Home insurance is a critical safeguard for homeowners, protecting their property and belongings from unforeseen events. A key aspect of home insurance is the premium – the regular payment you make to maintain your coverage. Understanding what influences your home insurance premium is essential for securing adequate protection at a reasonable cost. This guide delves into the factors that determine your premium, offering insights to help you make informed decisions about your home insurance needs.

What is a Home Insurance Premium?

A home insurance premium is the amount of money you pay to your insurance company in exchange for coverage. This payment can be made monthly, quarterly, or annually. The premium ensures that your insurance policy remains active, providing financial protection against covered losses, such as damage from fire, wind, theft, or vandalism. The premium is calculated based on the insurer’s assessment of the risk associated with insuring your home.

Factors Affecting Your Home Insurance Premium

Numerous factors influence the cost of your home insurance premium. Insurers evaluate these factors to determine the likelihood of a claim and the potential cost of that claim. Understanding these factors can help you anticipate your premium and potentially take steps to lower it.

Location, Location, Location:

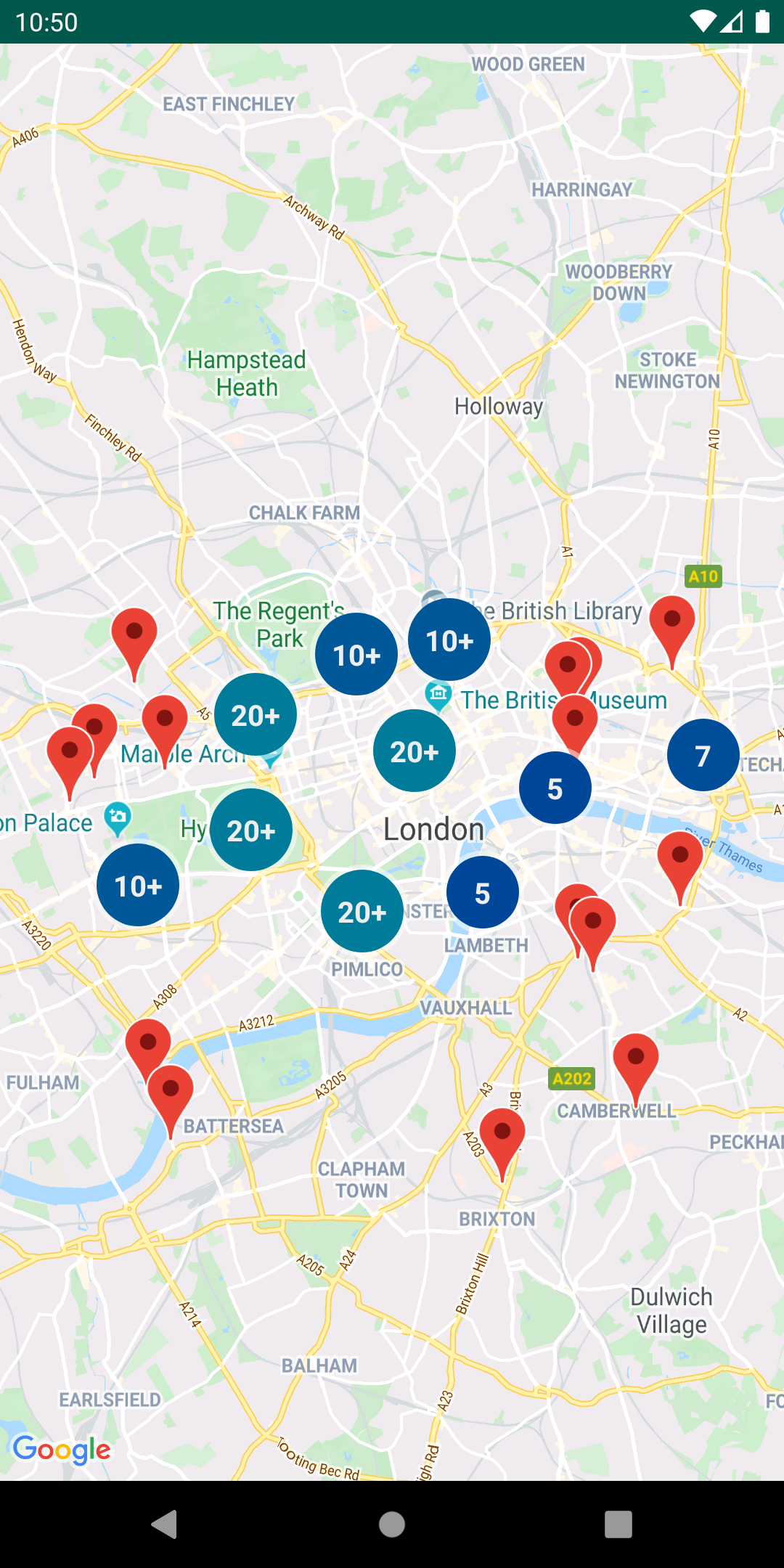

- Your home’s location is a primary determinant of your premium. Insurers assess the risk of events like burglaries, natural disasters, and even proximity to fire services based on your zip code. Areas with higher crime rates or a greater risk of flooding, wildfires, or hurricanes will typically have higher premiums.

Coverage Amount:

- The amount of coverage you need directly impacts your premium. Higher coverage limits for your dwelling and personal property will result in higher premiums. This is because the insurer is taking on more financial risk in the event of a significant loss. Accurately assessing the value of your home and belongings is crucial to avoid being underinsured or overpaying for unnecessary coverage.

Property Characteristics:

- The characteristics of your home, such as its age, size, construction type, and roof type, all play a role. Older homes may have higher premiums due to the potential for outdated wiring, plumbing, or roofing. Homes with certain roofing materials, like wood shingles, may also be considered higher risk due to fire hazards. The number of bedrooms and bathrooms can also be a factor.

Security Features:

- Security features can significantly reduce your premium. Installing a burglar alarm system, security cameras, deadbolt locks, and reinforced doors can demonstrate to your insurer that you are taking steps to mitigate the risk of theft. Monitored alarm systems often result in larger discounts.

- Security features can significantly reduce your premium. Installing a burglar alarm system, security cameras, deadbolt locks, and reinforced doors can demonstrate to your insurer that you are taking steps to mitigate the risk of theft. Monitored alarm systems often result in larger discounts.

Claims History:

- Your claims history is a significant factor. If you have filed multiple claims in the past, your premium will likely be higher. Insurers view frequent claims as an indicator of higher risk. Maintaining a clean claims history can help you secure lower premiums. Being honest with insurers is critical; failure to disclose prior claims can invalidate your insurance.

Deductible:

- The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible will lower your premium, as you are assuming more of the financial risk. However, it’s essential to select a deductible that you can comfortably afford in the event of a claim.

Personal Circumstances:

- Your personal circumstances, such as your age, credit score (in some states), and marital status, can also influence your premium. Insurers may use these factors as indicators of risk based on statistical data.

How to Lower Your Home Insurance Premium

While some factors are beyond your control, there are several strategies you can employ to potentially lower your home insurance premium:

- Improve Home Security: Installing a burglar alarm, security cameras, and other security features can reduce the risk of theft and lower your premium.

- Increase Your Deductible: Opting for a higher deductible can significantly reduce your premium, but ensure you can afford to pay it if needed.

- Bundle Your Insurance: Many insurers offer discounts for bundling your home and auto insurance policies.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Maintain Your Home: Regular maintenance can prevent costly repairs and reduce the risk of claims.

- Review Your Coverage: Periodically review your coverage limits to ensure they are accurate and avoid overpaying for unnecessary coverage.

Understanding Excess and Voluntary Excess

Excess, also known as the deductible, is the amount you agree to pay towards a claim before your insurance covers the rest. A voluntary excess is an additional amount you can choose to pay on top of the mandatory excess to further reduce your premium. By increasing your voluntary excess, you demonstrate to the insurer that you’re willing to shoulder more of the financial burden in the event of a claim, resulting in a lower premium. However, always ensure you can comfortably afford the total excess amount if a claim arises.

Recent Premium Increases

The average home insurance price has increased in recent years due to several factors, including rising rebuilding costs, increased frequency and severity of extreme weather events, and insurance fraud. The cost of materials and labor for home repairs and rebuilding has risen significantly, impacting insurance premiums. Additionally, events like severe storms, floods, and wildfires have led to more claims and higher payouts, prompting insurers to adjust premiums to cover these increased costs.

Conclusion

Understanding the factors that influence your home insurance premium is crucial for making informed decisions and securing adequate protection at a reasonable cost. By taking steps to mitigate risk, such as improving home security and maintaining your property, you can potentially lower your premium. Shopping around, comparing quotes, and reviewing your coverage regularly will help you find the best value for your home insurance needs.

Leave a Reply