Auto collision insurance coverage is a crucial aspect of protecting your vehicle and finances in the event of an accident. Understanding what this type of insurance entails, what it covers, and how it differs from other types of coverage can help you make informed decisions about your auto insurance policy. This guide aims to provide a comprehensive overview of auto collision insurance coverage for drivers in the United States.

What is Auto Collision Insurance?

Auto collision insurance is a type of auto insurance that covers damages to your vehicle if you’re involved in a collision with another vehicle or object. This coverage applies regardless of who is at fault in the accident. Whether you rear-end another car, hit a stationary object like a fence or tree, or are involved in a multi-car pileup, collision insurance can help pay for the repairs to your vehicle or its replacement if it’s deemed a total loss.

Collision coverage is designed to protect your vehicle in scenarios where there’s a direct impact resulting in damage. This includes accidents with other vehicles, rollovers, or even hitting a pothole that causes significant damage.

What Does Auto Collision Insurance Cover?

Auto collision insurance provides coverage for a variety of accident-related scenarios:

- Collision with another vehicle: If you collide with another car, whether it’s your fault or the other driver’s, collision insurance helps cover the costs to repair or replace your vehicle.

- Collisions with objects: This includes hitting stationary objects like fences, trees, guardrails, or poles.

Single-car accidents: Collision insurance covers incidents like rollovers or hydroplaning where no other vehicle is involved.

- For example, if you lose control of your car on a rainy day and slide into a ditch, collision insurance can help cover the repair costs.

- Damage to your parked car: If your parked car is hit by another vehicle or damaged while unattended, collision insurance can assist with repairs.

Rental car accidents: In some cases, collision coverage can extend to rental vehicles, providing additional protection if you have an accident while driving a rental car.

Before relying on your personal auto policy for a rental car, review the terms and conditions. Some policies have exclusions for certain types of rental vehicles.

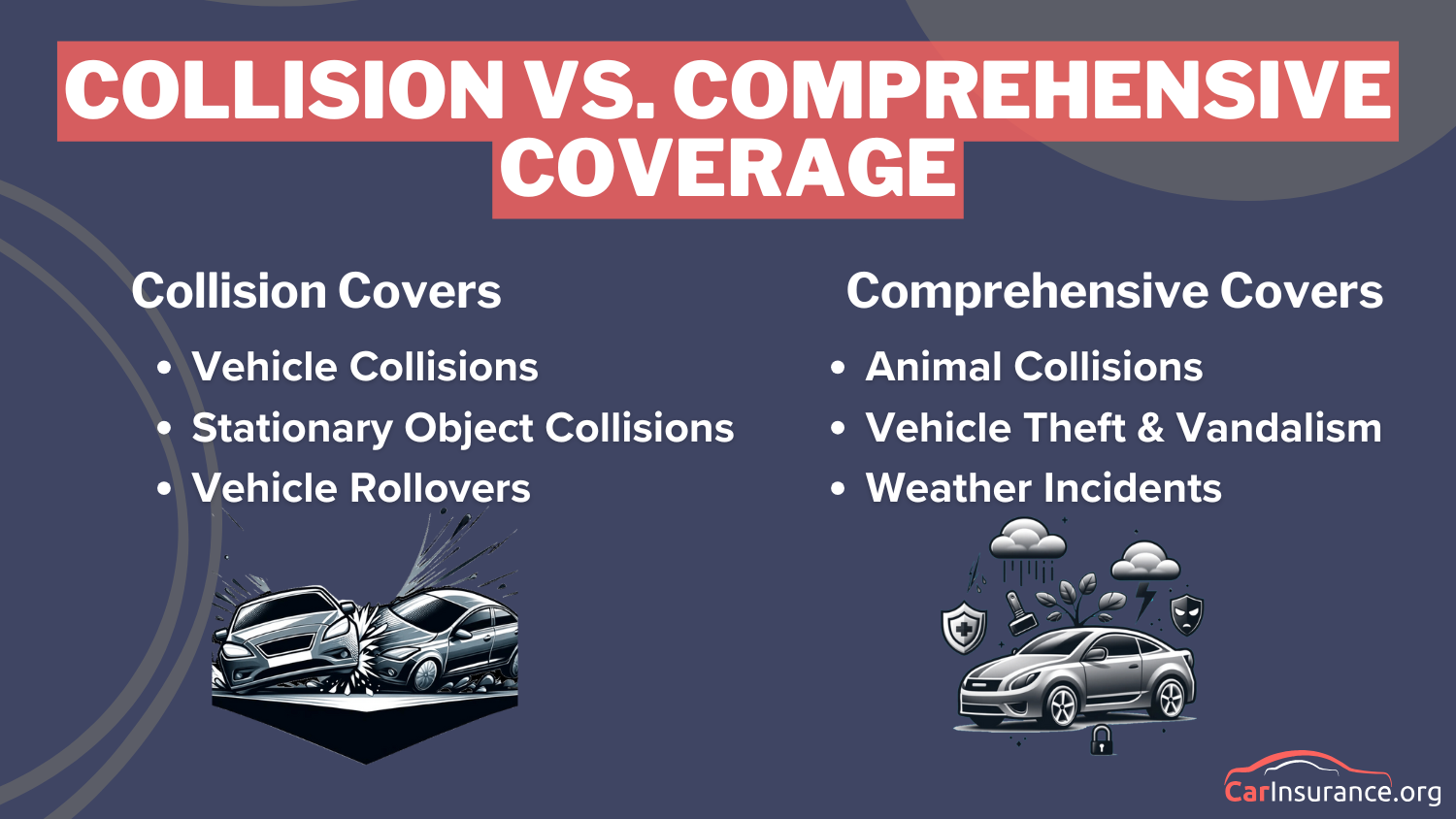

Auto Collision Insurance vs. Comprehensive Insurance

It’s important to distinguish auto collision insurance from comprehensive insurance. While both offer protection for your vehicle, they cover different types of incidents.

- Collision insurance focuses on damage resulting from collisions, as mentioned above.

Comprehensive insurance, on the other hand, covers damages caused by events other than collisions. This includes things like:

- Theft

- Vandalism

- Fire

- Natural disasters (e.g., hail, floods, hurricanes)

- Falling objects (e.g., tree branches)

- Damage from animals (e.g., hitting a deer)

Choosing between collision and comprehensive insurance often depends on your vehicle’s value, your financial situation, and your individual risk profile. If your car is newer and more valuable, carrying both types of coverage can protect your investment and provide peace of mind. For older vehicles with a lower market value, it may not be cost-effective to carry both.

Factors Affecting Auto Collision Insurance Premiums

Several factors can influence the cost of your auto collision insurance premiums:

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Driving Record: A clean driving record with no accidents or traffic violations will usually result in lower premiums. Conversely, a history of accidents or violations can increase your premiums.

- Vehicle Type: The make and model of your vehicle can affect your premiums. More expensive vehicles or those that are more costly to repair typically have higher premiums.

- Location: Your location can also impact your premiums. If you live in an area with high traffic density, a high rate of auto theft or vandalism, or is prone to severe weather, you may pay higher premiums.

- Coverage Limits: The amount of coverage you choose also affects premiums. Higher coverage limits will typically mean higher premiums.

- Age and Experience: Younger, less experienced drivers usually face higher premiums because they are statistically more likely to be involved in accidents.

Choosing the Right Auto Collision Insurance Policy

Selecting the appropriate auto collision insurance policy involves considering several factors to ensure that you get the right coverage at a reasonable price:

- Assess Your Needs: Evaluate your driving habits, the value of your vehicle, and your risk tolerance.

- Compare Quotes: Get quotes from multiple insurance companies to compare coverage options and premiums.

- Understand Deductibles: Consider the trade-off between higher deductibles and lower premiums.

- Review Policy Details: Read the fine print to understand the policy’s exclusions and limitations.

- Consider Bundling: Bundling your auto insurance with other policies, such as homeowners or renters insurance, may result in discounts.

Conclusion

Understanding what auto collision insurance covers and how it works is essential for making informed decisions about your auto insurance needs. This coverage provides crucial financial protection in the event of an accident, helping you cover the costs to repair or replace your vehicle, regardless of who is at fault. By carefully considering your individual circumstances and comparing your options, you can choose the right collision insurance policy to protect your vehicle and provide you with peace of mind on the road.

Leave a Reply