Navigating the world of car insurance can feel like a daunting task, especially with so many companies vying for your attention. Finding the right car insurance in the UK involves balancing cost, coverage, and customer service. This guide provides a comprehensive overview of the top car insurance companies in the UK, helping you make an informed decision.

Understanding Car Insurance Basics

Before diving into specific companies, it’s important to understand the different types of car insurance available. The main types of cover are:

- Third Party: This is the minimum legal requirement. It covers damage you cause to other people’s vehicles or property but doesn’t cover damage to your own car.

- Third Party, Fire and Theft: This includes third-party cover, plus protection if your car is stolen or damaged by fire.

- Comprehensive: This offers the broadest coverage, including damage to your own car, even if you’re at fault. It also covers fire, theft, and vandalism.

It’s generally recommended to opt for fully comprehensive cover for peace of mind. While it might sometimes be a cheaper option, for peace of mind it is hard to recommend anything other than fully comprehensive. It provides third party cover, as well as fire and theft, plus it ensures that should you be involved in an incident where you are at fault you can still make a claim and get back on the road as soon as possible.

Top-Rated Car Insurance Companies

Customer satisfaction, claims handling, and value for money are key factors to consider when choosing a car insurance company. Here are some of the top-rated insurers in the UK:

NFU Mutual: Consistently ranked at the top for customer satisfaction, NFU Mutual is known for its excellent service and high claims payout rate. They achieved a highly impressive rating for overall satisfaction. It also pays out on a high percentage of claims.

- Known for high customer satisfaction.

- High claims payout rate.

- Specialist policies for motorhome and campervan insurance.

John Lewis Money Car Insurance: Associated with excellent service, John Lewis Money Car Insurance offers comprehensive coverage, including legal liability protection, a guaranteed courtesy car, and a new car replacement if your vehicle is less than a year old and written off or stolen.

- Excellent service reputation.

- Comprehensive coverage options.

- Includes legal liability protection.

Dial Direct Car Insurance: Offering three levels of cover, Dial Direct includes RAC breakdown cover with all its policies. The fully comprehensive package covers vandalism and provides up to £300 for replacement child seats.

- Three levels of cover available.

- Includes RAC breakdown cover.

- Comprehensive cover includes vandalism and child seat replacement.

Sainsbury’s Bank Car Insurance: This supermarket brand offers various levels of comprehensive cover, including a courtesy car and protection against uninsured drivers.

- Various levels of comprehensive cover.

- Includes a courtesy car.

- Protection against uninsured drivers.

LV= Car Insurance: Formerly Liverpool Victoria, LV= is known for its frequent advertising campaigns. Its car cover includes an uninsured driver promise, cover for window repairs, lost keys, and vandalism damage.

- Well-recognized insurance company.

- Offers van insurance and multi-car policies.

- Includes uninsured driver promise.

Factors Affecting Car Insurance Premiums

Several factors influence the cost of your car insurance. Understanding these can help you find the best possible deal:

- Age and Experience: Younger drivers typically pay more due to their higher risk profile.

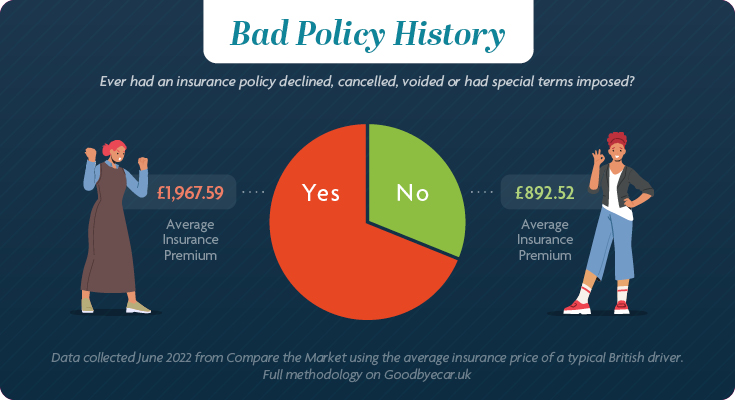

- Driving History: A clean driving record with no accidents or points results in lower premiums. Accumulating points on your driving licence can significantly increase your car insurance premiums.

- Type of Car: The make and model of your car affect the cost. High-performance or expensive cars are generally more expensive to insure. What insurance group is my car? Our handy tool shows you which car insurance group your car falls into.

- Location: Urban areas with higher traffic density and crime rates tend to have higher premiums.

- Excess: The amount you agree to pay towards a claim (the excess) can lower your premium. An excess is the amount you pay towards any claim you make on your car insurance policy.

- Annual Mileage: Lower annual mileage can result in lower premiums, as it indicates less time spent on the road.

How to Find the Best Car Insurance Deals

Finding the right car insurance deal requires some research and comparison. Here are some tips to help you get the best price:

- Use Comparison Sites: Compare The Market, MoneySuperMarket, Confused.com, Gocompare, Quotezone and SimplyQuote are useful for comparing quotes from multiple insurers.

- Check Direct Insurers: Some insurers, like Direct Line, don’t appear on comparison sites, so it’s worth getting a quote directly from them.

- Consider Telematics (Black Box) Insurance: If you’re a young or inexperienced driver, a black box policy can lower your premium by tracking your driving habits. While black box insurance offers fair pricing, make sure you understand the rules and penalties for bad driving – how black box car insurance works

- Increase Your Excess: Opting for a higher voluntary excess can reduce your premium, but make sure you can afford to pay it if you need to make a claim.

- Pay Annually: Paying for your insurance annually is often cheaper than paying monthly, as insurers may charge interest on monthly payments. One solution is to pay annually using an interest-free purchase credit card, which you then pay off over 12 months.

- Shop Around Annually: Don’t automatically renew your policy. Shop around each year to ensure you’re getting the best deal.

Understanding Insurance Terminology

Car insurance policies often come with a lot of jargon. Here are some key terms to understand:

- Premium: The amount you pay for your insurance policy.

- Excess: The amount you pay towards a claim.

- No Claims Discount (NCD): A discount you earn for each year you don’t make a claim.

- Third Party: Someone other than yourself who is involved in an accident.

- Comprehensive Cover: The most extensive level of insurance, covering damage to your own vehicle and third parties.

- Uninsured Losses: Costs not covered by your insurance, such as loss of use or personal injuries.

The Importance of Customer Reviews

While price is a significant factor, it’s also important to consider customer reviews and satisfaction ratings. Look for insurers with high scores for customer service, claims handling, and overall satisfaction. Online platforms like Trustpilot and Feefo can provide valuable insights into the experiences of other customers.

Conclusion

Choosing the right car insurance company in the UK requires careful consideration of your individual needs, driving history, and budget. By understanding the different types of cover, factors affecting premiums, and how to find the best deals, you can make an informed decision and secure the best possible protection for yourself and your vehicle. Consider reviewing the top-rated companies like NFU Mutual, John Lewis Money Car Insurance, and Dial Direct, but always compare quotes and read customer reviews before making a final choice.

Leave a Reply