Choosing the right car insurance can feel like navigating a maze. With so many providers vying for your attention, how do you determine which one offers the best coverage at a price that fits your budget? Understanding car insurance company ratings is crucial for making an informed decision. This article will guide you through the key factors to consider when evaluating car insurance companies, helping you find the provider that best suits your individual needs and driving profile.

Understanding the Importance of Car Insurance Company Ratings

Car insurance isn’t just a legal requirement; it’s a financial safety net that protects you in case of an accident. A good car insurance policy can save you from significant expenses related to vehicle repairs, medical bills, and legal liabilities. However, not all car insurance companies are created equal. Their financial stability, customer service quality, and claims handling efficiency can vary significantly. This is where car insurance company ratings come into play. They provide an objective assessment of an insurer’s ability to meet its obligations and satisfy its customers. Ignoring these ratings could mean the difference between a smooth claims process and a frustrating, costly experience.

Key Factors to Consider in Car Insurance Company Ratings

Several factors contribute to a car insurance company’s overall rating. Understanding these factors will empower you to evaluate insurers effectively.

Financial Strength:

- A company’s financial strength is crucial because it indicates its ability to pay out claims, especially during widespread disasters. Ratings from independent agencies such as A.M. Best, Moody’s, Standard & Poor’s, and Fitch assess an insurer’s financial stability. Look for ratings of “A” or higher, signifying a strong capacity to meet financial obligations.

Customer Satisfaction:

- Customer satisfaction reflects policyholders’ overall experience with the insurance company. Factors like ease of communication, helpfulness of customer service representatives, and claims handling efficiency contribute to customer satisfaction. J.D. Power and other consumer review platforms provide valuable insights into customer experiences.

Claims Handling:

- The claims process is a critical aspect of car insurance. A company with a streamlined, efficient claims process can significantly reduce stress after an accident. Look for companies that offer multiple ways to file claims (online, phone, app) and have a reputation for prompt and fair claim settlements. Reviews from other customers can offer insights into claims processing experiences.

Coverage Options and Discounts:

- The best car insurance company offers a variety of coverage options to meet different needs. This may include collision, comprehensive, liability, uninsured/underinsured motorist, and medical payments coverage. Additionally, a wide range of discounts can help lower your premium. Common discounts include safe driver, good student, multi-car, and bundling discounts.

Complaint Ratios:

- The National Association of Insurance Commissioners (NAIC) calculates complaint ratios for insurance companies. This ratio compares the number of complaints a company receives relative to its size. A ratio below 1.0 indicates fewer complaints than average, while a ratio above 1.0 suggests more complaints.

How to Find and Interpret Car Insurance Company Ratings

Finding and interpreting car insurance company ratings requires a multi-faceted approach. Start by researching independent rating agencies like A.M. Best, Moody’s, Standard & Poor’s, and Fitch to assess financial strength. Then, consult customer review platforms like J.D. Power, Consumer Reports, and the Better Business Bureau to gauge customer satisfaction. Pay attention to the NAIC complaint ratios to understand the company’s complaint history.

Next, compare quotes from multiple companies. Websites allow you to enter your information once and receive quotes from several insurers. Don’t solely focus on the lowest price; consider the ratings and reviews alongside the cost to determine the best value.

Top Car Insurance Companies and Their Ratings

While ratings can fluctuate, several car insurance companies consistently receive high marks for financial strength and customer satisfaction.

- State Farm: Generally receives high ratings for customer satisfaction and has a strong financial standing.

- GEICO: Known for competitive rates and a user-friendly online experience, often scoring well in customer satisfaction surveys.

- Progressive: Offers a variety of coverage options and discounts, with a focus on technology and innovative services.

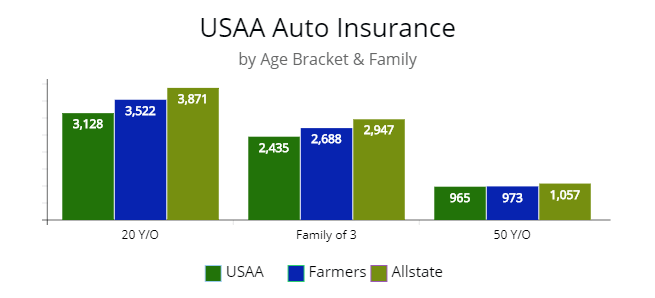

- USAA: Consistently ranked among the top insurers for customer satisfaction, but eligibility is limited to military members and their families.

The Impact of Location and Personal Factors on Car Insurance Rates

It’s essential to remember that car insurance rates are highly individualized. Your location, driving history, age, gender, and vehicle type significantly impact your premium. Urban areas with higher traffic density typically have higher rates than rural areas. A clean driving record will result in lower rates, while accidents or traffic violations will increase your premium. Young drivers and drivers with less experience tend to pay more due to their higher risk profile. The type of vehicle you drive also plays a role; sports cars and luxury vehicles generally cost more to insure than sedans or SUVs.

Making an Informed Decision

Choosing a car insurance company shouldn’t be solely based on price. While finding an affordable rate is important, prioritizing coverage and customer satisfaction is critical. Researching car insurance company ratings, comparing quotes, and understanding the factors that influence your premium will help you make an informed decision. By taking the time to evaluate your options, you can find a car insurance provider that offers peace of mind and protects you financially in case of an accident. Remember to regularly review your policy and shop around for better rates, as your needs and circumstances may change over time.

Leave a Reply