Finding the right car insurance can feel like navigating a maze. With so many car insurance company quotes available, deciphering the best deal requires understanding your needs, knowing what factors influence your premium, and comparing policies effectively. This guide will walk you through the process of comparing car insurance company quotes, helping you secure the right coverage at the best possible price.

Understanding Car Insurance Basics

Before diving into comparing car insurance company quotes, it’s essential to grasp the fundamentals of car insurance. There are primarily three types of car insurance coverage:

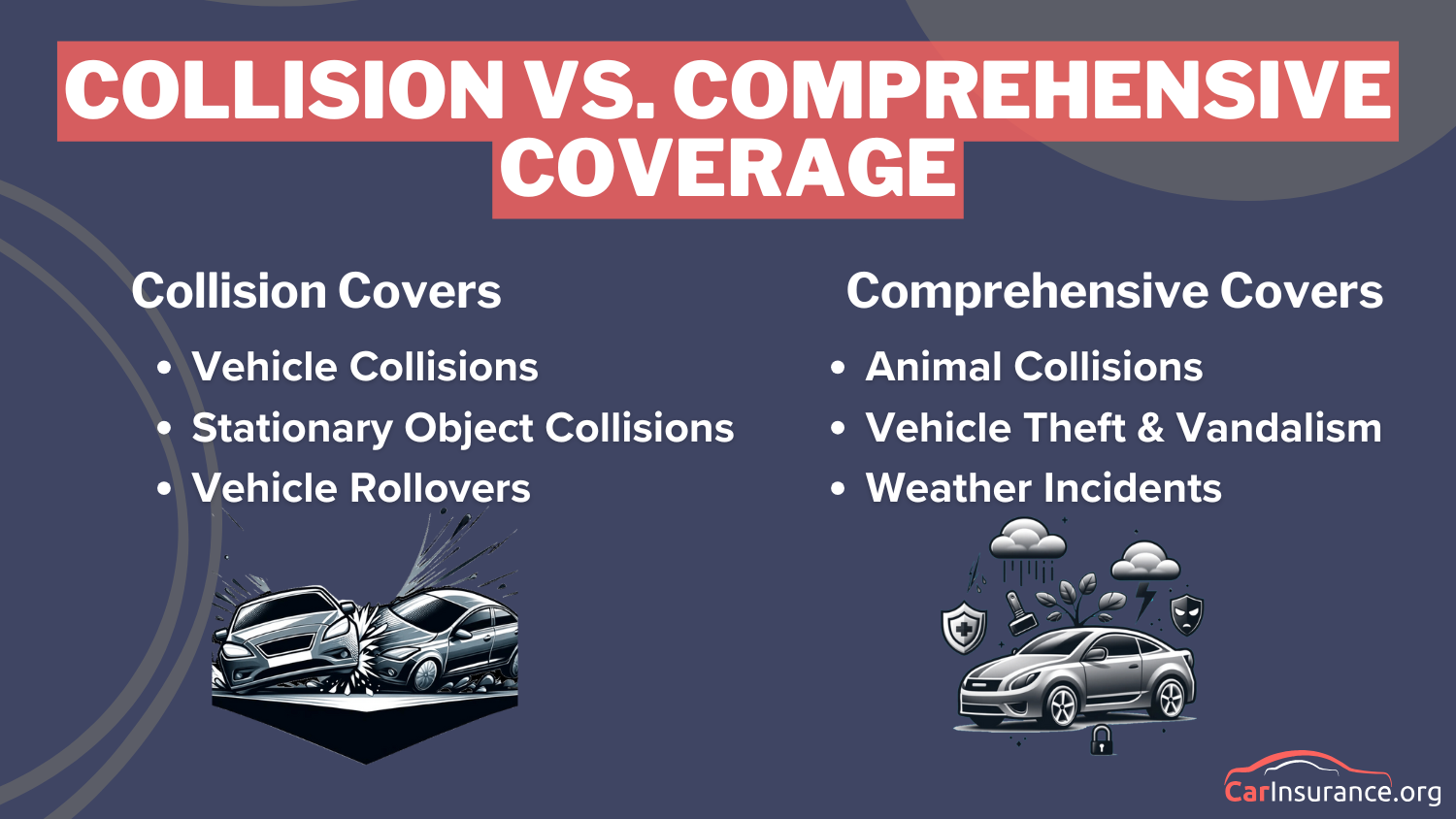

- Third Party: This is the minimum legal requirement. It covers damages you cause to other people and their property but doesn’t cover damages to your own vehicle.

- Third Party, Fire, and Theft: This offers the same coverage as third-party insurance but also protects your car if it’s stolen or damaged by fire.

- Comprehensive: This provides the broadest coverage, including damage to your car, even if you’re at fault in an accident, as well as covering fire, theft, and vandalism.

Choosing the right level of coverage depends on your individual circumstances. If you have a newer, more valuable car, comprehensive coverage might be the best option. If you have an older, less valuable car, third-party or third-party, fire, and theft coverage might suffice.

Factors Affecting Car Insurance Company Quotes

Several factors influence the car insurance company quotes you receive. Understanding these can help you anticipate and potentially lower your premiums.

- Age: Younger drivers, particularly those under 24, typically face higher premiums due to their perceived lack of experience. For instance, a 21-year-old might pay significantly more than a 55-year-old.

- Location: Where you live plays a significant role. Densely populated areas with higher rates of accidents or theft generally have higher premiums. For example, inner London residents might pay more than those in northern England.

- Driving History: A clean driving record translates to lower premiums. Accidents, traffic violations, and previous claims can all increase your rates.

- Type of Car: The make and model of your car influence insurance costs. High-performance vehicles or those prone to theft tend to have higher premiums.

- Job Title: Your occupation can also affect your car insurance premiums. Certain professions are seen as higher risk than others.

- Annual Mileage: The more miles you drive, the higher the risk of an accident, leading to potentially higher premiums.

How to Effectively Compare Car Insurance Company Quotes

Comparing car insurance company quotes doesn’t have to be daunting. Here’s a step-by-step approach to ensure you find the best deal:

- Gather Information: Before you start, have all the necessary information handy, including your driver’s license, vehicle registration, and details about your driving history.

- Use Comparison Websites: Comparison websites are a great starting point. These sites allow you to enter your details once and receive quotes from multiple insurers. Popular comparison sites include Confused.com and others.

- Get Direct Quotes: Comparison sites don’t always include all insurers. Some, like NFU Mutual, only offer quotes directly. Therefore, it’s wise to get quotes directly from several insurers in addition to using comparison websites.

- Understand the Policy Details: Don’t just focus on the price. Carefully review the policy details, including the level of coverage, the excess (the amount you pay towards a claim), and any exclusions.

- Check Customer Reviews: Look beyond the price and consider the insurer’s reputation for customer service and claims handling. Resources like Which? provide customer scores and policy analysis.

- Adjust Your Excess: Increasing your voluntary excess can lower your premium, but make sure you can afford to pay it if you need to make a claim.

- Consider Telematics (Black Box) Insurance: If you’re a young driver, consider telematics insurance, which monitors your driving habits and adjusts your premium accordingly.

- Pay Annually: Paying your premium annually is typically cheaper than paying monthly, as insurers often charge interest for monthly installments.

Finding Cheap Car Insurance

While comparing car insurance company quotes is crucial, there are additional strategies to reduce your car insurance costs:

- Shop Around Regularly: Don’t just renew your existing policy. Shop around each year to see if you can find a better deal.

- Improve Security: Installing security devices like alarms and immobilizers can deter theft and lower your premiums.

- Park Securely: Parking your car in a garage or secure parking area can also reduce the risk of theft and lower your insurance costs.

- Reduce Mileage: If possible, reduce your annual mileage. Fewer miles driven means less risk of an accident.

- Consider Multi-Car Insurance: If you have multiple cars in your household, consider a multi-car insurance policy, which can offer discounts.

- Add an Experienced Driver: If you’re a young driver, adding an experienced driver to your policy might lower your premium, but be honest about who the main driver is to avoid “fronting,” which is illegal.

Recommended Car Insurance Providers

While the best car insurance provider depends on your individual needs, some companies consistently receive high ratings:

- NFU Mutual: Known for excellent customer service and comprehensive coverage. They don’t charge admin fees or interest for monthly payments.

- LV: Offers policies with minimal “gaps” in coverage and provides protection for no-claims discounts against an unlimited number of claims.

- Aviva: Praised for their sympathetic claims handling, particularly in situations like pothole damage.

These companies are often recommended, but always compare their quotes with others to ensure you’re getting the best deal for your specific circumstances.

Understanding Policy Scores and Customer Reviews

When comparing car insurance company quotes, pay attention to policy scores and customer reviews. Policy scores, like those provided by Which?, assess the quality of the coverage offered. Customer reviews reflect the experiences of other policyholders, particularly regarding claims handling and customer service.

The Which? Recommended Providers are selected based on customer surveys and policy analysis, ensuring they meet high standards of service and cover.

Don’t Rely Solely on “Essential” Cover

Some insurers offer “essential” or stripped-down policies. While these might seem appealing due to their lower price, they might lack crucial coverage. Always check what’s included in the policy and ensure it meets your specific needs. For example, some essential policies might exclude windscreen cover or have higher excesses.

Conclusion

Comparing car insurance company quotes is an essential step in securing the right coverage at the best price. By understanding the factors that influence premiums, using comparison websites and getting direct quotes, and carefully reviewing policy details, you can make an informed decision. Remember to consider customer reviews and policy scores to find an insurer with a good reputation for customer service and claims handling. Don’t settle for the first quote you receive; shop around and compare to find the best deal for your needs.

Leave a Reply