Finding the right car insurance in Philadelphia can feel like navigating a maze. With numerous companies vying for your business and a variety of coverage options to consider, it’s essential to approach the process strategically. This article provides a comprehensive guide to the top car insurance companies in Philadelphia, helping you compare rates, understand coverage needs, and ultimately secure the best possible deal.

Understanding Philadelphia’s Car Insurance Landscape

Philadelphia, like many urban areas, tends to have higher car insurance rates compared to rural regions. This is due to factors such as higher population density, increased traffic congestion, and a greater risk of accidents and theft. According to recent data, Philadelphia drivers pay an average of $237 per month for full coverage and $98 per month for minimum coverage. These figures highlight the importance of shopping around and comparing quotes from multiple insurers to find the most competitive rates.

Factors Influencing Premiums: Several factors influence your car insurance premiums in Philadelphia, including your age, driving history, credit score, the type of car you drive, and your zip code. Young drivers and those with accidents or DUIs on their records typically face higher rates.

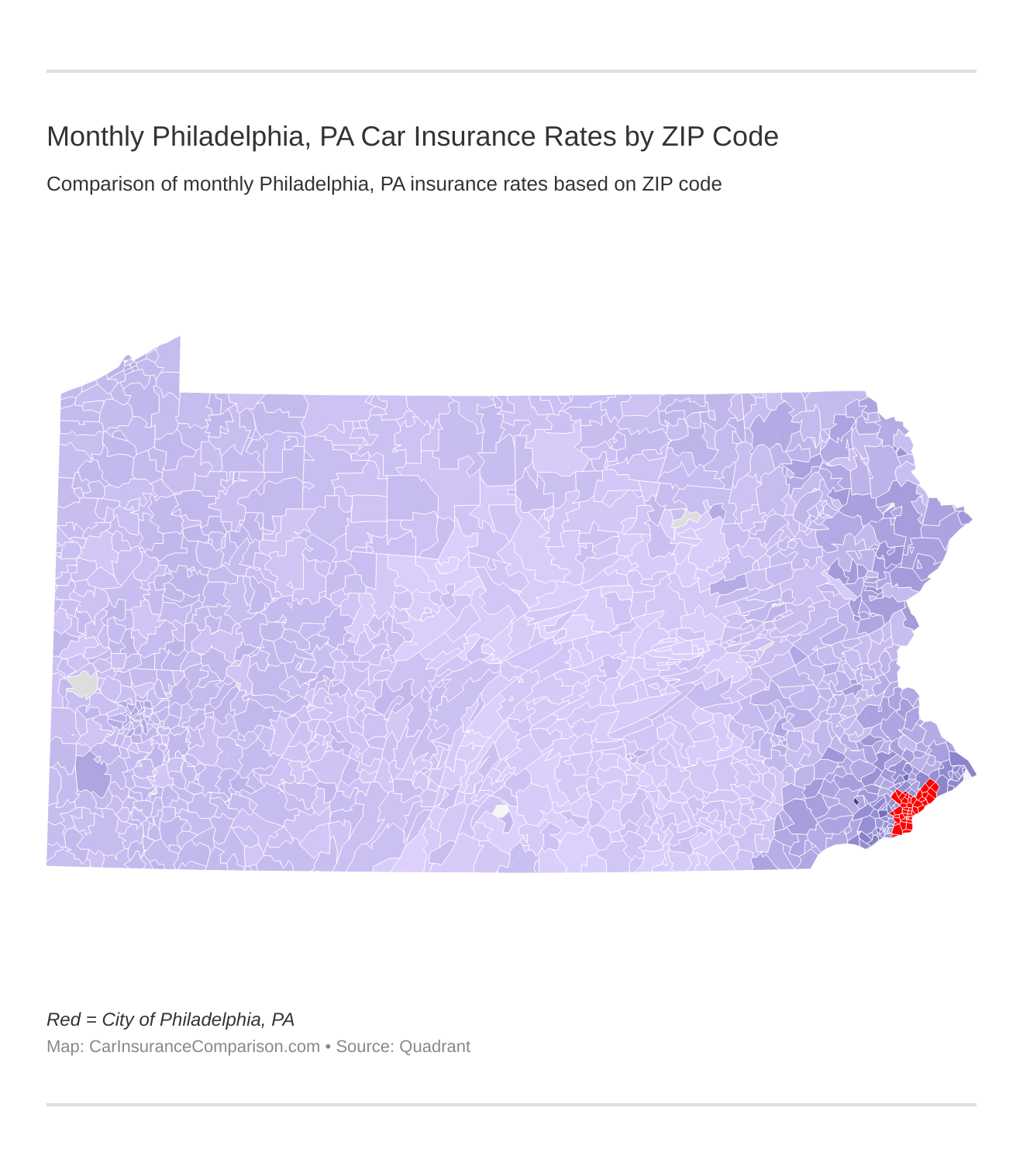

Zip Code Matters: Even within Philadelphia, car insurance rates can vary significantly by zip code. Areas with higher crime rates or a greater frequency of accidents tend to have higher premiums. For example, zip code 19120 may have different rates than 19118.

Top Car Insurance Companies in Philadelphia

Several car insurance companies stand out in Philadelphia for their competitive rates, customer service, and comprehensive coverage options. These include Travelers, Westfield, Nationwide, Erie, and State Farm.

Travelers: Travelers consistently ranks as one of the cheapest car insurance companies in Philadelphia, particularly for full coverage. They offer the lowest rates across most driver categories, including young drivers, adult drivers, senior drivers, and drivers with accidents or speeding tickets. Travelers also boasts strong customer service ratings and multiple coverage customization options.

Westfield: Westfield offers the lowest annual rate for minimum coverage in Philadelphia. They are also a good choice for drivers with bad credit, providing some of the best rates in this category.

Nationwide: Nationwide is another top contender, offering competitive rates and a range of coverage options. They also stand out for their financial stability and customer satisfaction.

Erie: Erie is known for its outstanding customer service. While their rates may be slightly higher than Travelers, their personalized support through local agents and comprehensive coverage options make them a popular choice. Erie particularly appeals to drivers who value personal service and extensive policy customization.

State Farm: State Farm is a well-established insurer with a strong reputation. They offer competitive rates and a wide range of coverage options, making them a reliable choice for many Philadelphia drivers.

Comparing Car Insurance Rates and Coverage

The best way to find the cheapest car insurance in Philadelphia is to compare quotes from multiple insurers. Online tools and local agents can help you gather quotes and assess your coverage needs.

Determine Your Coverage Needs: Start by evaluating your individual needs. Consider factors such as the value of your vehicle, your assets, and your risk tolerance. A car insurance coverage needs calculator can provide a personalized recommendation.

Explore Different Coverage Types: Familiarize yourself with various types of car insurance available in Philadelphia.

- Liability Coverage: This covers damages you cause to others in an accident.

- Collision Coverage: This covers damage to your vehicle, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver with little or no insurance.

Identify Potential Discounts: Many car insurance companies offer discounts for things like safe driving, good grades (for students), bundling multiple policies, and having anti-theft devices. Make sure to inquire about all available discounts when getting quotes.

Obtain and Compare Quotes: Contact at least three different insurance companies for quotes, using a mix of local agents, online tools, and direct carrier websites. Compare the quotes carefully, paying attention to both the price and the coverage offered.

The Impact of Driving History and Credit Score

Your driving history and credit score can significantly impact your car insurance rates in Philadelphia. A clean driving record with no accidents or tickets will typically result in lower premiums. Conversely, accidents, speeding tickets, and DUIs can lead to higher rates.

Driving History: Insurers view drivers with a history of accidents or traffic violations as higher risk and charge them accordingly. Even a single speeding ticket can increase your premiums.

Credit Score: In Pennsylvania, insurers can use your credit score to help determine your car insurance rates. A good credit score generally translates to lower premiums, while a poor credit score can lead to higher rates.

Improving Your Rates: While you can’t change your past driving history, you can take steps to improve your driving habits and maintain a clean record going forward. You can also work on improving your credit score by paying bills on time and reducing your debt.

Choosing the Right Car Insurance Company

Selecting the right car insurance company in Philadelphia involves balancing cost, coverage, and customer service. While Travelers and Westfield offer the lowest average premiums, it’s essential to consider other factors as well.

Customer Service: Look for companies with strong customer service ratings and a reputation for handling claims efficiently. Online reviews and ratings can provide valuable insights into the customer experience.

Coverage Options: Make sure the company offers the coverage options you need, such as collision, comprehensive, and uninsured/underinsured motorist coverage.

Financial Stability: Choose a company with strong financial ratings to ensure they can pay out claims in the event of an accident.

Staying Informed and Reviewing Your Policy

Car insurance rates and coverage options can change over time. It’s essential to review your policy annually to ensure it still meets your needs and that you’re getting the best possible rate.

Annual Review: Set a yearly reminder to review your car insurance policy and compare quotes from other insurers.

Life Changes: Significant life changes, such as moving to a new address or buying a new car, can affect your insurance rates. Be sure to update your policy accordingly.

Discounts: Re-evaluate your eligibility for discounts each year. You may qualify for new discounts based on your driving record, age, or other factors.

By following these tips and carefully comparing your options, you can find the best car insurance rates in Philadelphia and ensure you have the coverage you need to protect yourself and your vehicle. Remember that the cheapest option isn’t always the best; it’s crucial to find a balance between affordability, coverage, and customer service.

Leave a Reply