Homeowners insurance is a crucial safeguard for your most valuable asset: your home. A key component of this insurance is the premium, which is the regular payment you make to keep your coverage active. Understanding what a homeowners insurance premium ...

Understanding insurance can often feel like navigating a complex maze, filled with unfamiliar terms and confusing calculations. Among these, the “insurance premium” stands out as a fundamental concept. This article aims to demystify what an insurance premium is, how it’s ...

Home insurance is a critical safeguard for homeowners, protecting their properties and belongings from unforeseen events like natural disasters, theft, and accidents. A key component of home insurance is the premium – the amount you pay to maintain your coverage. ...

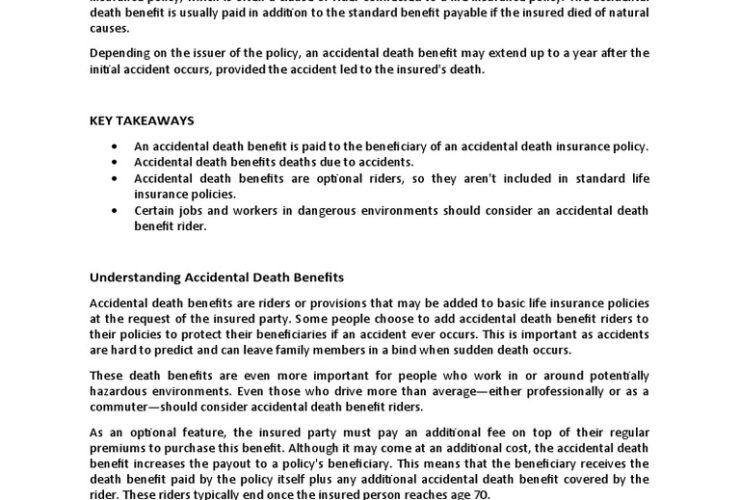

Accidental death insurance offers a layer of financial security in the unfortunate event of death caused by an accident. Unlike traditional life insurance, which covers death from most causes, accidental death insurance specifically targets deaths resulting from unforeseen and unintentional ...

Car accidents are a stressful reality, and even the most careful drivers can find themselves in a situation where they’re at fault. In the aftermath, one of the biggest concerns is how your car insurance rates will be affected. This ...

Accidents are an unfortunate reality of life. From minor mishaps to severe incidents, they can happen unexpectedly and leave a lasting impact, both physically and financially. While no one wants to think about the possibility of an accident, being prepared ...

Accidents happen. Despite our best efforts to create safe working environments, unforeseen events can lead to injuries, impacting not only an employee’s physical well-being but also their financial stability. Understanding accident insurance at work is crucial for both employers and ...

Accidents are an unfortunate reality of life. While we can take precautions, unexpected events can lead to injuries and financial strain. Accident insurance coverage offers a safety net, providing financial support to help manage the costs associated with accidental injuries ...

Accidents are an unfortunate reality of life, and the financial burden that follows can be significant. Medical bills, lost wages, and other unexpected costs can quickly add up, even with comprehensive health insurance. That’s where accident insurance through your employer ...

Accident insurance is a financial safety net designed to protect you and your family from the unexpected costs associated with accidental injuries or death. In the United States, where accidents are a leading cause of injury and death, understanding accident ...