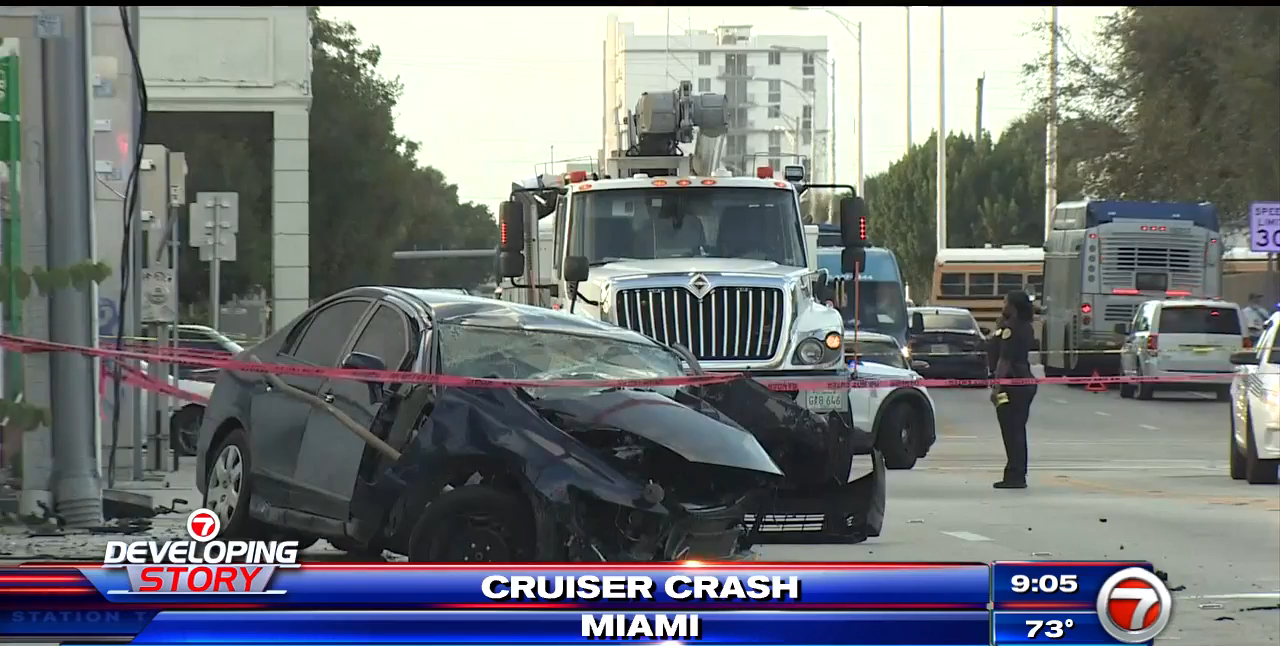

Miami, known for its vibrant culture and bustling streets, also presents unique challenges for drivers. Higher population density, increased traffic congestion, and a greater risk of accidents can contribute to elevated car insurance premiums compared to the national average. Understanding the factors that influence your rates is the first step towards finding affordable and comprehensive coverage.

- Coverage Types: Florida law requires drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers your medical expenses, regardless of fault, while PDL covers damages to another person’s property if you are at fault in an accident. However, many drivers opt for additional coverage such as collision, comprehensive, and uninsured/underinsured motorist (UM/UIM) to provide broader protection.

- Factors Affecting Premiums: Several factors influence your car insurance rates in Miami, including your driving record, age, gender, credit score, the type of vehicle you drive, and your coverage selections. Insurers assess these factors to determine the risk associated with insuring you.

- Importance of Comparison: Given the variation in rates and coverage options among insurers, comparing quotes from multiple companies is essential. By shopping around, you can identify the best combination of price and protection that meets your specific needs.

Top Car Insurance Companies in Miami

Several car insurance companies stand out in Miami for their competitive rates, comprehensive coverage options, and customer satisfaction. While the “best” company varies depending on individual circumstances, the following are some of the top contenders:

- GEICO: GEICO often emerges as a top choice for Miami drivers seeking affordable rates. Known for its digital-first approach, GEICO allows for easy online quotes and policy management. They also offer discounts for military personnel and federal employees. However, they do not offer gap coverage or rideshare coverage. According to customer satisfaction surveys, Floridians are happy with their service.

- Travelers: Consistently ranked among the top insurers, Travelers offers a range of coverage options and discounts.

- State Farm: A well-established insurer with a strong reputation for customer service, State Farm provides a comprehensive suite of insurance products and a network of local agents.

- Progressive: Known for its innovative offerings and competitive rates, Progressive allows customers to compare rates from multiple insurers alongside its own quotes.

- Other Notable Insurers: Other companies like Allstate, USAA (for military members and their families), and smaller regional insurers may also offer competitive rates and suitable coverage options in Miami.

Key Considerations When Choosing a Car Insurance Company

Beyond price, several factors should weigh into your decision when selecting a car insurance company in Miami:

- Coverage Options: Evaluate the different coverage options offered by each insurer and choose those that align with your specific needs and risk tolerance. Consider adding collision, comprehensive, and UM/UIM coverage for enhanced protection.

- Discounts: Inquire about available discounts, such as those for safe driving, good students, multi-policy bundling, and vehicle safety features.

- Financial Stability: Choose an insurer with a strong financial rating, indicating its ability to pay out claims in the event of an accident.

- Customer Service: Read online reviews and check customer satisfaction ratings to gauge the insurer’s responsiveness and claims handling process.

- Claims Process: Understand the insurer’s claims process and ensure it is transparent and efficient. A smooth claims experience is crucial when you need it most.

Comparing Car Insurance Quotes in Miami

Obtaining and comparing car insurance quotes is a crucial step in finding the best coverage at the most competitive price. Here’s how to effectively compare quotes:

- Gather Information: Before requesting quotes, gather the necessary information, including your driver’s license, vehicle registration, and details about your driving history.

- Online Comparison Tools: Utilize online comparison tools to quickly obtain quotes from multiple insurers simultaneously. These tools can save you time and effort.

- Direct Quotes: Visit the websites of individual insurers or contact their agents directly to obtain personalized quotes.

- Compare Apples to Apples: Ensure that the quotes you are comparing offer the same coverage limits, deductibles, and coverage options.

- Read the Fine Print: Carefully review the terms and conditions of each policy before making a decision. Pay attention to exclusions and limitations.

Understanding Florida’s Unique Insurance Requirements

Florida’s car insurance laws differ from those in many other states. Here’s what you need to know:

- No-Fault State: Florida is a no-fault state, meaning that your PIP coverage will pay for your medical expenses regardless of who is at fault in an accident.

- PIP Coverage: Florida law requires drivers to carry a minimum of $10,000 in PIP coverage.

- PDL Coverage: Drivers are also required to carry a minimum of $10,000 in PDL coverage.

- Uninsured Motorist Coverage: While not mandatory, UM/UIM coverage is highly recommended to protect yourself if you are involved in an accident with an uninsured or underinsured driver.

Tips for Lowering Your Car Insurance Rates in Miami

Even with Miami’s higher-than-average premiums, there are several strategies you can employ to lower your car insurance rates:

- Improve Your Credit Score: A good credit score can significantly impact your insurance rates. Pay your bills on time and reduce your debt to improve your creditworthiness.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to maintain a clean driving record, which can qualify you for lower rates.

- Increase Your Deductible: Opting for a higher deductible can lower your premium, but make sure you can afford to pay the deductible in the event of an accident.

- Bundle Your Insurance Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts.

- Review Your Coverage Annually: Review your coverage needs annually and adjust your policy as necessary. As your circumstances change, you may be able to reduce your coverage or take advantage of new discounts.

- Shop Around Regularly: Car insurance rates can fluctuate, so it’s a good idea to shop around and compare quotes from multiple insurers regularly.

The Future of Car Insurance in Miami

The car insurance landscape in Miami, like everywhere else, is constantly evolving. Factors such as the increasing adoption of electric vehicles, the development of autonomous driving technology, and changing consumer preferences will likely shape the future of car insurance in the region. As these trends emerge, insurers will need to adapt their products and services to meet the changing needs of Miami drivers. Staying informed about these developments can help you make informed decisions about your car insurance coverage in the years to come.

Leave a Reply