The home insurance declaration page, often called the “dec page,” is a crucial document that summarizes the key details of your homeowners insurance policy. Think of it as a snapshot of your coverage, outlining everything from your coverage limits and deductible to the types of perils you’re protected against. Understanding this document is essential for every homeowner to ensure they have adequate protection and avoid surprises when filing a claim. This guide will walk you through the ins and outs of a home insurance declaration page, explaining its purpose, contents, and why it’s so important to review it carefully.

What is a Home Insurance Declaration Page?

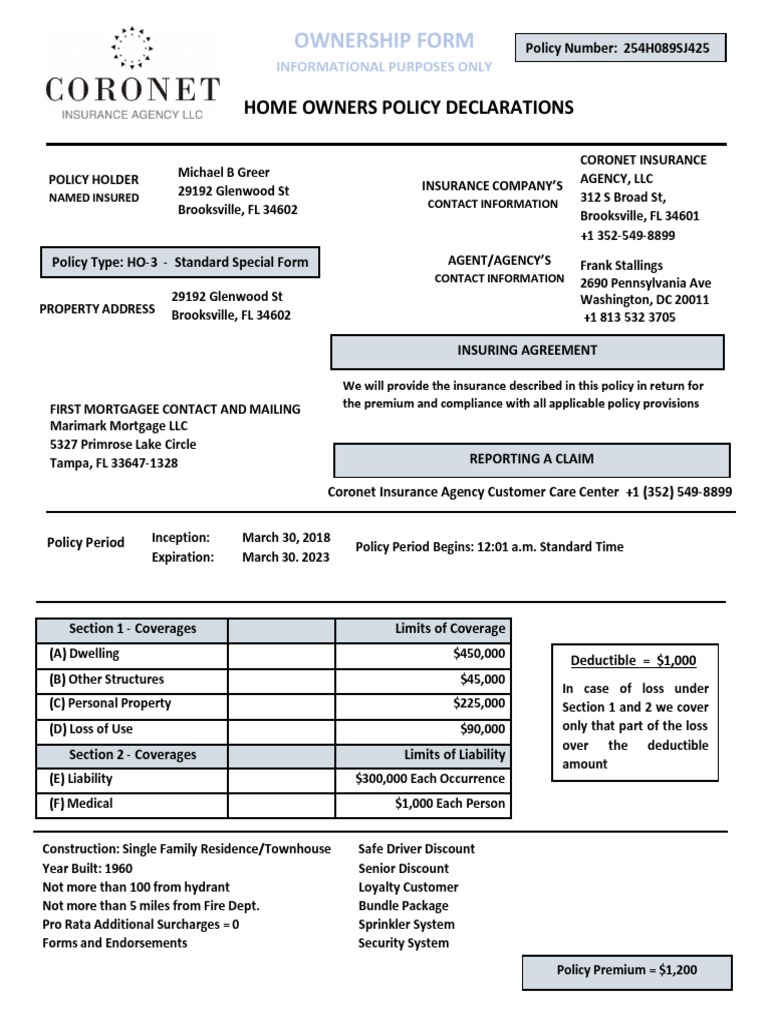

A home insurance declaration page is a summary document provided by your insurance company that outlines the essential information about your homeowners insurance policy. It’s typically the first page (or few pages) of your complete policy paperwork and acts as a quick reference guide to your coverage. The dec page highlights the key aspects of your policy, making it easier to understand what’s covered, how much coverage you have, and the terms and conditions of your agreement with the insurer. It essentially encapsulates the most important details of your insurance contract.

Key Components of a Home Insurance Declaration Page

Understanding the different sections of your declaration page is crucial for making informed decisions about your home insurance needs. Here’s a breakdown of the typical information you’ll find:

- Policy Number: This is your unique identifier for the insurance policy. Keep it handy for any communication with your insurance company.

- Policyholder Information: This section includes your name(s) and the address of the insured property. Verify that this information is accurate to avoid potential issues with claims.

- Insurer Information: Here, you’ll find the name, address, and contact information of the insurance company providing the coverage.

- Policy Period: This specifies the effective date and expiration date of your policy. Mark these dates on your calendar to ensure continuous coverage and timely renewals.

Coverage Details: This is a critical section that outlines the types of coverage included in your policy, such as:

- Dwelling coverage: Protects the physical structure of your home.

- Other structures coverage: Covers detached structures like garages, sheds, and fences.

- Personal property coverage: Protects your belongings inside the home.

- Loss of use coverage: Covers additional living expenses if your home becomes uninhabitable due to a covered loss.

- Personal liability coverage: Protects you if someone is injured on your property and you are found liable.

- Medical payments coverage: Covers medical expenses for guests injured on your property, regardless of fault.

- Coverage Limits: For each type of coverage, the declaration page will specify the maximum amount the insurance company will pay out in the event of a covered loss. Make sure these limits are adequate to cover potential damages or losses.

- Deductibles: This indicates the amount you’ll have to pay out of pocket before your insurance coverage kicks in. Note that different coverages may have different deductibles.

- Premiums: This section shows the total cost of your insurance policy, often broken down into payment installments.

- Endorsements: These are any additions or modifications to your standard policy. They may include coverage for specific items like jewelry or artwork, or additional protection against certain perils like flood or earthquake.

- Discounts: Any discounts applied to your policy, such as those for security systems or being a long-term customer, will be listed here.

Why is the Declaration Page Important?

The home insurance declaration page serves several important purposes:

- Quick Reference: It provides a concise summary of your coverage, allowing you to quickly understand the key details of your policy without having to read through the entire document.

- Proof of Coverage: Lenders, such as mortgage companies, often require a copy of your declaration page as proof of insurance. This verifies that you have adequate coverage to protect their investment in your property.

- Claims Filing: When filing a claim, the declaration page is a valuable resource. It provides the necessary information, such as your policy number and coverage limits, to initiate the process.

- Policy Review: The declaration page is a useful tool for reviewing your coverage annually or when significant changes occur in your life, such as home renovations or the acquisition of valuable possessions.

- Error Detection: Reviewing your declaration page allows you to identify any errors, such as incorrect address or misspelled names, that could potentially cause problems with claims processing.

Common Errors to Watch Out For

It’s crucial to carefully review your declaration page for errors as soon as you receive it. Common mistakes include:

- Incorrect Name or Address: Even a small typo can cause issues with claims.

- Wrong Coverage Types: Ensure you have the coverage you need, such as replacement cost coverage for personal property.

- Inaccurate Coverage Amounts: Make sure your dwelling coverage is sufficient to rebuild your home in case of total loss.

- Missing Endorsements: Verify that any agreed-upon endorsements, such as flood insurance or coverage for valuable items, are listed on the declaration page.

- Incorrect Deductibles: Confirm that the deductible amounts match your understanding of the policy.

If you find any errors, contact your insurance agent immediately to have them corrected. Failing to do so could result in claim denials or delays.

How to Access Your Home Insurance Declaration Page

Accessing your home insurance declaration page is typically a straightforward process:

- New Policy: You’ll receive a copy of your declaration page when you purchase a new policy.

- Renewal: You’ll receive an updated declaration page each time your policy renews.

- Online Access: Many insurance companies offer online portals where you can access and download your declaration page at any time.

- Contact Your Agent: If you can’t find your declaration page, contact your insurance agent or company representative, and they can provide you with a copy.

Keep your declaration page in a safe and easily accessible place, both in physical and digital formats. This will ensure you have the information you need when you need it.

Understanding covered perils in your Home Insurance Declaration Page

Your declaration page might list specifically which risks are covered by your policy (named perils) or state it covers all risks except those specifically excluded. Common perils include fire, wind, hail, theft, and vandalism. It’s important to note that standard homeowners policies typically do not cover flood or earthquake damage, which may require separate policies or endorsements. Reviewing the covered perils on your declaration page will help you understand what events are protected under your policy.

Conclusion

The home insurance declaration page is a vital document for every homeowner. By understanding its contents and purpose, you can ensure you have adequate coverage, avoid costly errors, and navigate the claims process with confidence. Take the time to review your declaration page carefully and contact your insurance agent with any questions or concerns. Being proactive about your home insurance will protect your most valuable asset and provide peace of mind.

Leave a Reply