Accidental death insurance offers a layer of financial security in the unfortunate event of death caused by an accident. Unlike traditional life insurance, which covers death from most causes, accidental death insurance specifically targets deaths resulting from unforeseen and unintentional accidents. This guide explores what constitutes accident death insurance, what it covers, its limitations, and how it compares to traditional life insurance policies, tailored for understanding within the United States.

What is Accident Death Insurance?

Accidental death insurance, often referred to as AD&D (Accidental Death and Dismemberment) insurance, is a type of insurance that pays out a benefit if the insured dies as a direct result of an accident. This contrasts with standard life insurance, which covers death from nearly any cause, including illness or natural causes. Accident death policies are designed to provide a financial safety net when an unexpected, accidental death occurs, offering beneficiaries a lump-sum payment to help manage the financial burdens that arise.

Events Typically Covered

Understanding what constitutes an accident under an accidental death insurance policy is crucial. The types of incidents generally covered include:

- Motor Vehicle Accidents: Car crashes, motorcycle accidents, and other transportation-related fatalities are frequently covered.

- Falls: Fatal injuries resulting from accidental falls, whether at home or elsewhere, typically qualify.

- Drowning: Accidental drownings, excluding those resulting from natural disasters (which may have separate coverage considerations), are usually covered.

- Fires: Deaths caused by fires, encompassing burns, smoke inhalation, or injuries from falling debris, are typically included.

- Accidental Poisoning: Deaths resulting from accidental poisoning, such as carbon monoxide poisoning, are generally covered.

- Workplace Accidents: Accidents occurring in the workplace, particularly those involving machinery or hazardous conditions, are often included.

- Exposure to the Elements: Deaths due to accidental exposure to extreme weather conditions like hypothermia or heatstroke are covered.

- Homicide: If the insured is the victim of a homicide, the death is generally classified as accidental for insurance purposes.

- Transportation Accidents: Fatalities involving common carriers like planes, trains, or buses are often covered.

In addition to death benefits, many AD&D policies provide coverage for dismemberment resulting from accidents. This may include the loss of limbs, eyesight, hearing, or speech. Benefits for dismemberment are typically a percentage of the total death benefit, varying based on the severity and nature of the loss.

Common Exclusions

While accidental death insurance offers broad coverage, it’s essential to understand its limitations. Standard exclusions often include:

- Illness or Natural Causes: Deaths resulting from sickness, disease, or other natural causes like heart attacks, strokes, or cancer are not covered.

- Suicide: Deaths resulting from suicide or self-inflicted injuries are explicitly excluded.

- Drug or Alcohol Overdose: Deaths due to drug or alcohol overdoses or abuse are generally not covered, particularly if the insured was under the influence at the time of the accident.

- Commission of a Felony: Deaths occurring while the insured was committing a felony are commonly excluded.

- War: Death as a result of war or acts of war is a standard exclusion.

- Dangerous Activities: Certain high-risk activities, such as professional racing or skydiving, may be excluded unless specifically covered by a policy rider.

- Pre-existing Medical Conditions: Deaths resulting from pre-existing medical conditions, even if indirectly contributing to the accident, are generally not covered.

- Medical Malpractice: Deaths resulting from medical or surgical treatment are excluded unless the treatment was necessitated by a covered accidental injury.

How it Differs from Life Insurance

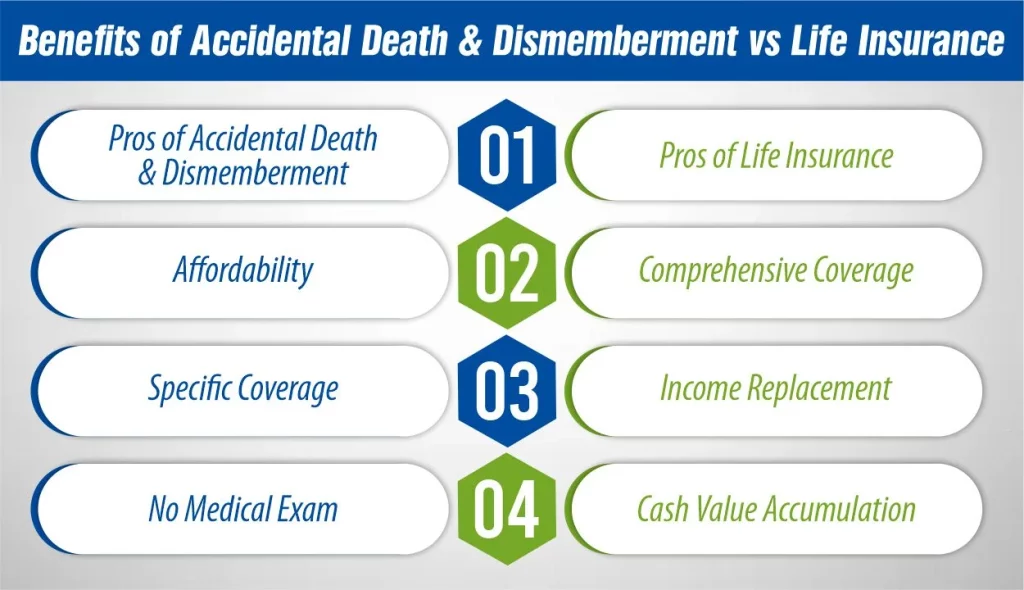

The key differences between accidental death insurance and traditional life insurance lie in coverage scope and payout triggers. Traditional life insurance covers death from virtually any cause, while accidental death insurance only pays out if death is the direct result of a covered accident.

Accidental death insurance is generally more affordable due to its limited coverage. The underwriting process is often simpler, sometimes requiring no medical examination, making it more accessible to individuals who may not qualify for traditional life insurance. However, its purpose is usually supplementary, offering additional protection in specific high-risk scenarios rather than serving as a comprehensive life insurance solution.

Key Policy Aspects

When considering accidental death insurance, several policy aspects are crucial to understand:

Beneficiary Designation: The policyholder must designate beneficiaries who will receive the payout upon their death. It’s important to keep this information up-to-date.

Payout Structure: Accidental death policies typically provide a lump-sum payment to beneficiaries. Dismemberment benefits are paid as a percentage of the policy’s face value, depending on the specific loss.

Additional Benefits and Riders: Policies may offer additional benefits or riders for specific events, such as accidents on common carriers, or enhanced dismemberment coverage.

Standalone vs. Rider: The policy can be purchased as a standalone policy or added as a rider to an existing life or health insurance plan. As a rider, it can increase the overall death benefit paid if the death is accidental.

Premiums: Premiums are determined by factors such as age, coverage amount, and occupation. Higher-risk occupations typically lead to higher premiums.

Is Accidental Death Insurance Right for You?

Accidental death insurance can be a valuable supplement to traditional life insurance, particularly for individuals in high-risk occupations or those seeking additional coverage for specific accidental scenarios. It offers peace of mind knowing that beneficiaries will receive financial support in the event of an accidental death. However, it’s essential to weigh the benefits against the limitations, ensuring it aligns with your overall insurance needs.

Accident Death Insurance FAQs

What qualifies as accidental death for insurance? Insurance companies define accidental death as an event that strictly occurs as a result of an accident. Deaths from car crashes, slips, choking, drowning, machinery, and any other situations that are out of control are accidental.

Is accidental death insurance a good idea? An AD&D policy may be a good idea, especially if you work in a high-risk job. Supplemental AD&D coverage could be a wise investment regardless, but understand that AD&D doesn’t cover you for any type of death or dismemberment.

What is the difference between life insurance and AD&D? Life insurance pays a tax-free benefit to your beneficiaries if you die. Whereas AD&D pays out to your beneficiaries if you die or have an injury in an accident.

By understanding the coverage, exclusions, and policy aspects of accidental death insurance, individuals can make informed decisions to protect their loved ones financially in the event of an unforeseen accident.

Leave a Reply