Navigating the world of car insurance can feel overwhelming, especially with so many companies vying for your attention in a bustling city like Kansas City. Finding the right car insurance company involves more than just comparing prices; it requires understanding your individual needs, the types of coverage available, and the reputation of the insurers operating in the Missouri market. Whether you’re a new resident, a seasoned driver looking for better rates, or simply seeking more comprehensive coverage, this guide will help you find the best car insurance companies in Kansas City.

Understanding Missouri’s Minimum Car Insurance Requirements

Before diving into specific companies, it’s essential to understand the minimum car insurance requirements in Missouri. These mandatory coverages are designed to protect you and other drivers on the road. In Missouri, the minimum requirements are:

- Bodily Injury Liability: \$25,000 per person / \$50,000 per accident. This covers medical expenses and lost wages if you are at fault in an accident that injures another person.

- Property Damage Liability: \$25,000. This covers the cost of repairing or replacing another person’s vehicle or property if you are at fault.

- Uninsured/Underinsured Motorist Coverage: \$25,000 per person / \$50,000 per accident. This protects you if you’re injured by an uninsured or underinsured driver.

While these minimums fulfill the legal requirements, they might not be sufficient to cover all potential costs in a serious accident. It’s important to assess your own risk tolerance and consider higher coverage limits for greater financial protection.

Key Factors to Consider When Choosing Car Insurance

Choosing the right car insurance company involves several considerations beyond just the price. Here are some crucial factors to evaluate:

- Coverage Options: Does the company offer a wide range of coverage options to meet your specific needs? This includes not only the basic liability coverage but also collision, comprehensive, uninsured/underinsured motorist, and additional add-ons like roadside assistance or rental car reimbursement.

- Price and Discounts: Compare quotes from multiple companies to find the best rates. Explore available discounts, such as multi-policy, good driver, good student, and pay-in-full discounts.

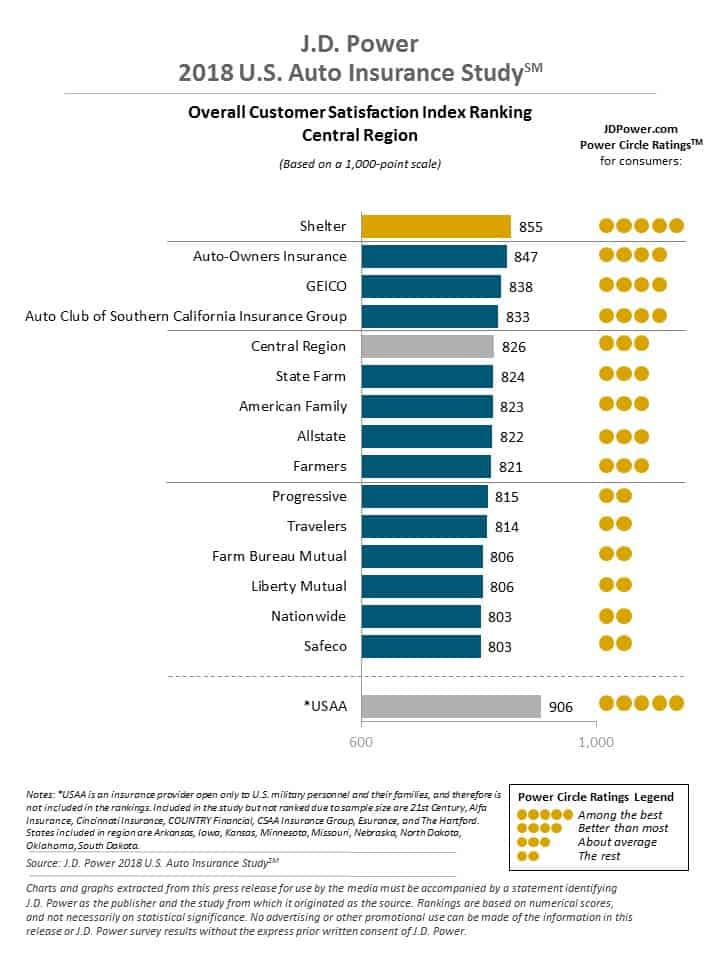

- Customer Service and Claims Handling: Research the company’s reputation for customer service and claims handling. Look for reviews and ratings that indicate how efficiently and fairly they handle claims. A smooth claims process is essential when you need it most.

- Financial Stability: Check the financial strength ratings of the insurance company. A financially stable insurer is more likely to be able to pay out claims promptly and reliably.

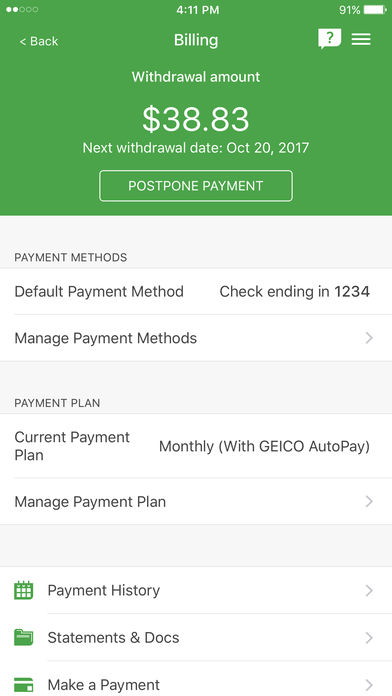

- Ease of Use: Consider the ease of obtaining quotes, managing your policy online, and contacting customer service. A user-friendly experience can save you time and frustration.

Top Car Insurance Companies in Kansas City

While individual needs and circumstances vary, some car insurance companies consistently stand out in the Kansas City market. These companies often excel in areas such as coverage options, competitive pricing, customer service, and financial stability.

- GEICO: Known for its competitive rates and user-friendly online platform, GEICO offers a wide range of coverage options and discounts. GEICO also features a mobile app with programs like DriveEasy that rewards safe driving habits.

- State Farm: A well-established insurer with a strong local presence, State Farm offers personalized service through its network of agents. They are known for their strong customer satisfaction and comprehensive coverage options.

- Progressive: Progressive is another major player in the car insurance market, offering a variety of coverage options and online tools. They are known for their Name Your Price tool, which allows you to find coverage that fits your budget.

- Farmers Insurance: Farmers Insurance provides a range of insurance products, including car insurance, and offers personalized service through local agents. They often provide discounts for bundling multiple policies.

- Local and Regional Insurers: Don’t overlook local and regional insurance companies like Metzler Brothers Insurance. These companies may offer more personalized service and a better understanding of the specific needs of Kansas City drivers.

Exploring Additional Coverage Options

While Missouri’s minimum coverage requirements provide a basic level of protection, consider adding optional coverages to enhance your policy and safeguard against unexpected events. Here are a few important options:

- Collision Coverage: This helps pay for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This protects your car from non-collision incidents like theft, vandalism, fire, or weather-related damage.

- Medical Payments (MedPay): This helps pay for medical expenses for you and your passengers after an accident, regardless of who caused it.

- Emergency Roadside Service: This provides coverage for services like towing, jump-starts, and tire changes if you’re stranded on the road.

- Rental Car Reimbursement: This covers the cost of a rental car while your vehicle is being repaired after a covered accident.

Tips for Finding the Best Car Insurance Rates in Kansas City

Finding the best car insurance rates in Kansas City requires a bit of research and comparison shopping. Here are some tips to help you save money without sacrificing coverage:

- Shop Around: Get quotes from multiple insurance companies. Use online comparison tools and contact local agents to get a variety of quotes.

- Increase Your Deductible: A higher deductible typically results in a lower premium. However, make sure you can afford to pay the deductible if you need to file a claim.

- Bundle Your Policies: Many insurers offer discounts for bundling your car insurance with other policies, such as home or renters insurance.

- Maintain a Good Driving Record: A clean driving record is one of the best ways to keep your insurance rates low. Avoid accidents and traffic violations.

- Improve Your Credit Score: In many states, including Missouri, your credit score can impact your insurance rates. Improving your credit score can lead to lower premiums.

- Review Your Coverage Regularly: As your needs change, review your coverage to ensure it still meets your requirements. You may be able to reduce coverage if your car is older or no longer worth as much.

Staying Informed and Making the Right Choice

Choosing the right car insurance company in Kansas City is a crucial decision that requires careful consideration of your individual needs, budget, and risk tolerance. By understanding Missouri’s minimum requirements, exploring different coverage options, and comparing quotes from multiple companies, you can find the best coverage at a price that fits your budget. Don’t hesitate to contact insurance specialists and ask questions to ensure you’re making an informed decision. Remember, the cheapest option isn’t always the best; prioritize comprehensive coverage and reliable customer service to protect yourself and your vehicle on the roads of Kansas City.

Leave a Reply