Navigating the world of car insurance can be a daunting task, especially in a state like Florida, where rates are historically among the highest in the nation. Whether you’re a new driver, a long-time resident, or just looking to switch providers, understanding your options is crucial to securing the best possible coverage at a price you can afford. This guide will explore the top car insurance companies in Florida, discuss factors influencing premiums, and offer tips for finding cheap car insurance that meets your individual needs.

Understanding Florida’s Unique Insurance Landscape

Florida operates under a “no-fault” car insurance system. This means that regardless of who is at fault in an accident, each driver’s own Personal Injury Protection (PIP) insurance covers their medical bills and lost wages, up to the policy limits. Florida requires drivers to carry a minimum of $10,000 in PIP coverage and $10,000 in Property Damage Liability (PDL) coverage. However, these minimums may not be sufficient to cover the full extent of damages in a serious accident, making it wise to consider higher coverage limits and additional protection.

It’s important to note that while Florida is a no-fault state, drivers can still be held liable for damages if injuries are considered “serious” under Florida law, including significant disfigurement, permanent limitation of a body organ, or significant limitation of a body function. This can lead to lawsuits and potentially significant out-of-pocket expenses for drivers who only carry the minimum required coverage.

Top Car Insurance Companies in Florida

Several car insurance companies stand out in Florida based on factors like price, coverage options, customer service, and financial strength. Here’s a look at some of the leading providers:

State Farm: Consistently ranked among the top insurers nationwide, State Farm offers competitive rates, especially for drivers with clean records and good credit. They also boast a strong network of local agents, providing personalized service. According to NerdWallet’s October 2025 analysis, State Farm offers the cheapest full coverage in Florida, with an average monthly rate of $174. State Farm also tends to have cheaper rates after a DUI or accident.

GEICO: Known for its aggressive advertising and budget-friendly rates, GEICO is a popular choice for cost-conscious consumers. GEICO offers the cheapest liability coverage in Florida, with an average monthly rate of $30. GEICO also has user-friendly mobile app features with quick claims filing, roadside assistance, and policy management.

Travelers: Travelers stands out for its excellent customer service and diverse coverage options, including unique add-ons tailored to Florida’s insurance landscape.

Progressive: Progressive offers innovative budgeting tools and specialized coverage options, such as rideshare insurance, making it a good choice for gig workers and those seeking flexible policies.

USAA: If you’re an active member of the military, a veteran, or have an immediate family member who is, USAA consistently offers some of the best rates and customer service in the industry. However, eligibility is restricted to those with military affiliations.

Factors Affecting Car Insurance Rates in Florida

Several factors influence how much you’ll pay for car insurance in Florida. Understanding these factors can help you take steps to lower your premiums:

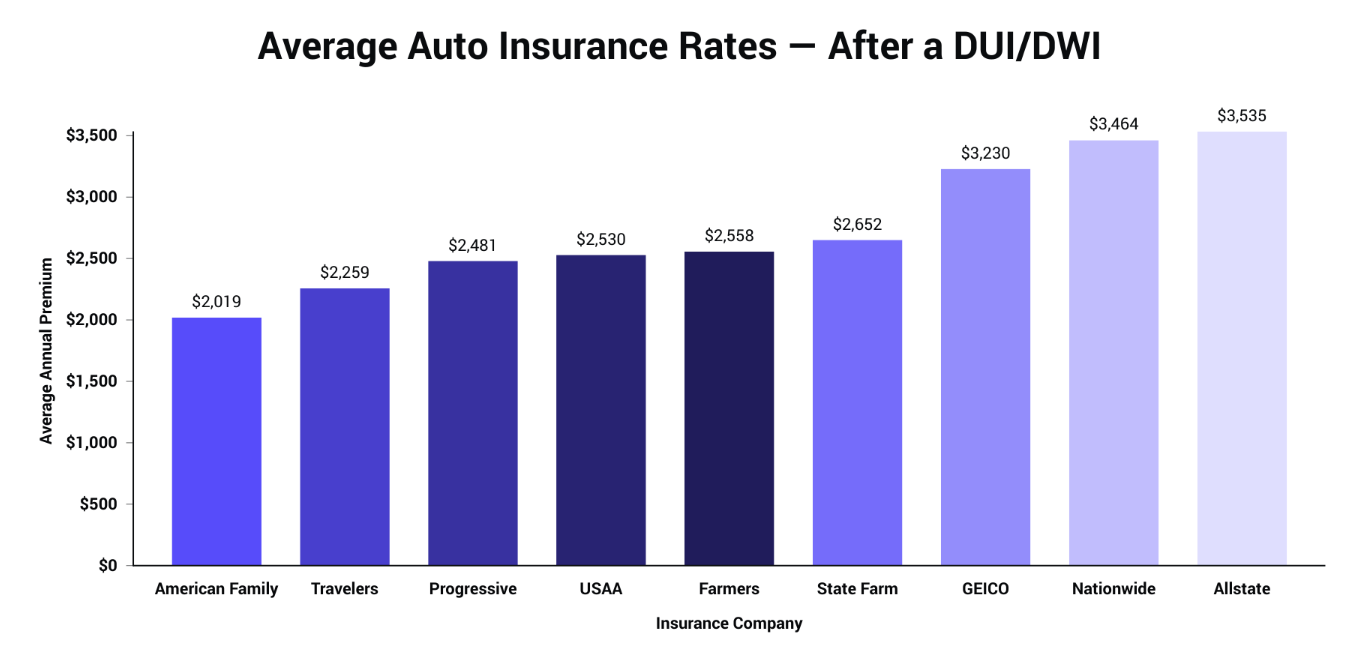

Driving History: A clean driving record with no accidents, tickets, or DUIs will result in lower rates. Conversely, violations will significantly increase your premiums.

Age and Gender: Younger drivers, particularly teenagers, typically pay the highest rates due to their inexperience. Rates generally decrease as you age, but may increase again in your 70s. Gender can also play a role, with young male drivers often paying more than young female drivers.

Credit Score: In Florida, insurance companies use a credit-based insurance score to assess risk. A good credit score can lead to lower rates, while a poor credit score can result in significantly higher premiums.

Coverage Type and Limits: The amount of coverage you choose directly affects your premium. Opting for minimum coverage will be cheaper, but may leave you financially vulnerable in the event of a serious accident. Full coverage, including comprehensive and collision insurance, will provide more protection but also increase your rates.

Vehicle Type: The make and model of your car can also impact your insurance costs. Safer vehicles with advanced safety features often qualify for lower rates.

Location: Where you live in Florida can affect your insurance rates. Densely populated areas with high traffic and accident rates tend to have higher premiums.

Discounts: Many car insurance companies offer a variety of discounts, such as multi-policy discounts, good student discounts, safe driver discounts, and discounts for having anti-theft devices installed in your car.

Tips for Finding Cheap Car Insurance in Florida

Finding affordable car insurance in Florida requires some research and comparison shopping. Here are some strategies to help you lower your premiums:

Shop Around: Get quotes from multiple insurers to compare rates and coverage options. Online comparison tools can help you quickly gather quotes from several companies.

Increase Your Deductible: Raising your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your monthly premium. Just make sure you can afford to pay the higher deductible if you need to file a claim.

Bundle Policies: If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with the same provider to qualify for a multi-policy discount.

Ask About Discounts: Inquire about all available discounts and see if you qualify.

Improve Your Credit Score: Work to improve your credit score, as this can have a positive impact on your insurance rates.

Maintain a Clean Driving Record: Practice safe driving habits to avoid accidents and traffic violations.

Drop Unnecessary Coverage: Evaluate your coverage needs and consider dropping optional coverage types that you no longer need, such as collision and comprehensive insurance on an older vehicle.

Review Your Policy Annually: Car insurance rates and your coverage needs can change over time. Review your policy annually to ensure you’re still getting the best deal and that your coverage adequately protects you.

The Importance of Adequate Coverage

While saving money on car insurance is important, it’s crucial to ensure that you have adequate coverage to protect yourself financially in the event of an accident. Florida’s minimum coverage requirements may not be sufficient to cover all damages and injuries, especially in a serious crash.

Consider purchasing higher liability limits to protect your assets if you’re found at fault in an accident. Uninsured/Underinsured Motorist (UM/UIM) coverage is also recommended to protect you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Conclusion

Finding the best car insurance company in Florida requires careful consideration of your individual needs, driving history, and budget. By understanding the factors that influence premiums, shopping around for quotes, and taking advantage of available discounts, you can secure affordable coverage that provides adequate protection. Remember to prioritize adequate coverage over simply finding the cheapest rate, as being properly insured can save you from significant financial hardship in the event of an accident.

Leave a Reply