Choosing the right car insurance company in Maine can feel overwhelming. With numerous providers vying for your attention, it’s crucial to make an informed decision that balances affordability with reliable coverage. This comprehensive guide explores the top car insurance companies in Maine, offering insights into how they stack up in terms of premiums, customer satisfaction, and claims handling. Whether you’re a new driver, seeking a better rate, or simply reassessing your current policy, this guide will equip you with the knowledge to navigate the Maine auto insurance landscape.

Understanding Maine’s Car Insurance Requirements

Maine, like most states, mandates that drivers carry a minimum level of car insurance to legally operate a vehicle. These requirements are designed to protect both drivers and other road users in the event of an accident. Typically, the minimum coverage includes:

- Bodily injury liability: This covers expenses related to injuries you cause to another person in an accident.

- Property damage liability: This covers damages you cause to another person’s property, such as their vehicle.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver without insurance or with insufficient coverage to pay for your damages.

While meeting the minimum requirements is essential, it’s often wise to consider higher coverage limits to ensure adequate financial protection in the event of a serious accident.

Factors to Consider When Choosing Car Insurance in Maine

Several factors influence the cost and suitability of a car insurance policy. Evaluating these elements can help you narrow down your options and find the best fit for your individual needs:

- Coverage Options: Beyond the mandatory coverage, consider options like collision coverage (which covers damage to your vehicle regardless of fault), comprehensive coverage (which covers damage from events like theft, vandalism, or natural disasters), and medical payments coverage (which covers medical expenses for you and your passengers, regardless of fault).

- Price and Discounts: Obtain quotes from multiple insurers to compare prices. Inquire about available discounts, such as those for safe driving, good student status, bundling policies, or having anti-theft devices.

- Customer Service and Claims Handling: Research the insurance company’s reputation for customer service and claims handling. Online reviews, ratings from consumer organizations, and word-of-mouth recommendations can provide valuable insights.

- Financial Stability: Choose an insurer with a strong financial rating. This indicates the company’s ability to pay out claims, even in the face of widespread losses.

- Local Expertise: Some insurance companies may have a better understanding of Maine-specific risks and regulations, which can be beneficial in tailoring a policy to your specific needs.

Evaluating Top Car Insurance Companies in Maine

When evaluating car insurance companies in Maine, several metrics can help determine the best options. Factors such as average premiums, customer satisfaction scores, and complaint ratios can offer insights into the quality of service and value provided.

- Average Premiums: Examining state-level average premiums provides a benchmark for comparing costs across different insurers. However, remember that individual rates will vary based on personal factors like driving history, age, and vehicle type.

- Customer Satisfaction: Survey responses and ratings from organizations like J.D. Power can offer insights into customer satisfaction. Look for companies with consistently high scores in areas like communication, claims handling, and overall service.

- NAIC Complaint Ratio: The National Association of Insurance Commissioners (NAIC) compiles data on consumer complaints filed against insurance companies. A lower complaint ratio indicates fewer complaints relative to the company’s size.

U.S. News & World Report, for instance, analyzes publicly available data about car insurance companies, including state-specific insurance premiums, survey responses from Maine residents, and state-level auto insurance complaints filed to the NAIC. Their methodology involves standardizing data points and applying weights to different factors to arrive at an overall rating. For example, state-level average premiums might account for 40% of the rating, while survey responses and the NAIC Quotient (based on complaint ratios) might each account for 20%.

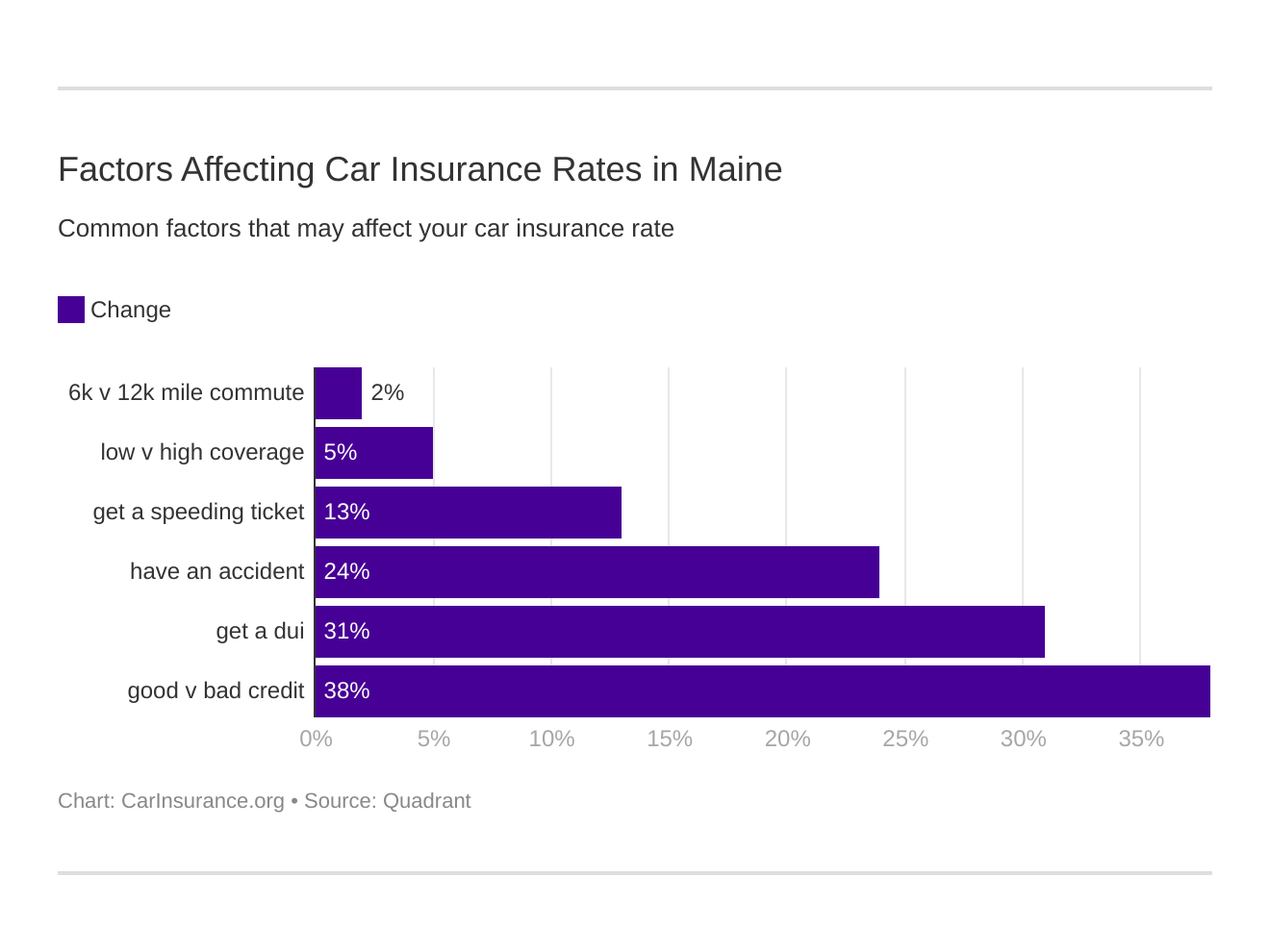

Factors Affecting Car Insurance Rates in Maine

Several factors contribute to the car insurance rates you’ll pay in Maine:

- Driving Record: A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, a history of accidents, tickets, or DUIs will increase your rates.

- Age and Experience: Younger drivers, particularly those under 25, typically pay higher premiums due to their lack of driving experience. Rates tend to decrease with age and experience.

- Vehicle Type: The make and model of your vehicle can impact your insurance rates. More expensive vehicles, sports cars, and vehicles that are more likely to be stolen generally have higher premiums.

- Credit Score: In Maine, insurance companies are allowed to use credit scores as a factor in determining premiums. A good credit score can result in lower rates, while a poor credit score can lead to higher rates.

- Location: Your location within Maine can also affect your rates. Urban areas with higher traffic density and rates of theft or vandalism may have higher premiums than rural areas.

- Coverage Levels: The amount of coverage you choose also impacts your rates. Higher liability limits, comprehensive and collision coverage, and other optional coverages will increase your premiums.

Tips for Finding the Best Car Insurance Rates in Maine

Finding affordable car insurance in Maine requires a proactive approach. Here are some tips to help you secure the best rates:

- Shop Around: Obtain quotes from multiple insurance companies to compare prices and coverage options. Online comparison tools can streamline this process.

- Increase Your Deductible: Raising your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums. However, ensure you can comfortably afford to pay the higher deductible if you need to file a claim.

- Bundle Your Policies: If you have other insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same insurer. Many companies offer discounts for bundling.

- Maintain a Good Driving Record: Practice safe driving habits to avoid accidents and traffic violations. A clean driving record is the best way to keep your insurance rates low.

- Improve Your Credit Score: If your credit score is low, take steps to improve it. Paying bills on time and reducing debt can help boost your credit score over time.

- Review Your Policy Regularly: Periodically review your insurance policy to ensure it still meets your needs and that you’re taking advantage of all available discounts. Your needs change over time, so make sure your coverage keeps pace.

- Ask About Discounts: Don’t hesitate to ask your insurance company about available discounts. You may be eligible for discounts based on your profession, affiliations, or safety features in your vehicle.

By carefully considering your individual needs, researching your options, and implementing these tips, you can find the best car insurance companies in Maine that provides affordable coverage and peace of mind. Remember to prioritize both price and the quality of service when making your decision.

Leave a Reply