Homeowners insurance is a critical safeguard for what is often a person’s largest investment: their home. Understanding the average cost of homeowners insurance is the first step in securing adequate protection without overpaying. This article provides a comprehensive overview of homeowners insurance costs in the US, breaking down the factors that influence premiums and offering insights to help you find the best coverage at the right price.

National Average Homeowners Insurance Cost

In 2025, the average annual cost of homeowners insurance in the United States is $3,548, which translates to approximately $296 per month. This figure is based on a standard policy that includes $250,000 in dwelling coverage, $125,000 in personal property coverage, and $200,000 in liability protection. However, it’s important to recognize that this is just an average. Your actual premium can vary significantly based on a multitude of factors.

Factors Influencing Homeowners Insurance Costs

Several key factors determine your homeowners insurance premium. Understanding these elements can help you anticipate potential costs and make informed decisions about your coverage.

Location: Your geographical location is one of the most significant determinants of your insurance rate. States prone to natural disasters like hurricanes, tornadoes, and wildfires typically have higher premiums. Even within a state, premiums can vary considerably between cities and ZIP codes due to differences in crime rates, fire protection services, and local claim history.

- For example, coastal areas susceptible to hurricanes tend to have higher premiums than inland regions. Similarly, urban areas with higher crime rates may see increased insurance costs compared to suburban communities.

Dwelling Coverage Limit: The amount of dwelling coverage you choose directly impacts your premium. This coverage protects the physical structure of your home, including attached structures like garages.

- Increasing your dwelling coverage from $250,000 to $500,000 can substantially raise your annual premium. While adequate coverage is essential to protect your investment, it’s crucial to find a balance to avoid overpaying.

Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible generally lowers your annual premium, but it also means you’ll need to pay more if you file a claim.

- Increasing your deductible from $500 to $2,000 can result in significant savings on your premium. However, it’s important to select a deductible amount that you can comfortably afford to pay in the event of a loss.

Credit Score: In most states, your credit score plays a role in determining your homeowners insurance rate. Insurers often view higher credit scores as an indicator of lower risk, which can translate to lower premiums.

- Homeowners with excellent credit may pay significantly less per year compared to those with poor credit. However, it’s important to note that some states, such as California, Hawaii, Massachusetts and Michigan, prohibit insurers from using credit scores as a factor in setting rates.

Age of Home: The age of your home can also affect your insurance premium. Older homes may have outdated systems that are more prone to failure, increasing the risk of damage and potential claims.

- Newer homes built to modern safety codes typically have lower premiums due to their safer and more efficient systems. Upgrades to older homes, such as replacing outdated wiring or plumbing, can potentially lower insurance costs.

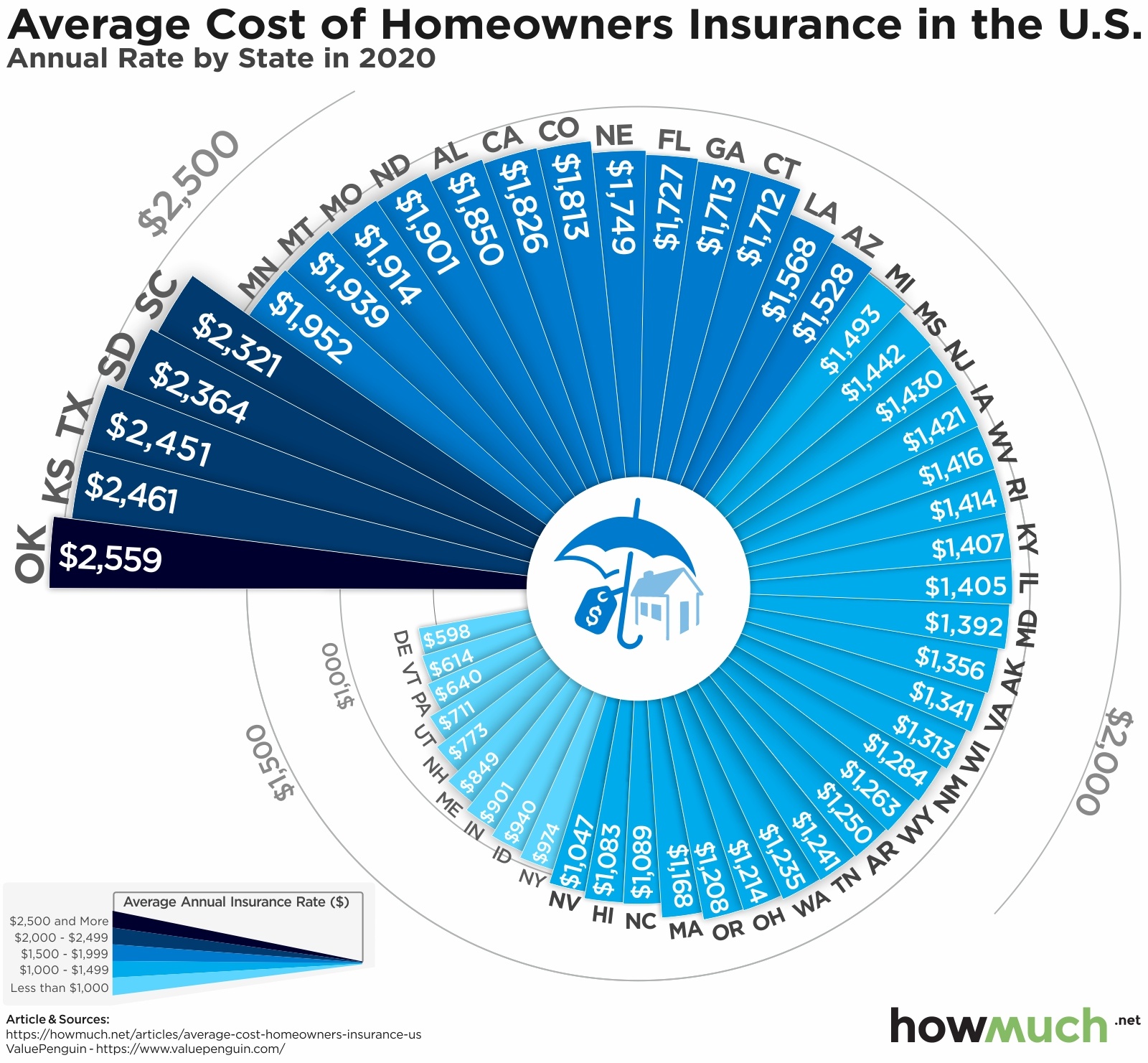

Average Homeowners Insurance Cost by State

Home insurance costs vary widely by state due to differences in regional hazards, building costs, and claim frequencies.

- States with frequent natural disasters, such as Florida and Louisiana, tend to have the highest premiums. Florida, exposed to hurricanes and flooding, has an average annual premium significantly higher than the national average.

- Conversely, states with fewer natural disasters and lower construction costs, such as Hawaii, Delaware, and Vermont, typically have the lowest premiums. Hawaii, for instance, boasts an average annual premium that is considerably lower than the national average.

Average Homeowners Insurance Cost by Company

The insurance company you choose can also significantly impact your premium. Different insurers use varying pricing models and risk assessments, resulting in substantial differences in quotes for the same property and coverage.

- Shopping around and comparing quotes from multiple insurers is crucial to finding the best rate. The difference between the most and least expensive options can be thousands of dollars per year.

- While price is an important consideration, it’s also essential to factor in customer service quality and claims handling efficiency when choosing an insurer.

Tips for Lowering Your Homeowners Insurance Costs

While some factors that influence your homeowners insurance rate are beyond your control, there are several steps you can take to potentially lower your costs.

- Increase Your Deductible: Opting for a higher deductible can significantly reduce your annual premium. Just be sure to choose an amount you can comfortably afford to pay out of pocket.

- Improve Your Credit Score: In states where credit score is a factor, improving your credit can lead to lower insurance rates.

- Bundle Your Insurance Policies: Many insurers offer discounts when you bundle your homeowners insurance with other policies, such as auto insurance.

- Install Safety Features: Installing safety features such as smoke detectors, burglar alarms, and security systems can potentially lower your premium.

- Shop Around and Compare Quotes: Always compare quotes from multiple insurers to ensure you’re getting the best rate for the coverage you need. Don’t hesitate to negotiate with your current insurer using competitive quotes as leverage.

- Review Your Coverage Annually: Make sure your coverage aligns with your current needs and that you’re not overpaying for unnecessary protection.

Understanding Coverage Types

Homeowners insurance typically includes several different types of coverage, each designed to protect against specific risks.

- Dwelling Coverage: This covers the cost to repair or rebuild your home’s structure if it’s damaged by a covered peril, such as fire, wind, or hail.

- Personal Property Coverage: This covers the cost to replace your personal belongings, such as furniture, clothing, and electronics, if they’re damaged or stolen.

- Liability Coverage: This protects you if someone is injured on your property and you’re found liable. It can cover medical expenses, legal fees, and damages.

- Additional Living Expenses (ALE) Coverage: This covers the cost of temporary housing and other expenses if you’re unable to live in your home due to a covered loss.

Conclusion

Understanding the average cost of homeowners insurance and the factors that influence premiums is crucial for protecting your home and finances. By taking the time to shop around, compare quotes, and explore ways to lower your costs, you can secure adequate coverage at a price that fits your budget. Remember that the cheapest option isn’t always the best. Consider customer service quality and claims handling efficiency when making your decision. By making informed choices, you can ensure that your home is protected against unexpected events without overpaying for coverage.

Leave a Reply