Choosing the right life insurance company can feel like navigating a maze. With so many options available in the UK, it’s essential to find a provider that offers comprehensive coverage at a competitive price, catering specifically to your unique circumstances. This guide aims to simplify the process, providing insights into the top life insurance companies in the UK and helping you make an informed decision about protecting your family’s financial future.

Understanding Your Life Insurance Needs

Before diving into the list of top companies, it’s crucial to assess your individual needs. Consider factors such as your age, health, financial obligations (mortgages, loans, childcare costs), and the level of financial support your family would require in your absence. Different types of life insurance policies exist, each designed to address specific needs:

Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). It’s often the most affordable option, ideal for covering temporary financial obligations like a mortgage or child-rearing expenses. If you outlive the term, the policy expires without a payout. Term life insurance could be level term (where the payout stays the same throughout the term), decreasing term (the payout decreases over time), or increasing term (the payout grows over time).

Whole Life Insurance: Offers lifelong coverage, ensuring a payout regardless of when you pass away. It also accumulates cash value over time, which you can borrow against or withdraw. Whole life insurance is generally more expensive than term life, but it provides long-term security and potential investment opportunities.

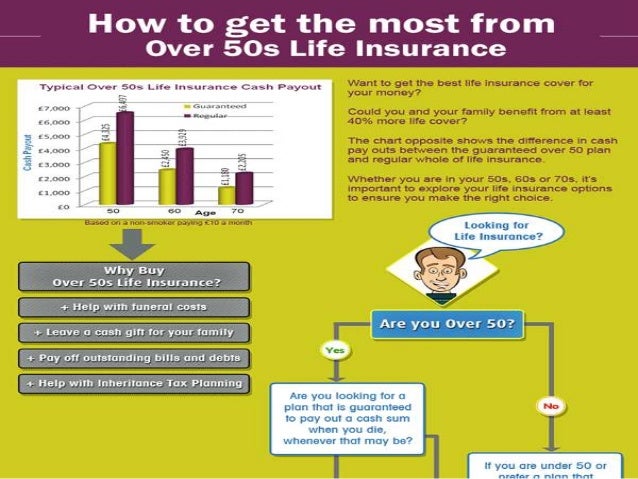

Over 50s Life Insurance: Specifically designed for individuals aged 50 to 80, often with guaranteed acceptance without medical exams. Coverage amounts are typically smaller, but these policies can help cover funeral costs or leave a small inheritance.

Top Life Insurance Companies in the UK

While there’s no single “best” provider for everyone, certain companies consistently receive high ratings for their comprehensive coverage, competitive pricing, customer service, and financial stability. Here’s a look at some of the top contenders:

Term Life Insurance:

VitalityLife: Known for its comprehensive cover and focus on rewarding healthy lifestyles. Their plans often include benefits like discounts on gym memberships and activity trackers. VitalityLife is frequently cited as a top pick for value.

Scottish Widows: Offers potential emotional and practical support for clients through Scottish Widows Care, in addition to standard term life cover.

Legal & General: A well-established provider with a range of term life insurance options, including level and decreasing term assurance. Their decreasing term is exceptionally good.

Zurich Insurance: Offers standard, high-quality life insurance plans. They are well-regarded for reliable policies.

Whole of Life Insurance:

Zurich Insurance: Again, Zurich makes the list with their Adaptable Life Plan, considered one of the top whole life insurance options in the UK.

VitalityLife: Their whole-of-life offerings are also considered a best-value option, similar to their term life products.

Legal & General: No list of UK insurance providers is complete without Legal & General, offering solid whole life protection plans.

Scottish Widows: Known for their top-notch supplementary support, adding value to their whole of life cover.

Aegon: Whole of life plans are designed with inheritance tax planning in mind.

Over 50s Life Insurance:

Smart Insurance: A top pick for over-50s cover, offering flexible policies, global coverage, accidental death benefits, and even a Will Kit. They do not require medical exams or health questions.

Foresters Friendly Society: Offers potential bonuses and only requires premium payments until age 85.

SunLife: Guarantees acceptance from age 49 to 85, with cash payments up to £18,000 and a high payout rate.

It’s important to note that this is not an exhaustive list, and other reputable companies may offer policies that better suit your specific needs.

Factors to Consider When Choosing a Company

Beyond the company’s reputation, several other factors should influence your decision:

Policy Exclusions: Carefully review the policy’s exclusions to understand what events or circumstances are not covered.

Customer Service: Look for companies with a reputation for excellent customer service, as you’ll want to be able to easily reach them with questions or concerns. Checking online review sites like Trustpilot and Feefo can be helpful.

Claim Payout Speed: Inquire about the company’s average claim payout time. A quick and efficient claims process can provide significant relief to your family during a difficult time.

Financial Stability: Ensure the company has a strong financial rating, indicating its ability to meet its future obligations. Ratings agencies like AM Best and Standard & Poor’s provide independent assessments of insurers’ financial health.

Obtaining Quotes and Comparing Policies

Once you have a shortlist of potential companies, the next step is to obtain quotes and compare policies. Several online comparison tools can help you get quotes from multiple providers simultaneously.

Remember that the cheapest policy isn’t always the best. Focus on finding a policy that provides adequate coverage and meets your specific needs, even if it means paying a slightly higher premium. It is very important to read the small prints before purchasing the best companies life insurance.

Seeking Expert Advice

Navigating the complexities of life insurance can be challenging, especially if you’re unfamiliar with the industry’s jargon and terminology. Consider seeking advice from an independent financial advisor who can assess your needs, explain your options, and recommend the most suitable policies for your circumstances.

Conclusion

Choosing the right life insurance company is a crucial step in protecting your family’s financial future. By understanding your needs, researching top providers, comparing policies, and seeking expert advice, you can make an informed decision and secure the peace of mind that comes with knowing your loved ones will be taken care of.

Leave a Reply